FORWARD FOODING

THE BLOG

Seafood alternatives: an ocean of opportunities

Meat production and consumption has proven to have major negative environmental impacts. Globally, the UN estimates that livestock generate 14% of all man-made greenhouse gases, including methane while, more broadly, 77% of world’s arable land is currently used to provide only 18% of the global proteins.

Interestingly though, the conversation is way less apparent and mainstream when it comes to the impact of the fish industry. Despite a steady increase in its consumption, with three-fourths of consumers adding more fish in their diets for health reasons, most people are still not aware that there are also negative repercussions for human health and the environment related to this sector.

To that matter, the polemical documentary Seaspiracy released in 2021 unravels the environmental impact of commercial fishing, denouncing issues ranging from bluefin tuna fishing, overfishing, illegal fishing, to false certifications of sustainability of seafood products and plastic pollution – and therefore raising concerns from consumers on the provenance, fishing/farming practices, or the mercury level of the fish we eat.

The rise in global fish consumption and its consequences

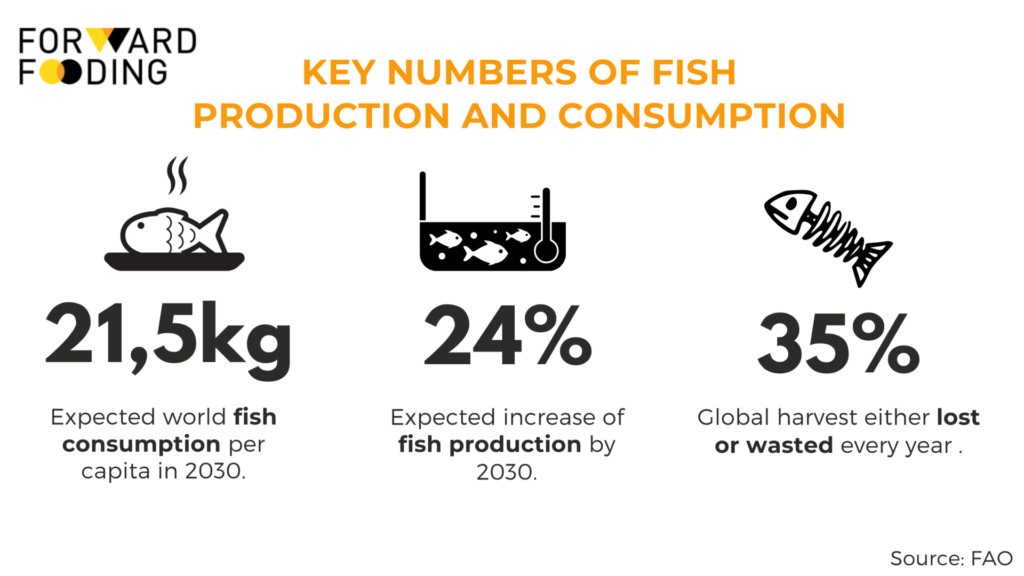

According to the FAO, global fish consumption has been steadily increasing from the 1960s to 2017 at the astonishing rate of 3.1% per year, twice as high as the annual population growth rate during the same period (1.6%). The average annual growth rate of fish for human consumption exceeded that of all terrestrial meat consumption combined (2.7% per year), excluding poultry, which grew by 4.7% per year. Just to put that in different terms, fish consumption per capita per year grew from 9.0 kg in 1961 to 20.3 kg in 2017.

The phenomenon is, according to the FAO, caused by diverse reasons:

- Advances in processing technology

- Cold chain development

- Enhanced logistics (for instance in transportation and distribution)

- Increased awareness from consumers of the health benefits of eating fish

With the world producing over 200 million tonnes of fish and seafood every year, nowadays the regular consumer eats around twice as much seafood as half a century ago.

Moreover, with the world’s population projected to reach 8.5 billion people by 2030, the demand for fish and seafood is also expected to increase, along with its negative effects.

According to a number of studies, this increase in consumption has major downfalls for the environment and, indirectly, for human health. Focusing on fishing alone, the following issues stand out:

- Overfishing: 34% of the world’s fish stocks experience overfishing.

- Bycatching: around 10% of annual catches are not targeted but incidentally caught and thrown away by commercial fisheries each year.

- Damaging the biodiversity of the ocean: Over 1/3 of marine mammals and nearly 1/3 of sharks and corals are threatened with extinction.

- Illegal Fishing: Up to 1 in 5 fish sold comes from illegal fishing.

- Plastic pollution: According to Nature’s scientific report, over three-quarters of the Great Pacific Garbage Patch consists of fishing nets. And by 2050, there will be more plastic than fish in the ocean.

- Threats to human health: Fish can take in harmful chemicals from polluted water, for instance, mercury.

Despite appearing more sustainable on the surface, fish farming (or aquaculture) comes as well with environmental and health challenges. For instance, as stated by the World Resource Institute, this practice has a negative impact on wild fish by harming it through the equipment it requires and by spreading diseases, in addition to contaminating oceans and other water bodies with a surplus of nutrients and fecal matter. Furthermore, fish feed is often boosted with additives and antibiotics which, as reported by The Economist, have proven to increase antibiotic resistance and that we as consumers end up eating and assimilating.

While many impactful startups like SafeyNet Technologies, Pure Salmon, or Agriloops are working hard to make fishing and aquaculture more efficient and sustainable (which will be the topic of a separate article), seafood lovers can bring a growing number of alternative options to their plate to still enjoy the taste of fish without harming the environment! We are now expanding below on some of the latest innovations in the seafood alternatives space that are contributing to the alternative protein transition.

Deep-dive into the alternative proteins space

According to BCG’s report, the alternative protein market is expected to account for 11% of the global protein market by 2035 vs 2% in 2020. According to our FoodTech Data Navigator, alternative protein companies have raised almost $7.7 billion in capital between 2012 and 2020, 60% of which was raised in 2020, when the pandemic disrupted global markets.

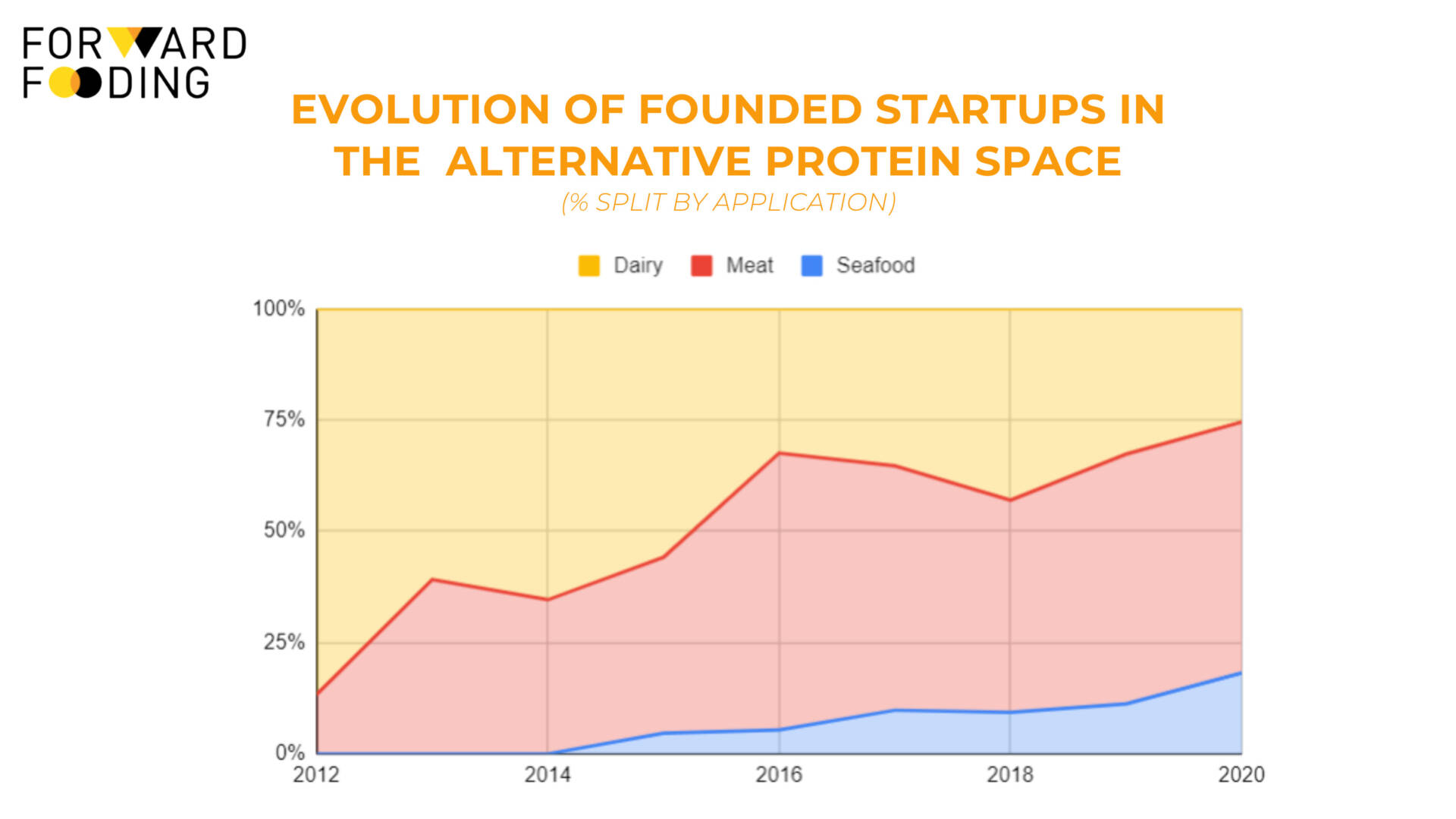

While meat and dairy alternatives represent a more mature market with a greater number of players and higher amounts of funding, seafood alternatives are following through.

Since 2014, a growing portion of newly founded alternative protein companies has been focusing on seafood application, increasing on average by 60% every year, compared to 15% and 21% for meat and dairy alternatives companies respectively (note: In this analysis, we exclude 2021 for which full data isn’t available at this stage).

Source: FoodTech Data Navigator

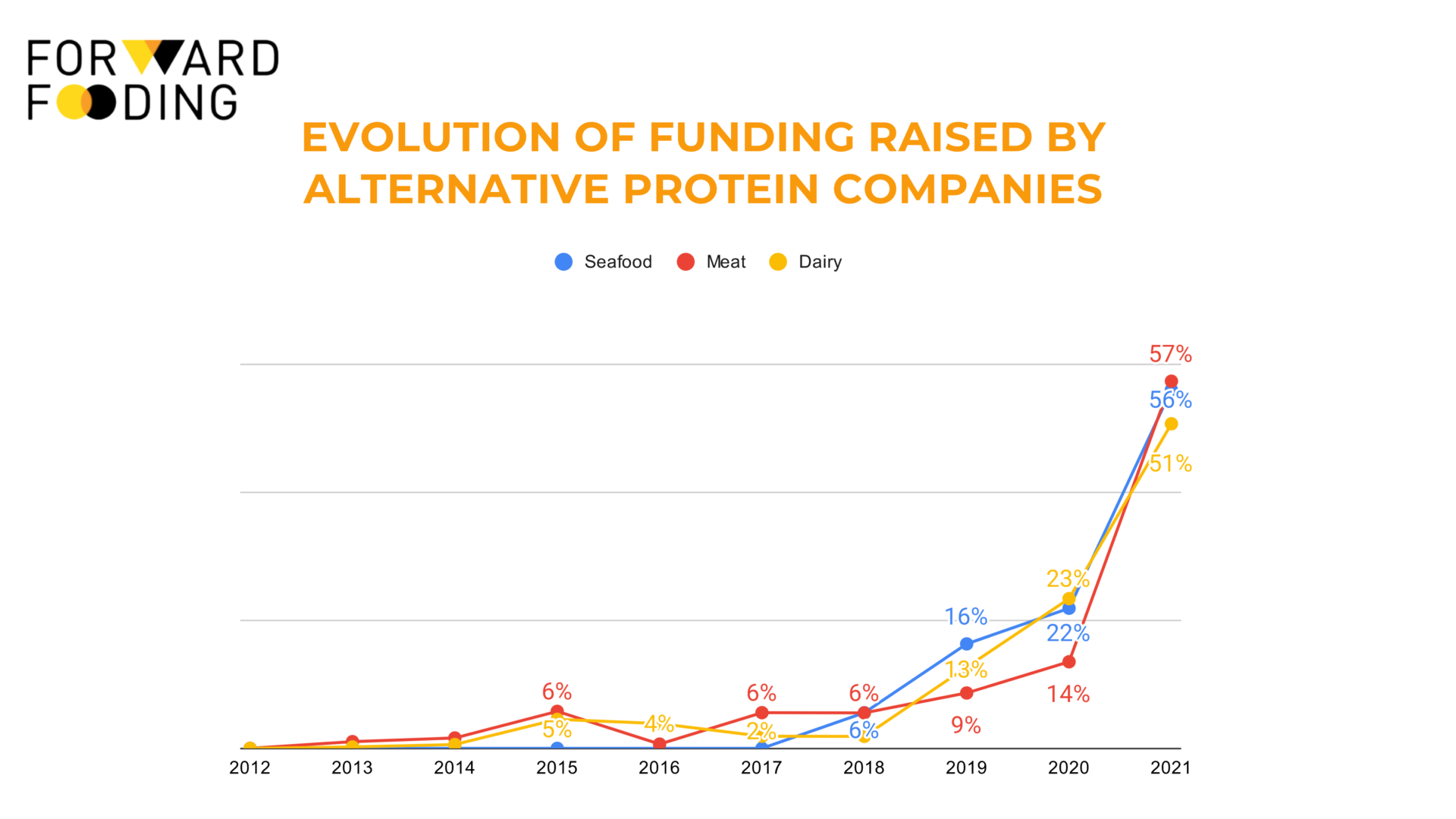

In terms of funding, meat and dairy emerged as the segments with major investment within the alternative protein space, due to their longtime presence in the market. Interestingly though, seafood alternatives companies followed a very similar steady growth as the other two segments, raising 56% of their overall funding from 2012 to 2021, a very similar percentage to meat and dairy, which raised respectively 57% and 51% of their total funding in the same year.

Source: FoodTech Data Navigator

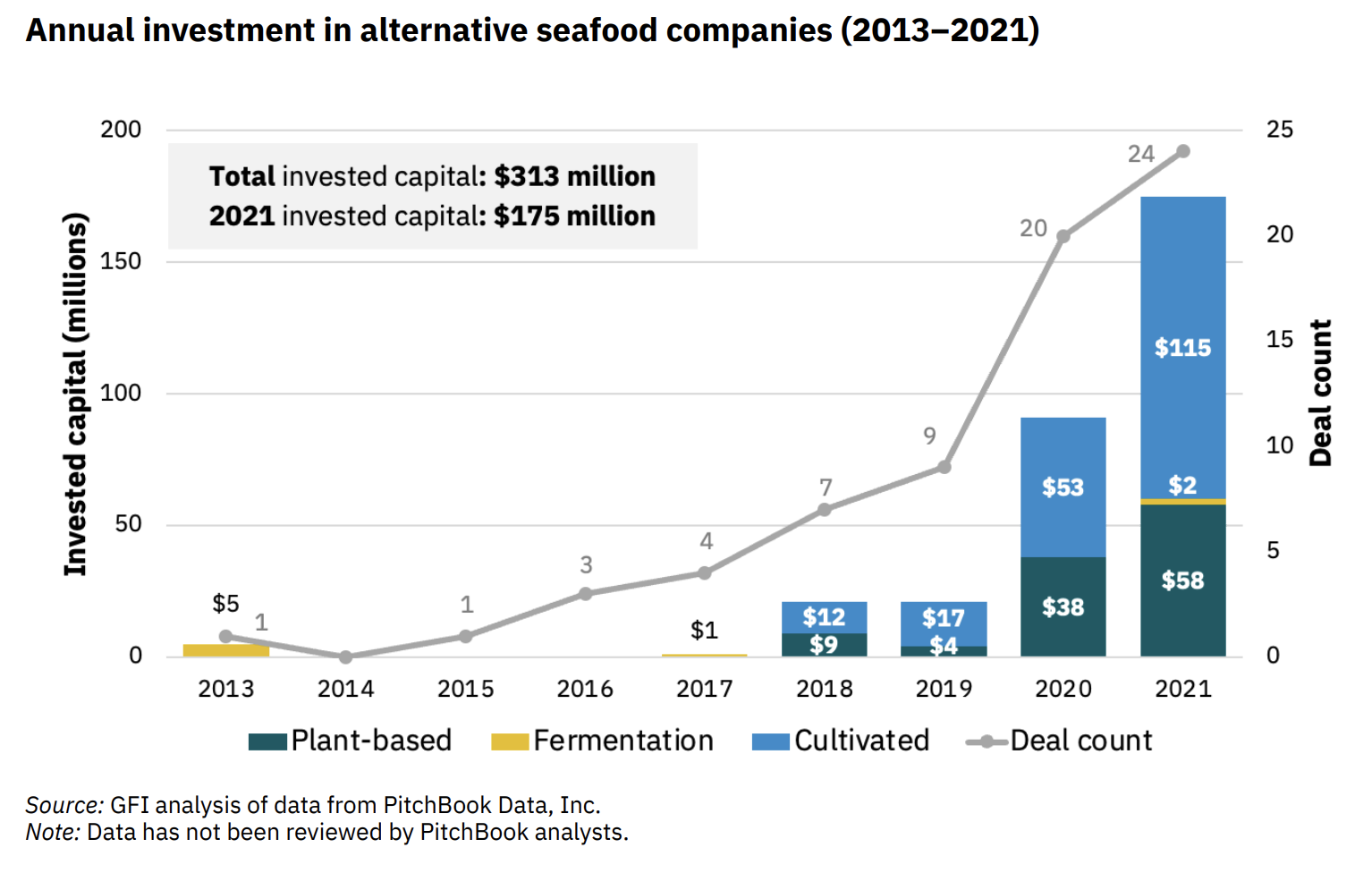

In absolute terms, investments in seafood alternatives reached a total of $310M between 2018-2021, with industry-level data suggesting a very similar amount as reported by Good Food Institute in its latest report with $308M.

Particularly, while fermentation remains a technology that has yet to attract great capital for seafood alternative applications, in 2021 companies using cellular agriculture raised for the first time over 2x the amount of those using plant-based, signaling a potential market trend for the future.

To learn more about the different technologies and elements behind alternative protein production, check out our blogpost where we dig deeper into the enabling aspects for each segment.

Top Alternative Seafood startups to watch

Following the analysis of general metrics, we propose a selection of some of the most impactful companies working on seafood alternatives, with some of them also being finalists for our 2021 FoodTech 500.

Plant-Based seafood

- Plantish (#461 of 2021 FoodTech 500)

Plantish produces whole-cut fish fillets that are delicious, nutritious, and sustainable. Luckily, this Israeli company just raised $12.45M in seed funding, to continue improving and growing its technology. Most importantly, Plantish managed to recreate a whole cut of plant-based salmon, something yet very difficult to find in seafood alternatives.

According to Ofek Ron, CEO & Co-Founder at Plantish:

‘’Most people enjoy fish as a whole-cut fillet, which does not yet exist in the alternative protein market. In addition, the fish we are currently eating is unsafe, filled with toxins, mercury, and microplastics; so given this picture, we understood that there is a huge opportunity here to offer people a nutritious, delicious, sustainable, and safe structured fish fillet made of plants. The impact that this will generate is that eventually 3 billion people will not need to rely on fishing the ocean for food, but rather can turn to our whole fish alternatives without any taste or cost compromise. This in turn will help save our oceans, protect our biosphere, and help reduce greenhouse gas emissions.’’

- The Plant-Based SeaFood (#343 of 2021 FoodTech 500)

They offer healthy and delicious alternatives to seafood that are really close to the actual thing. Get to know the great story of how they ended up creating plant-based seafood.

“Our background lies in the real seafood industry, where for nearly 20 years we successfully created and sold award-winning real seafood products. During these 20 years, we’ve witnessed some unacceptable and sometimes hidden practices in the seafood industry. These practices were leading to overfishing, among MANY other atrocities, and putting pressure on species and also our food supply system. If we are to feed a population of almost 10 billion by 2050, we believed an alternative, in addition to aquaculture, was needed. We set out to be the first seafood company to offer plant based alternatives in hopes to spur meaningful change and be part of the solution for the future.”

Monica Talbert, Co-founder & CEO at The Plant-Based SeaFood

Other startups working in plant-based seafood analogs are New Wave Foods, which just launched their new plant-based Shrimp with zero cholesterol, or Sophie’s Kitchen produces a line of delicious plant-based vegan seafood alternatives. Good catch foods, the plant-based seafood brand by US startup Gathered Foods, and major player in this space, currently develops plant-based tuna and crabcakes. Finally, worth mentioning as well Current Foods, an American-Spanish startup, creates fresh fish-free tuna that is already selling in California and planning to enter the Spanish market in April.

Cell-based seafood

- Bluu Biosciences (#242 of 2021 FoodTech 500)

Bluu’s mission is to create delicious, healthy seafood directly from fish cells by combining cell biotechnology and food technology. Sebastian Rakers, Co-Founder and Managing Director, explained why they started the company and what’s impact they want to generate.

Cell-Cultured Fish Startup Bluu Biosciences

“We felt that cell-based fish provides a viable alternative and Bluu Biosciences is well prepared for it as we can draw on more than a decade of experience in working with fish cells and because we are driven by a real passion for fish biodiversity. We envision a future in which seafood culinary traditions can be enjoyed for generations to come, without threatening human health, animals, or our planet’s fragile aquatic ecosystems. To make this vision a reality, we produce delicious, nutritious seafood directly from fish cells–no farms, hooks, or nets.”

Wildtype, based in California, is pioneering cellular agriculture to grow different cuts of seafood. They use cellular agriculture technologies to address the most pressing challenges of the generation: climate change, food security and health. They just raised $100 million in Series B funding recently to continue the development of their sushi-grade salmon made from cell cultivation.

Cell-Cultured Salmon by Wildtype

- BlueNalu (#20 of 2021 FoodTech 500)

With the rise of cell-based proteins entering the market, one company leading the charge is BlueNalu. It is on its mission to become the global leader in cell-based seafood, providing consumers with great tasting, healthy, safe, and trusted products. Thai Union, the world’s seafood leader, has invested in the company, joining other industry-leading strategic and financial partners.

Another startup working in cell-based seafood analogs is Wanda Fish, an Israel startup founded in late 2021, that just signed two agreements with Tufts University to explore the emerging field of cultivated seafood.

Fermentation-based seafood

AquaCultured Foods has developed a novel technology that creates an alternative seafood option through the use of microbial fermentation. They are working with biomass fermentation, which takes the fast-growing component of microorganisms as an ingredient to produce large amounts of alternative protein.

Whole Muscle Seafood from fermentation by Aqua Cultured Foods

Market leader in the meat segment already, Quorn is also a company that has been active in this space early on and that has contributed to popularising it, also thanks to their early coining of the term “mycoprotein” (protein from fungi). It offers fishless fillets, fishless fingers, fishless Scampi, and more.

The Better Meat Co, harnesses the power of fermentation to create delicious mycoprotein ingredients, with a specific type of fungi fermentation that grows with mycelium. With this mycoprotein, they are able to mimic salmon, tuna, pollock and crab alternatives.

What is next in the fish alternative space?

Similar to meat alternatives, scaling, imitating the texture and recreating whole cuts of seafood are the most recurrent challenges every company in the sector comes across. To overcome them and provide equivalent levels of structural integrity to whole fish, they must come up with new texturization and manufacturing processes.

In addition, from a regulatory standpoint, cultivated fish commercialization is not yet allowed in the majority of countries. So far, only Singapore has approved cultivated meat for both sale and consumption. Overcoming this regulatory hurdle elsewhere is a process that is likely to take a few years.

Growth through collaboration within the ecosystem

According to John Pattison, Co-founder & CEO at Cultured Decadence, a cell ag fish alternative company acquired in January 2022 by Upside foods and a finalist of the 2021 FoodTech 500, the collaboration will play a major role in scaling seafood alternatives:

“Knowing the importance of pairing with the right partners at the right time is vital to growth. Large corporations have experience with infrastructure, customer insight, and scale, which startups like ours will need to grow and commercialise. The combination of futurist, flexible, solution-focused small and startup businesses with corporate know-how will have far more impact than either one alone in reshaping the global food system.”

Besides being trendy, the sector will enable the supply for the growing global fish demand. To make this possible, collaborations will be key and we are already seeing interesting ones coming along. For instance, recently CellX and Bluu Seafood agreed to make a collaboration to share their respective knowledge and insights on cultivated meat and seafood alternatives and create new cultivated products. Another interesting collaboration is between Siimpli Good, a FoodTech company producing fresh spirulina biomass, and the international food conglomerate IFF-DuPont. The two will be developing a smoked salmon analog made entirely from whole fresh spirulina. Also, the Chinese startup Avant Meats established a partnership with VHC, the world’s largest pangasius fish company and a pioneer in sustainable functional proteins in Vietnam, to accelerate the commercialization of cultivated fish protein. Last but not least, BlueNalu and Nomad Foods, a leading frozen food company, will be exploring together the introduction of cell-cultured seafood in Europe to address its growing demand.

Do you want to learn more about the alternative protein space, the challenges it faces and opportunities you can harness? Access our Food Data Navigator HERE to discover all the companies analyzed in this blogpost, or get in touch HERE for a tailored consultancy.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]