FORWARD FOODING

THE BLOG

Food Waste: Understanding the issue before taking action

1.6 billion tonnes of food are wasted yearly, one-third of global food production. To give you a clear idea of these numbers, 1.6 billion tonnes is the same weight as 4,384 Empire State Buildings. If food waste was a nation, it would be the third-highest emitter of greenhouse gases after the US and China.

Reducing the amount of food wasted in the system – upstream (growing and harvesting), mid-production and downstream consumption – is an important lever to help solve the current and expanding food crisis. Given the scale of the problem, companies, politicians, farmers, and consumers are considering meaningful and innovative solutions to tackle it.

This article provides a look into:

- (1) The damaging effects of food waste;

- (2) Where food waste occurs across the supply chain;

- (3) Food waste at different stages of the supply chain;

- (4) Actions businesses are taking to fight food waste.

5 reasons why food waste is so devastating

Money gets thrown away

Boston Consulting Group (BCG) has predicted that at this rate, there will be a 40% increase in food waste by 2030. We will then waste 2.1 billion tonnes of food annually, which will cost $1.5 trillion. We have to add another trillion dollars for the hidden social, health and environmental costs to this staggering figure (such as fertilisers and soil used in vain, health effects on people, groundwater pollution, loss of pollinators, and subsidies spent to produce food that will be wasted).

Food waste contributes to world hunger

In developing countries, food waste occurs at harvest time for millions of people. Poor storage facilities on farms lead to pest and mould infestations that ruin crops. Lack of access to technology and markets means that many farmers are forced to watch their crops rot in the fields because the labour and financial investment required to harvest them is often unavailable. With chronic poverty, conflict and economic shocks, food loss is one of the leading causes of hunger in the world. Indeed, when FAO speaks of food loss, it refers to the waste along the first links in the chain (production, harvesting, storage and processing) of edible parts of plant or animal origin produced for human consumption.

The global water crisis is needlessly exacerbated

Wasted food is also wasted water. These losses accumulate when food is wasted before and after it reaches the consumer because huge amounts of water are needed to produce food.

Every year, humans use approximately 3.8 trillion cubic metres of water, 70% of which is consumed by the global agricultural sector. The amount of water wasted globally by growing products never reaching the consumer is estimated at 550 billion cubic metres. According to calculations, food waste accounts for more than a quarter of global freshwater consumption.

Food loss and waste also exacerbate the climate change crisis. Food production, transport and storage of food generate considerable carbon dioxide (CO2) emissions, and when food goes to landfills, it generates methane, an even more potent greenhouse gas. Growing, transporting, storing and cooking food requires oil, diesel and fossil fuels. This means again wasting tons of oil and fuel to produce food which will not be consumed.

Biodiversity is also under threat

Deforestation, especially in tropical areas, destroys natural flora and fauna to create more land for food production. In addition, marine fishing, a major contributor to the decimation of marine ecosystems and natural habitats, often results in areas or stocks being overexploited for fish that are then not consumed. Read more about solutions to mitigate the exploitation of the seas on our blogpost on sea food alternatives. Finally, food waste attracts wildlife, which these rotting foods can harm. This affects their numbers, reproduction patterns and predator-prey relationships.

Where is food wasted?

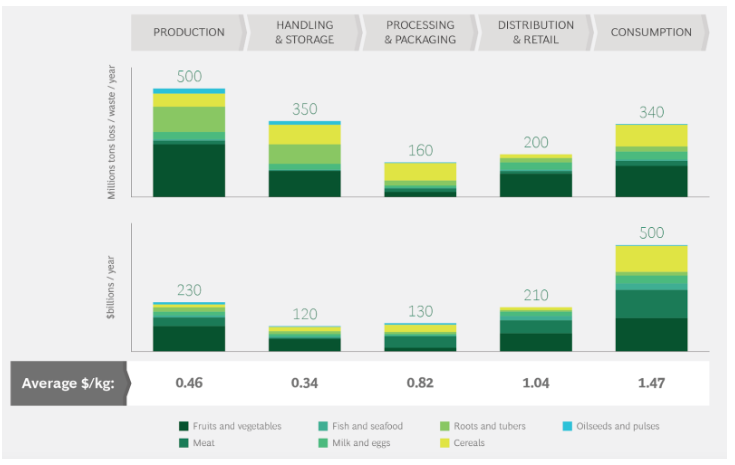

Figure 1 – Food supply chain

To understand the food waste problem, it is important to grasp the issue from a supply chain perspective, from production and packaging to distribution and retail. While food loss or waste occurs at all stages of the value chain, in developing countries, where 44% of global food losses happen, the problem is primarily related to the production and transportation of food from farms. In contrast, in developed countries, responsible for 56% of food wasted globally, it is more prevalent at the consumption stage among retailers and consumers.

Waste arising on farms and in production is caused mainly by weather conditions, harvesting and handling processes. 32% of all food wasted along the entire supply chain is lost at the production step as shown in figure 2 and 23% is lost during storage.

Moving forward in the food chain, food items in retail centres, wholesale markets and supermarkets often lead to food wastage. A large volume of food is discarded because of the high standard of quality expected of supermarket products. Large quantities of fruit or vegetables are not selected for sale simply because they do not meet specific aesthetic standards or, if they reach the place of consumption, are not bought because they are considered poor quality. Overcooking, production trials, packaging defects, test runs, and wrong sizes and weights are some aspects that lead to food imperfection and eventual rejection. At home, consumer waste is often caused by the poor purchase and meal planning, overbuying (influenced by oversized portions and packaging), confusion over labels (best before and to be consumed within), and inadequate storage at home.

Figure 2 – Food loss and waste occur across the value chain, 2018

The FAO infographic below shows examples of food waste for each stage of the food chain to have an overview of the issue.

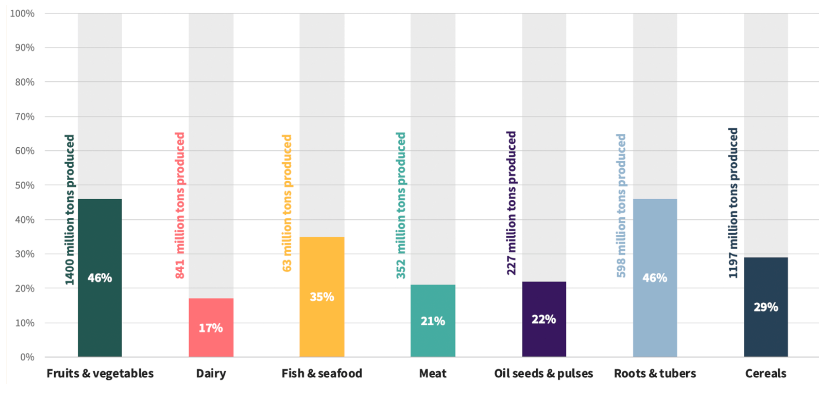

What type of food is wasted?

From fruit & vegetables to meat, the food waste issue applies to all kinds of food products. Let’s have a look at how much of each category is wasted compared to the total amount of food waste.

The data shown in Figure 3 demonstrate that almost half of all fruit, vegetables, roots and tubers produced are wasted along the supply chain while one-third of fish and seafood never reaches our plates.

- Fruit and vegetables: 1400 million tonnes produced (46% is wasted)

- Cereals: 1197 million tonnes produced (29%)

- Roots and tubers: 598 million tonnes produced (46%)

- Dairy products: 841 million tonnes produced (17%)

- Meat: 352 million tonnes produced (21%)

- Oilseeds and pulses: 227 million tonnes produced (22%)

- Fish and seafood: 63 million tonnes produced (35%)

Figure 3 – Food production and waste for each product category

To recap, there is no single cause or area where food waste occurs: businesses, governments, NGOs and individuals all have a role to play in fighting food loss and waste and mitigating their far-reaching effects. BCG has identified five key comprehensive solutions needed to tackle the problem:

- Spreading awareness: businesses, governments and NGOs should raise awareness and educate all the actors in the food chain;

- Developing and building the proper infrastructure for the entire food chain;

- Expand large-scale digitisation and the deployment of big data to make the food chain more efficient and monitor waste;

- Fostering participative collaboration and dialogue between value chain players;

- Change in the political environment, as current regulations still do not penalise either companies or consumers for the waste they create.

Startups can be part of the solution, especially by introducing innovations that can make the food chain more efficient and sustainable. Now let’s deep dive into the market and some of the latest innovations that are working to reduce food waste and loss.

Deep dive into action business fighting food waste

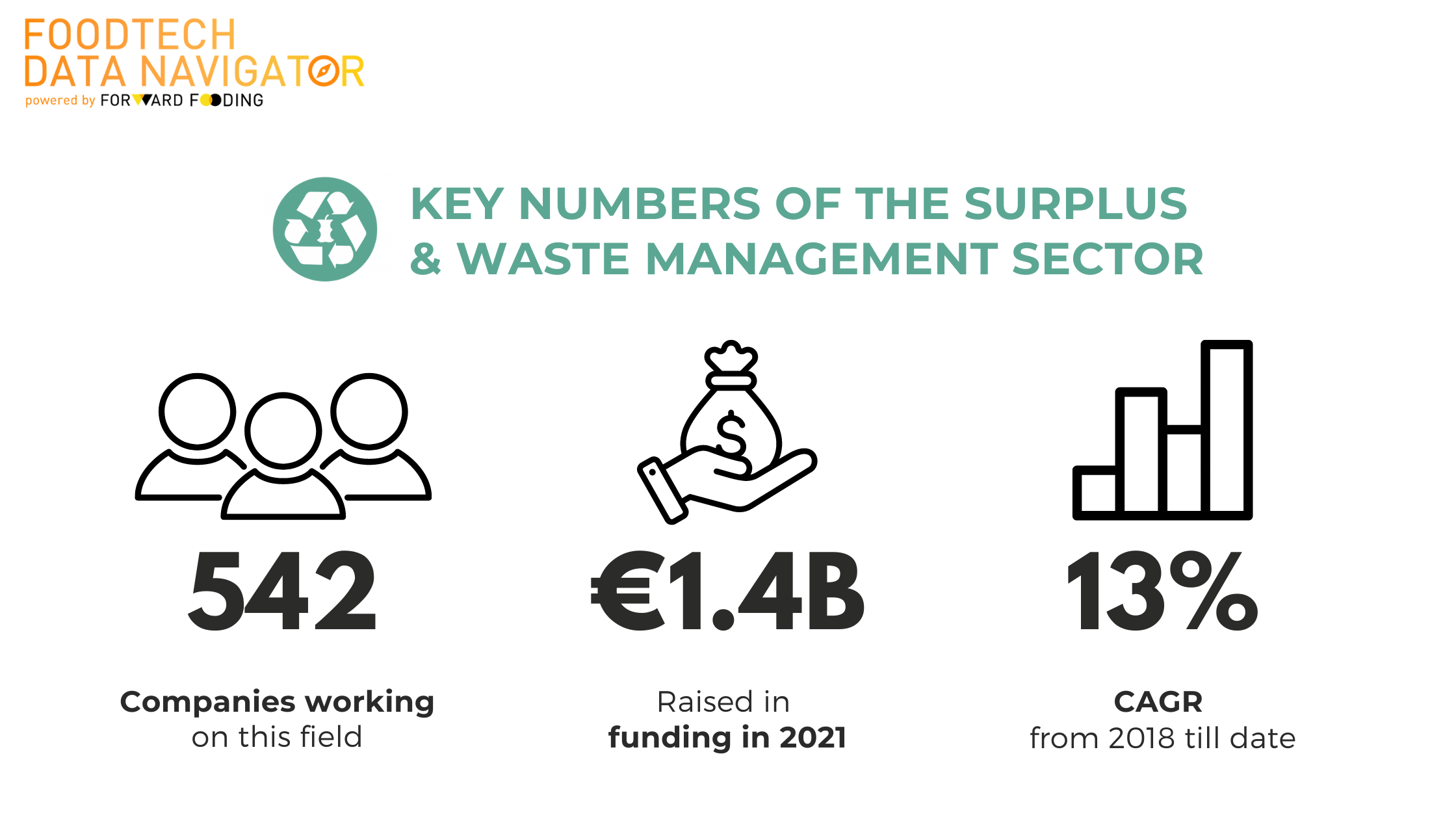

According to the FoodTech Data Navigator, startups offering solutions to mitigate or prevent food waste raised over €1.4Bn in funding in 2021.

This is almost a 50% increase from the $930m raised in 2020, indicating that food waste is a growing priority in the food industry for environmental and economic reasons.

Figure 4 – FoodTech Data Navigator

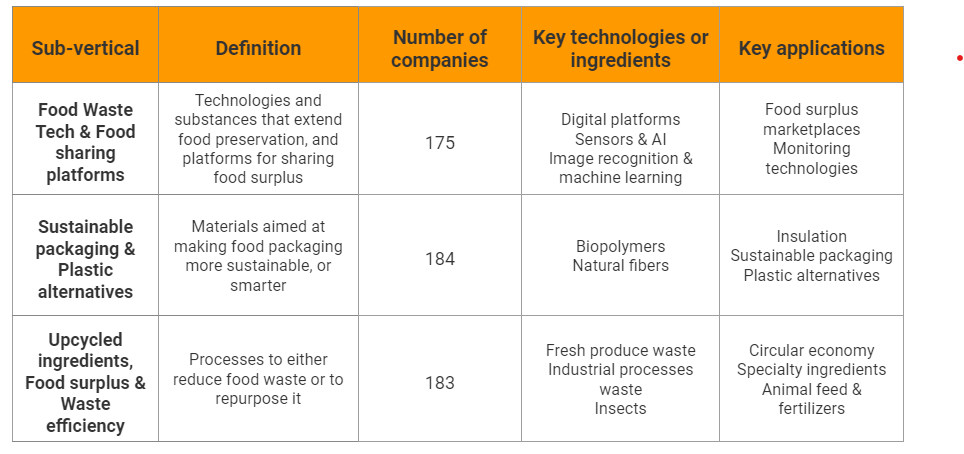

According to our proprietary taxonomy, we can divide this sub-sector into 3 main ‘sub-verticals’:

- Food waste Tech & Food sharing platforms: technologies and substances that extend food preservation, and platforms for sharing food surplus

- Sustainable packaging & plastic alternatives: materials aimed at making food packaging more sustainable, or smarter

- Upcycled ingredients, Food surplus & waste efficiency: processes to either reduce food waste or repurpose it

Figure 5 – FoodTech Data Navigator

Food Waste Tech & Food sharing platforms

In this area, key technologies include:

- Digital platforms;

- Sensors & AI;

- Image recognition & machine learning;

- Biochemicals.

Great examples include food surplus marketplaces such as Too Good To Go and Phenix, smart scale technologies Winnow or Orbisk, leveraging AI and image recognition to understand the amount and type of food wasted in commercial kitchens, or biotech solutions like Apeel that extend the shelf-life of fruits and vegetables thanks to a plant-based coating retaining moisture. You can find more examples here.

Winnow

Sustainable packaging & Plastic alternatives

According to the Organisation for Economic Co-operation and Development, global plastic production doubled between 2000 and 2019. In parallel, the volume of plastic waste more than doubled to 353 tons in 2019, and only 9% of it is actually successfully recycled.

Creating sustainable alternatives to plastic is critical for the food industry, not only for the environmental benefits, but also to meet a growing requirement from consumers. According to Trivium Packaging’s 2021 Global Buying Green Report, 54% of consumers take sustainable packaging into consideration when selecting a product.

Luckily, there are already forward-thinking companies exploring new ways to package their products with sustainable materials.

In this domain, the key application of biopolymers and natural fibres are insulation, finding sustainable and plastic alternative packaging such as TIPA that developed breakthrough 100% biodegradable and compostable flexible packaging solutions for food and beverages, ranging from simple one-ply films to complex multi-layer products. Edible packaging solutions are also gaining traction, for example with the likes of Notpla, which developed a revolutionary material made from seaweed and plants that biodegrades in weeks while being edible. The company raised $13.5M on their last funding round in Series A in December 2021.

Notpla packaging

Upcycled ingredients, Food Surplus & Waste Efficiency

We count about 183 startups and scaleups currently active in this area, having raised a combined 368M euros in 2021.

Amongst interesting examples is Canadian company Outcast, which has developed a technology that turns surplus fruits and vegetables into high-value whole plant powders. Also, MOA, a company member of our Barcelona’s FoodTech Hub, uses residues and byproducts as raw materials to turn these into protein biotechnology. MOA was recently selected by the innovation accelerator Unleashed of Purina for the pet care sector. Finally, a company like Kaffe Bueno combines biotechnology, and coffee byproducts as a platform to produce active and functional ingredients for cosmetics, nutraceuticals, and functional foods.

Kaffe Bueno

What’s next?

Food waste technologies is an investment opportunity that can lead to social and financial benefits. Yet food waste companies, that present a CAGR of 13% from 2018 to date, are still underfunded compared to other areas of the FoodTech sector (compared for example to 107% of CAGR, from 2018 to date, on Alternative Proteins).

That being said, some recent signals are leaving room for optimism. For example, online retailer Misfits Market, a company selling boxes containing fresh and organic ‘ugly’ fruits and veggies, has agreed to acquire its chief competitor, Imperfect Foods. Misfits CEO Abhi Ramesh established in a Bloomberg interview that if this happens Misfits ‘might not need to raise money again, and that an IPO ‘is the more likely path for the company.’ Amongst other big deals, Afresh Technologies, which makes software that helps grocery stores reduce food waste, just raised an impressive round $115 million in new funding. Last but not least, Too Good To Go is now collaborating with big companies such as Nestle, Bel Group, Danone, and more to educate consumers in using their senses instead of just following the ‘Best before’ label.

The growing interest and funding activity in this area is exciting, as is the increasing number of funders who recognise the huge opportunity to support the launch and scale-up of solutions that could transform the food system. As we always say at Forward Fooding, collaboration is the main key to helping the transition to a more sustainable food system.

Do you want to learn more about the food waste space, its challenges, and opportunities you can harness? Keep following our page to keep up to date with our latest posts, access our Food Data Navigator HERE to discover more about the companies analysed in this blog post, or get in touch HERE for a tailored consultancy.

This article was written by Ilaria Abba, in collaboration with Sol Ponteville.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]

![[panel 1] TrackEdit](https://www.winnowsolutions.com/hubfs/%5Bpanel%201%5D%20TrackEdit.png)