FORWARD FOODING

THE BLOG

Report: UK FoodTech ecosystem

The UK FoodTech ecosystem is seeing steady growth. Through overcoming certain obstacles, it has the potential to cement itself as one of the world’s Food Tech powerhouses.

This report was developed in partnership with Collective Equity Ownership.

Overview

Food Tech is steadily conquering the globe. New technologies, business models, infrastructures and perspectives have created a food landscape with diversity and complexity. This has been propelled by numerous drivers and interconnection of systems that create a highly efficient, global food value chain.

At the same time, shifting consumer preferences, centered around sustainability and environmentalism, are putting pressure on the existing business models and approaches of food companies and brands. As Fortune Magazine put it: “Big food is under attack from startup granola.”

The emerging Food Tech industry is capitalising on these factors and the dropping costs of digital technologies. And it is therefore set to revolutionise our food and agriculture systems through entrepreneurship and innovation. But it is not just startups. Key stakeholders across the global food system – from corporates to governments, investors, non-profits and academics – are reshaping how we produce, supply, deliver and consume foods around the globe.

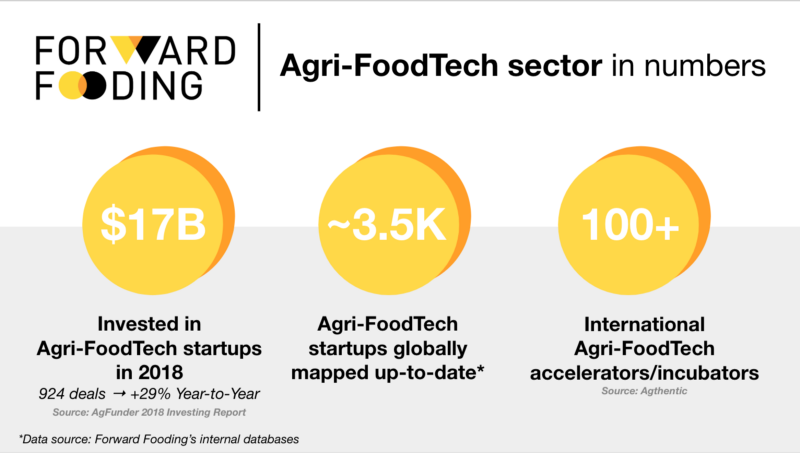

Although this nascent industry is still the largest within the US, FoodTech ‘hubs’ have emerged globally — Berlin, Singapore, Amsterdam, Tokyo and London. As demonstrated in figure 1, the growth of the sector is evidently clear.

Figure 1:

The UK Food Tech Ecosystem

The UK Food Tech ‘scene’ has seen strong growth in the number of startups, funding, and investors. London naturally gets the largest attention and attracts some big names. Thus the UK has the potential to cement itself as a powerhouse for Food Tech innovation within Europe. Some of the actors that have gained international traction include Deliveroo, Hello Fresh and Huel.

UK Food Tech Startup Scene: a snapshot

- ~220 AgriFoodTech Startups in the UK

- ~155+ AgriFoodTech Startups in London

Sue Nelson, group lead for Food Tech at Tech London Advocates, reflects on the proactive mindset in the growing UK ecosystem. She states: “Food Tech has to be far more important than most of the other ‘techs’ such as fintech, proptech, edtech and retailtech, because the future of food is critical to the future of mankind.”

The emergence of UK Food Tech

At the time of Deliveroo’s conception in 2013, some investors had a feeling that with the success of Just Eat, which went on to IPO a year later, the Food Tech market was full. However, Just Eat had initially been turned down by multiple VCs.

As it turned out, not only was Food Tech anything but done, but London — with its density of restaurants and hard-working professionals — was to emerge as a global hub in this space. In 2017 — just four years after its launch — Deliveroo raised a Series F investment round of £397 million, valuing the company at £1.48 billion. As of 2019 Deliveroo has secured a total investment of £1.34 billion.

David Buttress, co-founder and ex-CEO of Just Eat summarises the growth of the ecosystem.

“Food tech, as it’s now called, has become a sexy thing, but when we started Just Eat back in 2006, I can tell you barely a venture capitalist would have heard of it and probably wouldn’t want to have even met us because what we really were was an online platform for local takeaway restaurants. It was probably, at the time, the most unsexy business in the world, because if you’re a VC, a local kebab shop is not your idea of a sexy industry to engage with.”

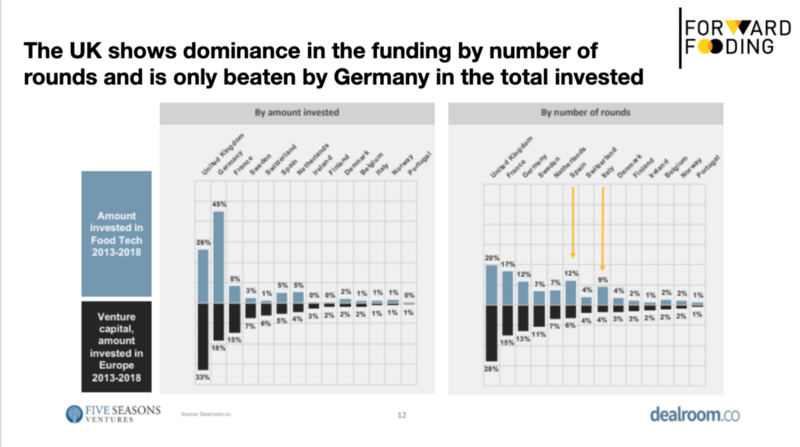

By early 2019, there are over 46 startups solely in the Food Delivery space with total funding of ~£1,5 billion. A stark difference from the few that existed 10 years ago. In the context of Europe, we can now see the UK’s growing leading position. Indeed, the Food Tech space has received over a quarter of all venture capital funding in the UK between 2013–2018.

Figure 2: UK Food Tech startup funding activities vs Rest of Europe (2013-2018)

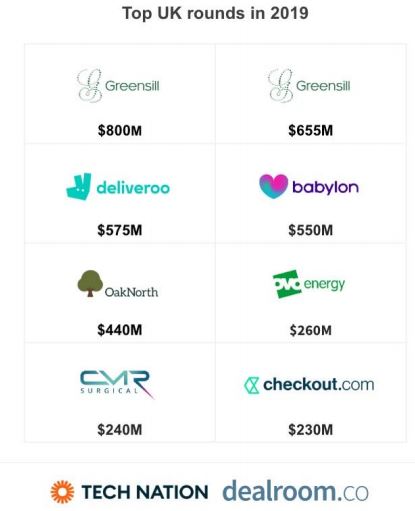

Figure 3: Top UK FoodTech rounds 2019

US vs. UK: Funding

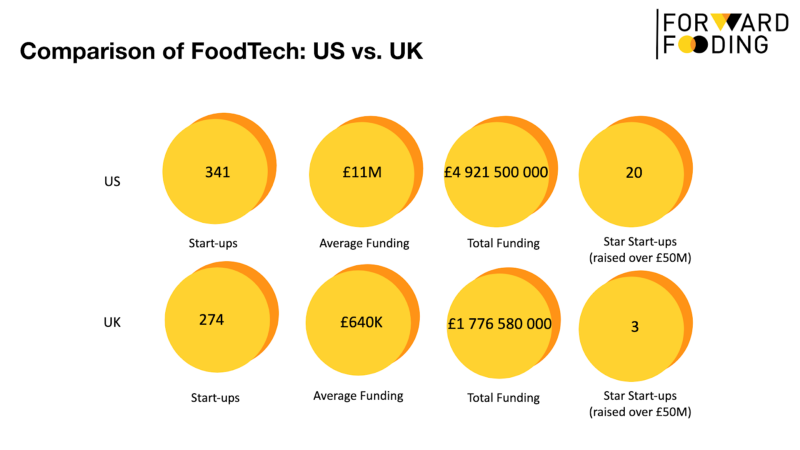

The signs of growth are clear: the UK has created a solid foundation to progress as a global hub for Food Tech innovation (figure 2). Nevertheless, in comparison to the US, the UK is still significantly behind in funding. This is especially true with respect to average funding per deal, which might restrict further accelerated development of high-potential startups.

Figure 4:

Credits: Forward Fooding & Collective Equity Ownership

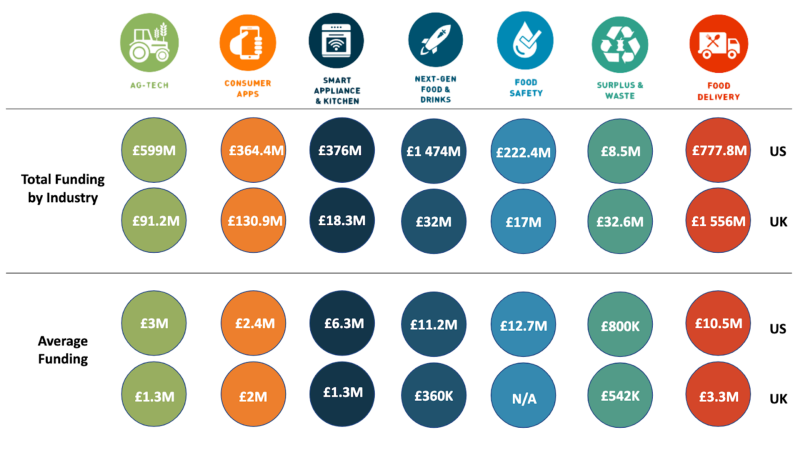

A comparison of the sub-categories (figure 5) also shows a clear divergence in the growth of the US ecosystem against the UK. The UK only leads the funding in the Surplus & Waste Management and Food Delivery category (here largely due to Deliveroo).

Figure 5:

Later-stage funding in Europe

Despite the strong and dynamic landscape, the UK FoodTech sector is obviously still lagging behind the American ecosystem. Why is this the case?

UK (and European) Food Tech startups evidently struggle to secure funding at later stages, as demonstrated in Figure 3. Only three UK startups have successfully secured over £50 million compared to the 20 in the US. Maarten Goossens from the Dutch AgriFood Tech fund Anterra Capital points out that “Europe does have a problem when it comes to later-stage capital, specifically for Series B to D funding rounds when larger amounts of capital are required while the risk of failure is still significant; there’s a gap in those investment stages across all tech industries.”

When comparing the UK to the US, it should be noted that there is 14 times more capital available in the US for startups in their later stages (scale-ups) than in Europe. Goossens states: “If you compare Europe and the US relative share of global VC funding — 15% vs 45% — you’d expect that to be a factor of three. The lack of later-stage capital will remain an issue until bigger pools of capital turn their eyes to Europe.”

Although later-stage funding is now more prevalent in other tech sectors, such as FinTech, Food Tech still captures only a low percentage of the total amount invested in UK startup companies, which was over £7 billion in 2018.

The Challenge

Overall, this seems to be a broader challenge with European venture capital. PitchBook expressed in their Q3 report: “The major difference (with the US) is a current lack of widespread VC support or ability to do €100 million+ deals. This has become a staple of the US VC playbook but is still relatively rare in Europe”.

Digital Food Lab speculates that this might be because investors are “less inclined to trust Europe’s startups with a few million before they have proven their worth”. And this definitely plays a role. A deeper look reveals profound differences in investment ecosystems. U.S. startups promote the “fail fast” approach, taking bold risks with big gains, or failures. In contrast, UK and European startups and VCs are generally more cautious, raising and investing money more gradually.

The UK as Europe’s Powerhouse

The UK Food Tech ecosystem performs well in multiple aspects. Firstly, there are no shortcomings regarding talent. The UK may be standing in the adversity of Brexit, with many questions unanswered. However, with London at the center, it remains a cultural powerhouse with a thriving startup environment. Already boasting 274+ companies, with many still undiscovered, the UK startup ecosystem is one of the most mature in Europe. And it has the potential to become a major player globally.

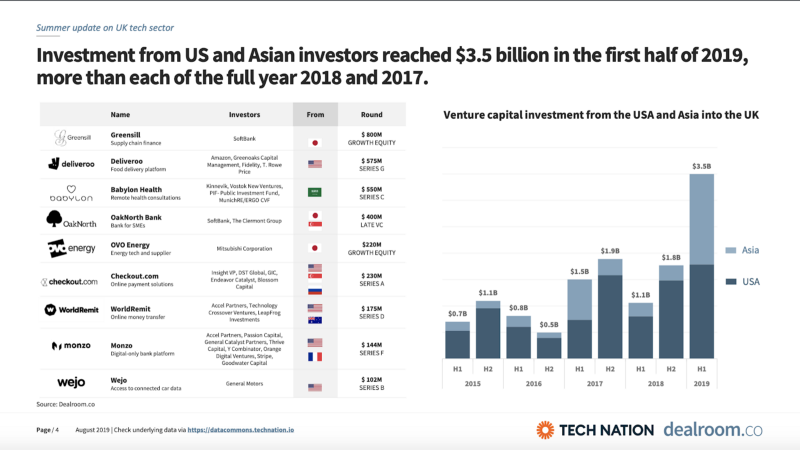

2019 has already seen investments skyrocketing in the UK tech sector, with Dealroom claiming the UK has become the world’s hottest tech hub this year. Investment in UK tech has increased by 43% when comparing Q1 & Q2 of 2018 vs 2019. Moreover, larger global investors from the US and Asia are more and more interested in the UK startup scene. In fact, there is a +147% rise in the capital invested in UK startups by US and Asian investors.

The Future is Bright

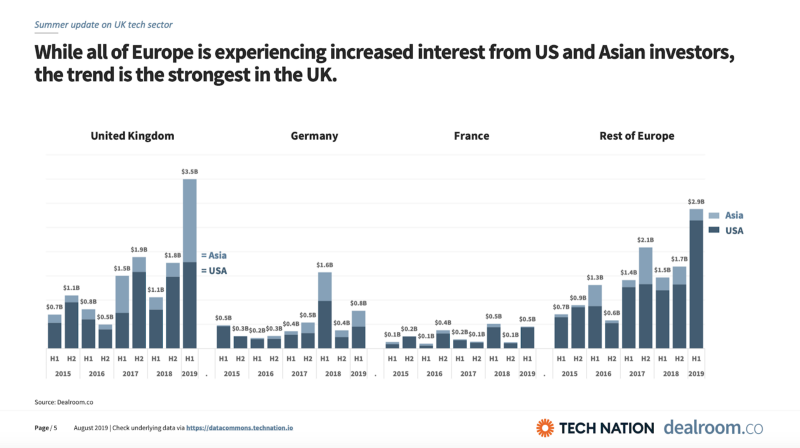

In addition, the UK is attracting much stronger investors, in comparison to the rest of Europe. This is putting the UK in a very beneficial position when looking at the future. Figures 6 and 7 demonstrate the growing UK startup scene.

Figure 6: The rising UK startup scene

Figure 7: The UK compared to the rest of Europe

2019 has already seen a large growth in startup investment across the UK tech sector. With one of the top deals this year already being in Food Tech (Deliveroo), the UK is poised for significant growth within Food Tech. In addition, 2018 already saw an increase in the number of larger funded deals, with 2 out of the 3 £50+ M, deals being completed the same year.

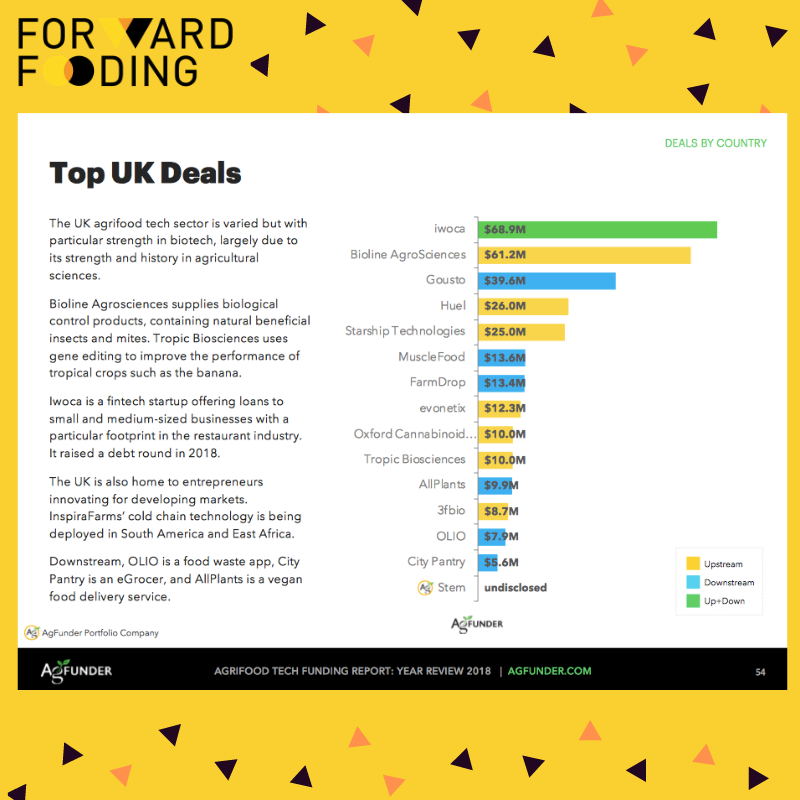

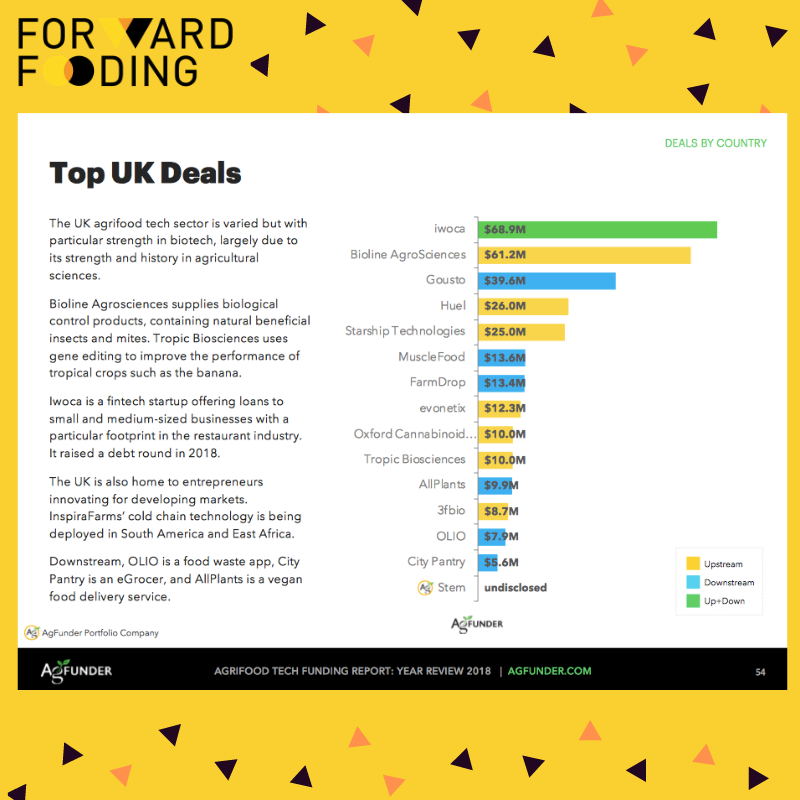

Figure 8: Forward Fooding’s summary of the Top Deals in 2018 for AgFunder News

London’s Great Potential

However, as outlined above, the UK ecosystem is still lacking maturity in comparison to the US. Nonetheless, we think that fostering communities to empower companies, corporates, investors and institutions to collectively get behind the opportunities that lie in devising tech-centric solutions for bettering our food system can actually put the UK ecosystem in a fantastic position to become a great Food Tech hotspot. Also, through a more high-risk, high-reward investment strategy, London has the potential to become Europe’s engine for Food Tech innovation.

Silicon Valley may still remain the current epicenter for Food Tech innovation — with its sizeable funding power . However, we think US investors should now keep an eye on what is happening across the Atlantic.

Forward Fooding

Forward Fooding is the world’s first collaborative platform for FoodTech Data Intelligence and Corporate Startup Collaboration.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]