FORWARD FOODING

THE BLOG

Taste Innovation: Alternative Flavours to the Rescue

Flavouring, the key element to all Food

What is a flavouring?

Flavouring can be found in a wide variety of food and beverage products that we consume daily. Whether it’s ice cream, gin, ready meal, or herbal tea, there is no escaping the presence of flavourings. These flavourings can be labelled differently according to their category such as “flavouring,” “natural flavouring,” “natural peach flavouring,” or “vanilla extract,” but they all serve the same purpose – to enhance the taste and aroma of the products we consume.

Flavourings are products that are added to food and beverage in order to modify aroma, and/or taste. Flavourings (both natural and non-natural) are composed of chemical compounds that are produced through precise chemical processes; and are not meant to be consumed on their own.

Flavourings play a crucial role in rebalancing flavour profile and compensating for flavour loss. In highly processed foods, the original flavour is often lost due to the manufacturing process and changes during storage. This is where flavourings come into play as they help bring back the desired flavours, as well as ensuring flavours consistency and standardisation. Moreover, flavourings can effectively mask off-notes or undesirable tastes that may be associated with ingredients like plant-based proteins, amino acids, vitamins, minerals, adaptogens, or high-intensity sweeteners.

Not only are flavourings convenient and easy to use, but they are also highly concentrated. In fact, the average amount of flavouring used in a finished product ranges from 0.1% to 1%, which can preserve the integrity of the food and beverage matrix and texture.

Flavour and taste remain the key influencers in consumer repurchase decisions. That’s why manufacturers invest in flavourings to ensure that their products deliver an enjoyable experience, leaving a lasting impression on their customers.

History of flavouring

For centuries, essential oils extracted from plants have been used by the food industry, chemists, and the perfume industry to enhance aromas and taste naturally.

During the late 19th century, aromatic molecules were extracted and isolated from ingredients, leading to a breakthrough in flavour science. Vanillin, responsible for the distinct aroma of vanilla, was one of the first compounds discovered. Driven by market demand and the need for cost-efficient alternatives, a non-natural vanillin molecule was then developed, which was more affordable and ten times stronger than its natural equivalent. This advancement marked the beginning of non-natural flavourings in the industry.

Initially, non-natural flavourings were used as supplements to natural ingredients; however, these natural ingredients were quickly substituted entirely by non-natural flavourings due to their lower cost and reliability. While cost-effective, non-natural flavourings are less complex compared to natural versions. For example, vanilla consists of hundreds of aromatic molecules, with vanillin being just one of them.

Until recently, consumers’ flavour expectations were shaped by cost-effectiveness, simplicity, and impact over complexity and authenticity. However, starting in the early 21st century, food safety concerns led to negative perceptions of chemical additives, prompting a shift towards natural alternatives. Since the 2000’s, consumer food anxieties were further exacerbated by the potential connection between 6 non-natural colourings and hyperactivity in children. As a result, food manufacturers and retailers began substituting non-natural colourings with natural alternatives. Since then, there has been a growing demand from consumers for “natural” foods and beverages without any artificial additives.

Consumers are moving away from artificial flavours and demanding functional and natural flavours.

Consumers are increasingly favoring natural, healthier, and more authentic flavours, seeking out food options that align with their “better for you” journey.

Kids’ food trends emphasize natural ingredients, lower sugar, and smaller portion sizes. Organic options with exciting flavor combinations are becoming more prevalent, along with snacks reduced in size to provide controlled, calorie-conscious options.

In the realm of sports nutrition, there’s a noticeable shift towards plant-based alternatives and natural flavors. Brands are expanding their offerings beyond traditional profiles like “cookie and cream,” now incorporating refreshing, fruity, and botanical options such as apple and elderflower, watermelon, or forest fruits. This trend reflects a broader consumer focus on health and wellness in all aspects of life, including physical performance optimization and mental well-being.

Low-calorie and alcohol-free options are gaining popularity as part of the mindful drinking movement. Plant-based diets are also shifting towards simpler, more nutritious options with less processing and more fruits, vegetables and pulses. Snack brands are reformulating products to comply with non-HFSS legislation, leading to innovative, healthier options but challenges in certain categories like biscuits and chocolate. The trends towards naturality, health, and wellness have recently expanded towards a more holistic approach that includes functionality with vitamins, minerals, botanicals (e.g. turmeric), and adaptogens (e.g. ashwagandha, lion’s mane), found in a wide array of products. From gum and snacks to protein shakes and coffee, these functional ingredients have become increasingly popular and their presence is expected to continue growing.

Through food and beverages, consumers are now seeking to optimise both their physical and mental performance, prioritise their mental well-being, enhance their appearance, and prolong their overall quality of life.

What and Why Alternative flavouring (market deep-dive)

According to Food Data Navigator, there are 190 actors and total funding of €1.1B. Numbers show that the alternative flavour market grew between 2018 and 2023, while the global FoodTech ecosystem decreased.

The increasing demand for alternative proteins and functional foods is driving the need for innovative technologies to enhance the taste and texture of these products. These technologies play a crucial role in ensuring that alternative proteins and functional foods not only meet but exceed consumer expectations, ultimately contributing to the widespread adoption of plant-based diets and the reduction of the environmental impact of food production.

Technologies Enhancing Taste and Texture of Alternative Proteins

Fermentation: This traditional method, which utilises microorganisms, has been used for food production for millenia to preserve food, produce alcoholic beverages and improve the nutritional value of foods. Even today, companies employ different types of fermentation for a range of applications in the alternative protein sector (e.g. biomass fermentation, precision fermentation, traditional fermentation).

Cellular Cultivation: This method involves growing animal cells in bioreactors to produce real animal fat- a crucial ingredient in alternative protein as it contributes to the taste and texture of meat substitutes.

Artificial Intelligence (AI): AI has a wide range of applications in flavour development in the alt protein sector. AI-based algorithms can analyse animal-derived food at a molecular level and then seek to closely replicate it in flavour, texture, scent and functionality using plant-based ingredients. It also aids companies in making clean-label products to cater to the demands of health-conscious consumers.

Optimised Flavour Delivery: It’s crucial to provide consumers with the tasty and familiar sensory experience they crave in products while cutting down salt and sugar. To achieve this without sacrificing flavour, solutions by re-designing food structure, use of carriers for flavour delivery, or even “simple swaps” are used in the food and beverage industry.

Several companies are championing these technological advancements to drive forward the development of sustainable and delicious plant-based foods that rival their animal-based counterparts.

- Fermentation

In Finland, biotech company Enifer produces PEKILO® mycoprotein ingredients using fungal fermentation. These are protein and fibre-rich powders with a neutral taste and colour that can be used similarly to plant-based proteins. The use of by-product streams as raw materials not only makes these products more sustainable but also lowers the production cost.

Just last month, Enifer secured a €12M grant from the European Union NextGenerationEU recovery instrument to build a first-of-its-kind mycoprotein ingredient factory. The new facility, costing €30M and set for completion by the end of 2025, will annually produce 3 million kg of sustainable, locally sourced protein.

ENOUGH is a UK-based B2B ingredient company that produces sustainable and nutritious foods using mycoprotein ingredients made from fungal fermentation. The company’s proprietary technology feeds fungi with sugars from sustainably sourced grain, which is then fermented in a zero-waste process to create ABUNDA, a food that is high in protein and fibre, contains all nine essential amino acids, and boasts a neutral flavour and meat-like texture that can be used to create plant-based meat, fish, and dairy products. ENOUGH has also recently expanded its partnership with Cargill, which will allow the food giant to use and market the ABUNDA mycoprotein.

ENOUGH Plant-Based Chicken Fingers made with ABUNDA protein

The company’s total capital raised to date is over €95M and it plans to double its production capacity to 60,000 tonnes per annum, as it eyes North America for expansion. ENOUGH has partnerships with big global companies in the feed and food industries, such as Skretting, Purina, Unilever, Plukon Food Group, and Marks & Spencer.

In Germany, B2B ingredient company Planet A Foods produces sustainable, cocoa-free chocolates using traditional and precision fermentation. Its process uses proprietary technologies to turn all-natural, locally sourced ingredients, including oats and sunflower seeds, into ChoViva, a cocoa mass and cocoa butter with a melt-in-the-mouth texture and full-bodied chocolate flavour. It contains up to 30% less sugar and has a very low CO2 footprint due to short supply chains.

Planet A Foods has raised a total of $24.81M in Series A funding, with its latest funding round being a €14.2M Series A round in 2023. The round was led by World Fund, with participation from Omnes Capital, Cherry Ventures, Mudcake, Nucleus Capital, TriplePoint Capital, Feast Ventures, and many more. The company has launched several products with REWE, one of the leading European retailers, and is now preparing for further launches with REWE and other German and UK retailers.

NoPalm Ingredients is a Dutch-based that has developed a sustainable and circular alternative to palm oil using fermentation technology. It secured €1M in recent funding from investors including Green Creators, Future Food Fund and ICOS Capital. With this investment, the company aims to scale and optimise its production technology to industrial levels.

Melt&Marble is a Swedish synthetic biology startup that produces animal-free fats to help close the taste gap between alternative proteins and their animal-based counterparts. The company’s fats offer similar fatty-acid compositions and saturation levels to animal-based fats, as they are produced using sustainable feedstocks with minimal land use.

The company has raised €5M in seed financing and €5.75M in a Series A round in 2022 led by IndieBio. Melt&Marble plans to launch animal-free dairy fats in the US this year starting with beef and pork fat.

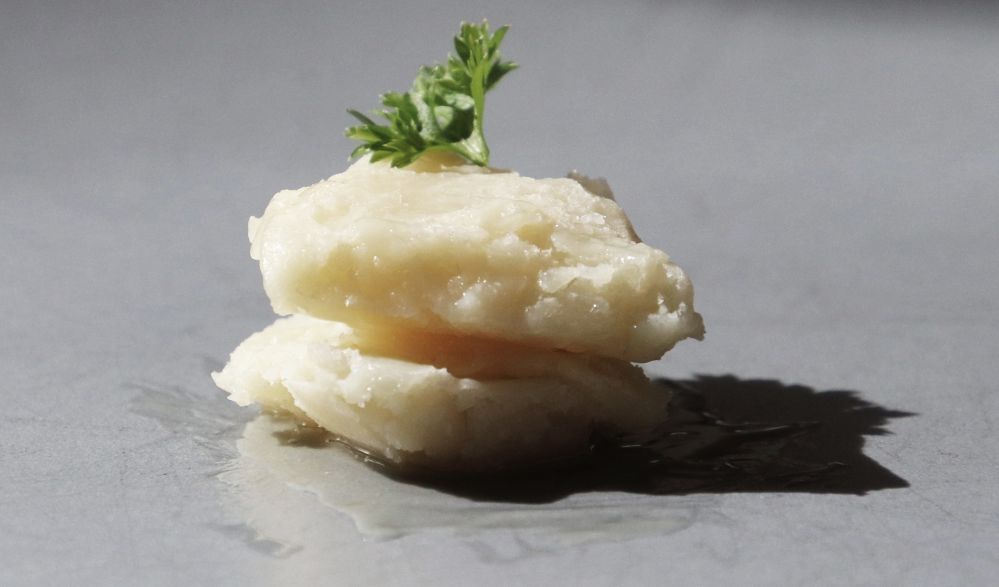

Melt&Marble fat formulation

US-based company MayaMilk produces animal-free dairy proteins and lipids with precision fermentation. Its product, made from yellow peas, is known for its high protein content and creamy texture, making it a popular choice among those seeking a dairy-free alternative. The company aims to provide a sustainable and environmentally friendly option for consumers looking to reduce their reliance on traditional dairy products.

- Cellular agriculture

Hoxton Farms is a London-based biotech company that produces cultivated animal fat using a tissue culture system that combines biology and mathematical modelling. Its technology platform grows animal fat in bioreactors to produce cruelty-free and sustainable ingredients. Recently, the company opened a 14,000-square-foot pilot production facility for cultivated animal fat in the UK, which features specialist cell culture laboratories, a food development kitchen, office space, and communal areas.

In October 2022, Hoxton Farms raised $22M in a Series A round led by Collaborative Fund, along with Fine Structure Ventures. The investment will be used to expand its team and increase production capacity to ten tonnes of cultivated fat per year. The company also aims to achieve price parity with plant oils when it moves from pilot to commercial scale.

- Artificial intelligence

US-based food tech Oobli uses a predictive algorithm named MADI to recognize and reveal proteins, enabling the company to produce sustainable chocolate. Oobli recently secured $25M in funding, which it plans to use to invest in R&D and accelerate commercial partnerships. Currently, the company has partnerships with big global companies in the food industry, such as Nestle, Mars, and Hershey’s.

Low-sugar chocolate from Oobli

twig:Tech leads in bioengineering innovation with its proprietary technology, twig:tech. AI is integral to all aspects of operations, from product roadmap to streamlining lab operations, data collection, analysis, and commercial decisions. Twig’s biotech process comprises three key elements: a tool that creates the “building blocks” (Bio:Builder), of ingredients; a versatile robotics system that analyses bacteria (Grow:Bot) and an AI refining tool that crunches data and extracts insights from experiments (ML:Bridge). Using AI and robotics. the company seeks to replace ingredients (like palmitic acid, isoprene, and acetone) with sustainable alternatives made from bio-fermented bacteria cells.

- Optimized Flavour Delivery:

Foodtech company Incredo (formerly DouxMatok) produces Incredo Sugar, a sugar-based sweetener that allows for 30% to 50% sugar reduction. The company raised $30M in Series C funding in May 2023, bringing its lifetime total to just above $6M. The investment round was led by DSM Venturing and Sienna Venture Capital, with participation from Teseo Capital, an investment fund managed by the Ferrero family. The company plans to use the funds to invest in R&D and accelerate commercial partnerships.

PhytoCo, a Seoul-based startup, pioneers sustainable plant-based foods using Salicornia, a salt-accumulating plant. Their flagship product, PhytoSalt, is the world’s first plant-based salt, with 20% less sodium and zero microplastics. With plans for international expansion, with its new product being initially available for US$7 for 30 servings via online retail in Korea, PhytoCo targets markets in Japan, China, Europe, and the United States. In addition to PhytoSalt, they are developing PhytoMeal, a superfood ingredient for humans and pets, also derived from Salicornia.

Future opportunities for alternative flavours:

In recent years, the availability of raw materials has been highly unstable and severely impacted by various factors such as climate change, crop diseases, labour shortages, land development, and geopolitical conflicts that led to supply chain disruptions across food, beverage, and flavour industries.

As a result, the availability of natural flavourings, extracts, essences, and essential oils is already at risk. It is also to note that consumers often seek natural flavourings, assuming they’re free from artificial additives and offer homemade-like quality. However, natural flavourings may include solvents, chemicals, and additives, diverging from this perception.

Despite being labelled as “natural flavouring,” these ingredients don’t necessarily guarantee superior quality or authenticity. Natural flavourings, extracts, essences, and essential oils are heavily dependent on crop and climate conditions. Take, for example, the impact of a hurricane on vanilla plantations in Madagascar a few years ago. This natural disaster led to a scarcity of vanilla and caused significant disruptions throughout the supply chain. Similarly, the citrus market is currently facing instability due to various factors like climate change and crop diseases. Although they’re preferred by consumers, they pose challenges such as lower intensity, limited availability, sustainability concerns, and higher costs for manufacturers.

Though non-natural flavours are considered more environmentally friendly, consumer perception remains negative despite safety evidence. Given climate change’s potential impact on ingredient availability, the flavour industry must innovate and adopt new technologies to address sustainability challenges.

We can already witness a glimpse into the future, as numerous discussions are taking place in the flavour industry regarding innovations and emerging technologies like biotechnology, genome editing, and molecular techniques. Artificial intelligence (AI) is also being explored, particularly in forecasting aroma perception and achieving success in various applications, especially plant-based proteins. The future of natural flavourings is rapidly evolving, aiming to create sustainable and consistently available natural options, without relying on traditional crop-based processes.

Food and beverage manufacturers, along with retailers, are considering moving away from traditional natural flavourings, extracts, essences, and essential oils in favour of exploring alternative processes and ingredients. This shift may involve leveraging ancient grains, microorganisms, and algae, and repurposing waste ingredients.

While the flavour industry struggles to compensate for the limited availability of natural raw materials like citruses, traditional methods often fall short in creating new and distinctive flavours. However, these emerging technologies present promising opportunities for the industry to unlock innovative and complex flavour profiles not achievable through conventional means. Embracing these advancements allows companies to gain a competitive advantage and influence the future of natural flavours.

About the Writers

Manon is a Food Scientist and R&D consultant specialising in flavour. With a Master’s degree and Engineering degree in Food Science and Technology, she brings over 10 years of industry experience in her role as the founder of EPICSI.

EPICSI is a F&B product development agency specialising in flavour profile development. EPICSI’s approach facilitates the rapid and efficient creation of market-ready products. EPICSI’s primary focus is to guarantee consumer satisfaction, repeat purchases, and customer loyalty. In addition, EPICSI offers a wide range of complementary services to support your project from idea to launch, as well as facilitate the growth of your business.

Kristine Lucas has been honing her craft as a writer for the past three years, specializing in the foodtech and sustainability sectors under the Growth Holistics digital marketing agency. Her work reflects a deep understanding of these niches, showcasing her ability to adapt and excel in complex and evolving domains. Driven by her curiosity and passion for learning, Kristine excels at translating intricate topics into engaging and informative content.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]