FORWARD FOODING

THE BLOG

Is Hybrid Meat The Sustainable Solution to the World’s Growing Meat Appetite?

Hybrid meats offer a suite of solutions: meatier taste and texture, better nutrition, lower emissions, reduced meat consumption, and lower cost than cultivated meat. But will it live up to its promise?

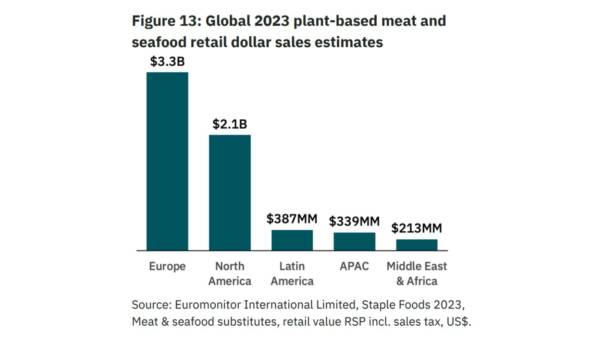

According to the recent State of the Industry report by The Good Food Institute (GFI), the total global retail sales of plant-based meat and seafood slightly increased from USD$6.1B in 2022 to USD$6.4B in 2023 (4.92% growth). This growth is attributed to the increasing demand for sustainable protein sources, driven by environmental and health concerns among consumers.

Image source: The Good Food Institute

Image source: The Good Food Institute

Meanwhile, GFI predicts that the market’s value will reach between USD$77B and USD$570B by 2030, with the help of advancements in innovation, production, and costs, as well as significant public and private investments.

But despite the prevalence of plant-based meat alternatives and the recent introduction of cultivated meat into retail, consumers remain skeptical. They are dissatisfied with the former’s taste and the latter’s high price point. Imagine if there was a third option: a meat product that is sustainably produced, nutritionally rich, and addresses these concerns.

Enter hybrid meat, an emerging innovation revolutionizing the FoodTech space.

Hybrid meat combines the best of both worlds: the familiar taste and feel of conventional animal-derived proteins with modern science. As the food industry grapples with the challenge of feeding a growing global population while mitigating environmental impact, hybrid meat emerges as a viable and appealing option.

What is Hybrid Meat?

Although there is no official definition of hybrid meat products, they are usually referred to as meat products containing plant-based ingredients but not as extenders. Instead, they are added to boost nutritional content, lower carbon emissions, and decrease meat consumption.

Meanwhile, according to the Good Food Institute, hybrid meat products are made with any alternative protein production platform. Examples could be a combination of animal-derived meat with plant-based or fungal-based ingredients or plant-based with fermentation-derived or cultivated protein sources. This approach is driven by the need to overcome high production costs and regulatory barriers, paving the way for a new era in sustainable protein production. Companies are hopeful that hybrid meat could help meat-eaters reduce their meat consumption and adopt a more sustainable diet.

The production of hybrid meat starts with choosing a conventional animal protein, such as those derived from poultry, beef, or other meat sources, as the foundation. Then, plant-based ingredients or cultured proteins are carefully selected to complement the animal proteins, enhancing sustainability and providing a balanced nutritional profile. Other ingredients that can also be used include those derived from fungi, precision fermentation, and alternative fats, among others.

The art of hybrid meat production lies in the precise formulation of the meat blend, ensuring a harmonious balance between traditional and alternative elements. Innovations in food science contribute to refining the texture and flavor of hybrid meat, aiming to replicate the sensory experience associated with conventional meat consumption.

Technologies such as extrusion and 3D printing are then employed to create the desired meaty textures and seamlessly combine animal and alternative proteins.

Innovations Making Hybrid Meat Possible

Image from Lypid

Producing hybrid meat that closely mimics the sensory experience of traditional meat while offering improved sustainability and ethical benefits lies in the incorporation of a number of components:

Fat Analogs – crucial for the taste and mouthfeel of hybrid meat products that can be derived from both plant-based and cultivated sources. Plant-based fats like oils from coconut, sunflower, and canola are structured to mimic the melting behavior and mouthfeel of animal fats. Meanwhile, cultivated fats can be combined with plant proteins to improve the flavor and juiciness of hybrid meat products.

Methylcellulose Alternatives – Methylcellulose is commonly used as a binder and texturizer in plant-based meats. It’s a highly synthetic compound that is not digestible, so many consumers and food producers are avoiding this ingredient, opting for better alternatives instead.

In the hybrid meat space, some alternatives to methylcellulose include algae, which can provide binding properties and enhance nutritional content. Meanwhile, bamboo, citrus, and oats fibers are natural binders and texturizers. Fermentation processes can also create ingredients that act as natural binders, reducing the need for synthetic additives.

Algae – a versatile ingredient in the hybrid meat industry, offering various benefits. It is rich in protein, omega-3 fatty acids, vitamins, and minerals, enhancing its nutritional profile. It can also improve the texture, color, and flavor of meat analogs. Algae cultivation is environmentally friendly, requiring fewer resources compared to traditional agriculture.

Plant-Based Heme – an iron-containing molecule that gives meat its characteristic color and flavor. In hybrid meat, leghemoglobin, extracted from the roots of soy plants, is used to replicate the taste and color of meat. It is commonly used in products like Impossible Foods’ burgers. Fermentation-derived heme proteins, meanwhile, provide an authentic meaty flavor without animal sources.

Companies at the Forefront of Hybrid Innovation

Image from Mission Barns

In the rapidly evolving landscape of food technology, the hybrid meat sector has emerged as a compelling bridge between traditional meat and plant-based alternatives. Several pioneering companies are leading the charge in this space, each contributing unique technologies and products that are transforming how we think about meat.

California-based Mission Barns produces the key component that gives meat flavor—animal fat. Its cultivated animal fat can provide flavor and juiciness to plant-based proteins, enabling the creation of delicious, sustainable, and ethical alternative meat products at much lower costs.

The company secured US$24M in 2021 to scale up its cultivated fat technology and establish a pilot manufacturing plant in the Bay Area. Mission Barns recently unveiled its latest innovation, a hybrid pepperoni that combines pork cells with pea, fava bean, and flaxseed proteins.

Hoxton Farms, based in London, also provides cruelty-free, sustainable fats that can be combined with plant protein to craft delicious meat alternatives. It recently closed a $22M series A round led by Collaborative Fund and Fine Structure Ventures, with further investment from Systemiq Capital, AgFunder, and MCJ Collective, among others.

The company is poised for its next phase of expansion, aiming to grow its team and ramp up production capacity to ten tonnes of cultivated fat annually at its pilot production facility. The biotech company asserts that it is progressing as planned to achieve price parity with plant oils once it reaches commercial scale. However, due to regulatory hurdles in the UK, Hoxton Farms is now considering moving to the US, where they are confident they will get approval from the US FDA.

Image from Meatable

Dutch FoodTech company Meatable and plant-based butcher Love Handle announced a partnership in 2022 to build the world’s first hybrid product innovation center, Future of Meat, in which both will invest US$6M. The collaboration has resulted in a number of hybrid sausages and pork belly tastings in Singapore, as the companies expect to launch their joint products sometime this year.

Last year, South Korean plant-based food manufacturer Pulmuone and cell-based startup Simple Planet started working together to develop and commercialize hybrid meat, with a 2025 retail launch target. The partnership aims to cater to the growing demand for alternative meat in the country.

Californian hybrid meat company SciFi Foods produces a hybrid burger patty composed of 90% vegan ingredients, mainly from soy and 10% cultivated meat. Earlier this year, the company announced that it is close to launching its blended product after its first commercial-scale production run.

Since its inception in 2019, SciFi Foods has raised USD$40M, with support from Silicon Valley VC Andreessen Horowitz (a16z), Valor Siren Ventures, BoxGroup, and the famous band Coldplay.

New York-based culinary innovator Mush Foods produces a mushroom-derived mycelium protein ingredient, 50CUT, designed to complement conventional meat, enhancing its flavor profile. A recent life cycle assessment from Boundless Impact Research & Analytics found that 50CUT produces <.02kg CO2e per 113g patty. This means that replacing 50% of conventional meat with this mycelium innovation results in a 1:1 reduction in CO2 emissions per burger.

Mush Foods raised USD$6.2M last year, which it will use to expand its 50CUT products to the US. Just last month, US butchery Pat LaFrieda Meat Purveyors debuted the 50CUT Burger, which blends ground beef with a mix of mushrooms.

Why hybrid meat?

As FoodTech companies innovate different possible solutions to make our food system healthier, more accessible, and more sustainable, hybrid meat is posing to be a viable answer, as evidenced by the different benefits it offers:

Consumer Appeal – Hybrid meats offer a solution for consumers who want to reduce their meat consumption but are not ready to give up their favorite meat dishes entirely. By blending meat with plant-based ingredients, hybrid products can provide the flavor and texture that consumers expect from meat while offering health and environmental benefits.

Affordability and Accessibility – Aside from taste, texture, and overall eating experience, price dictates people’s buying decisions. Hybrid meats could potentially land in shopping carts and more plates faster than cultivated meats. If cultivated meat, hybrid or not, stays premium, it won’t solve the meat paradox.

More cultivated meat companies and even investors are embracing this reality. SciFi Foods founder Joshua March said in an article with Fast Company, “Gone are the days of raising hundreds of millions of dollars to build a speculative facility. People are going to have to figure out how to be profitable earlier, and the only way to do that is by lowering the amount of cells.”

But “how low is too low to be even considered a hybrid or cultivated meat?” is another question. The announcement of GOOD Meat chicken in Singaporean retail stores drew mixed reactions, as it only contained 3% cultivated meat.

Health Benefits – Hybrid meats contain less fat, cholesterol, and calories than conventional meat products. They are also rich in protein, like traditional meat, but also high in dietary fiber.

Sustainability and Environmental Impact – Hybrid meat production has a lower carbon footprint than conventional meat production. For example, swapping out 30% of beef for mushrooms in 10 billion burgers could significantly reduce greenhouse gas emissions, land use, and water use. Additionally, blending meat with plant proteins effectively reduces the number of animals used for food production.

Consumers and experts weigh in: is hybrid meat really a win?

There clearly is an appeal to hybrid meat among consumers, especially those looking to cut their meat consumption. A study on European consumers’ thoughts on hybrid products found the following:

- The market for hybrid products is still small, as consumers are generally not yet willing to pay a premium for such new products. In fact, consumers generally reject hybrid burgers, albeit not more strongly than they reject plant-based meat-only products. Given the choice, they still prefer meat-only foods.

- Some consumers prefer hybrid products labeled with the claim “reduced fat” and branded with the “Carbon Trust label”, while others are not interested in this information.

- When consumers are informed about the benefits of hybrid products (i.e., health, sensory, and convenience), they become more willing to buy them.

- Younger consumers and those who have lower meat attachments tend to prefer hybrid meat.

- More educated and religious consumers like hybrid meat.

- Consumers who are more familiar with plant-based meat and have lower food neophobia prefer hybrid meat.

A number of players in the food industry space are also banking that this technology will take off:

- Israel-based Wilk has developed a hybrid plant-based yogurt product made with cultivated milk fat

- Big food Kerry Dairy is also employing the technique with its new range of oat and dairy products called Smug Dairy

- The Mushroom Council started the Blended Burger Project®, a movement to mix fresh mushrooms with ground meat to create more delicious, nutritious, and sustainable foods

But despite the benefits of hybrid meat in terms of environmental sustainability, cost, and functionality, many investors and sector experts have differing opinions about it:

- In a LinkedIn post, Clear Current Capital investor Steve Molino questioned a recent development in the cultivated meat sector when GOOD Meat’s cultivated chicken became available in retail. He wondered if the move was only made due to investor pressure, considering the product only has 3% cultivated cells.

- Alwyn Capital’s general partner Heather Courtney, meanwhile, sees hybrid meat as a short-term solution, especially with the mission of completely omitting animal meat in the food systems.

- Irina Gerry, Precision Fermentation Alliance Board Chair, wrote an opinion piece about the topic where she said it is not a big idea and that consumer preferences, cultural influences, and dietary choices need to be heavily considered if the sector aims to be successful.

Despite all the industry rumors, our main question is: Can innovation help overcome price hikes, engage more consumers, and drive sales?

Price hikes, although not exclusive to plant-based products, may have impacted the industry’s dollar share. However, the 2023 PBFA (Plant-based Food Association) report remains optimistic about sustained consumer interest across various categories and new products. The report highlights that making plant-based foods easily accessible leads to increased purchases in both units and dollar sales.

Examining sales channels more closely, PBFA notes significant growth in plant-based product sales in food service and e-commerce. This may suggest that when obstacles are minimized, and plant-based options are expanded, sales and consumer engagement rise, according to the association’s latest report.

With price parity and improved experience for plant-based products becoming leading factors for expanding consumer adoption and, more importantly, purchase repetition, only time will tell if this innovation will deliver on its promises.

Update on June 12, 2024: SciFi Foods has announced to shut down its operations and handed off to an advisory firm to run a sale process of their IP and assets. In a company statement on Linkedin, the shutdown was attributed to all the risk combined with today’s capital markets which effectively made it impossible for the company to raise the tens of millions needed for a small commercial launch.

Forward Fooding is the world’s first collaborative platform for the Food & Beverage industry via FoodTech Data Intelligence and Corporate-Startup Collaboration – Learn more about our Consultancy and Scouting Services and our Startup Network.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]