FORWARD FOODING

THE BLOG

The AgriFoodTech Sector: Towards More Sustainable And Innovative Solutions

“Investments are now focused on agricultural biotechnology, precision agriculture, and functional foods.” – Alessio D’Antino, CEO of Forward Fooding

The AgriFoodTech Sector

The sector has experienced major changes in recent years. 2021 global investment reached $63.7 billion, but in 2023, it suffered a 74% decline, in line with the general reduction in venture capital. This drop was driven by the pandemic, highlighting the importance of food security and supply chain resilience. However, many company valuations were inflated based on speculative expectations rather than demonstrated profitability. The current economic situation, marked by inflation and rising interest rates, has made investors more cautious, especially with long-term projects.

Redistribution of Investments

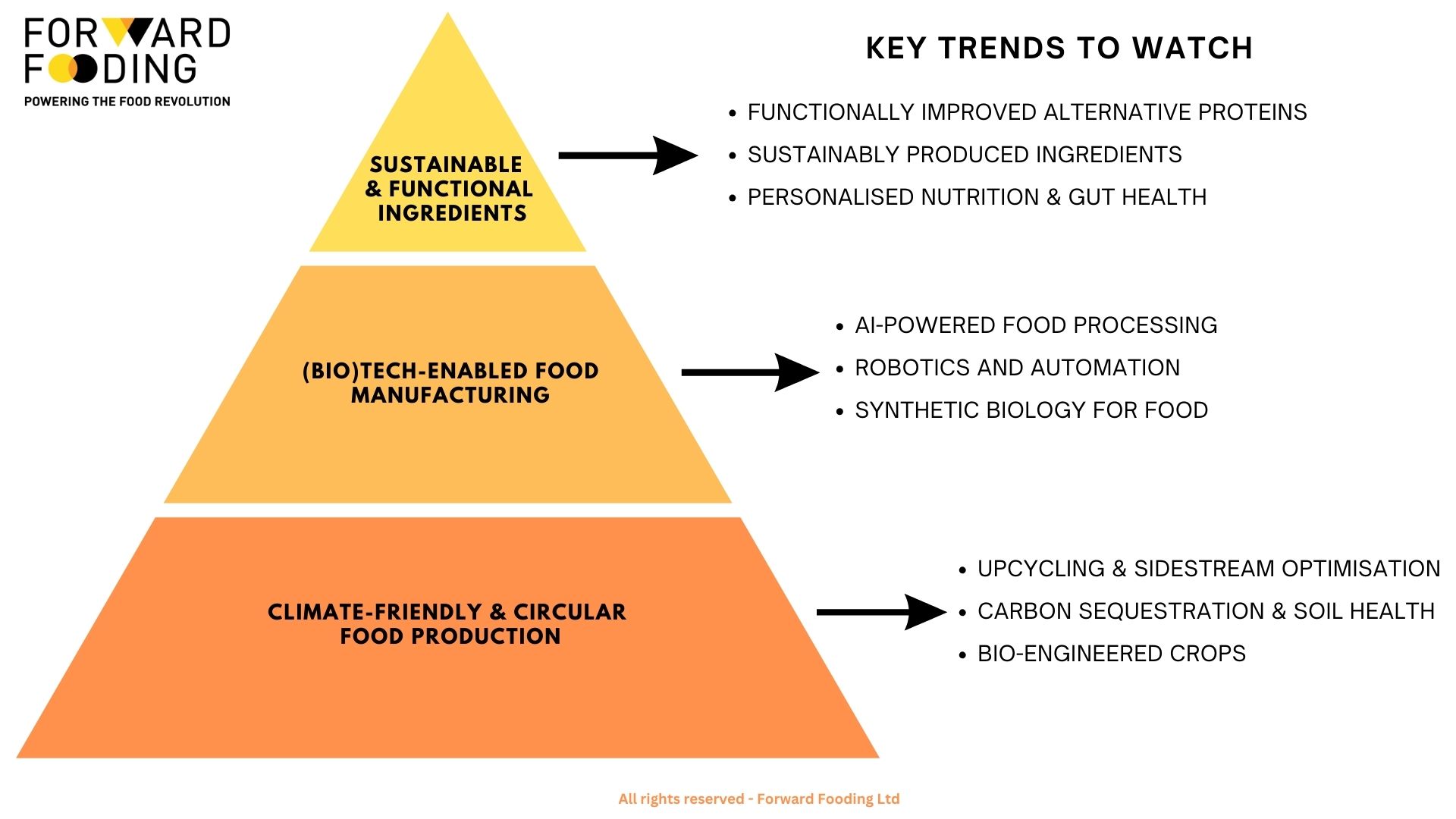

Despite the drop in global investment, the sector continues to show signs of recovery. In 2021, fund distribution focused on food delivery and alternative proteins, which captured 68% of financing. In 2023, this figure dropped to 38%, reflecting a shift towards new value chain areas such as agricultural biotechnology, precision agriculture, and functional foods. These areas increased from representing 19.4% of financing in 2021 to 27.9% in 2023, suggesting a diversification of investments towards more sustainable and innovative solutions.

Key Trends in AgriFoodTech

Alternative proteins in transformation

Despite a 62% drop in investment in alternative proteins since 2021, the sector continues to solidify and consolidate. Initially focused on plant-based products, it has evolved towards hybrid protein sources, combining cultured fats with vegetable ingredients. Fermentation technologies also play a key role in improving flavor and product scalability. Large companies like Cargill and Kraft Heinz have formed strategic alliances to expand in this field.

Sustainable alternative ingredients

The development of more sustainable ingredients is another important trend. Companies like Voyage Foods and Planet A Foods are using biotechnology to replace high-impact ingredients like palm oil, sugar, or cocoa. This transition is also supported by large companies like Cargill, which is investing in sustainable alternative production at scale.

AI-driven food processing

Artificial intelligence is transforming food processing, discovering new ingredients, reducing waste, and improving efficiency. Companies like Twig:bio and Oobli use AI to discover new ingredients and improve production efficiency to reduce waste. Companies like Givaudan have also launched AI-driven platforms that predict market trends, helping brands develop more innovative products adapted to changing consumer preferences.

Upcycling and optimization of lateral flows

Upcycling – the reuse of food waste – is gaining popularity as a solution to reduce food waste, a key challenge for the sector as it significantly contributes to greenhouse gas emissions. According to UN Environment Programme data, 14% of food is lost between harvest and point of sale, while 17% is wasted in consumption. Companies like Better Origin and MOA FoodTech are transforming waste into valuable ingredients, promoting a circular economy model that optimizes resource use. This approach reduces waste and adds value to products, creating new opportunities for sustainable growth within the food supply chain.

This article is a translation from Spanish. You can read the original version here.

Forward Fooding is the world’s first collaborative platform for the Food & Beverage industry via FoodTech Data Intelligence and Corporate-Startup Collaboration – Learn more about our Consultancy and Scouting Services and our Startup Network.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]