FORWARD FOODING

THE BLOG

Forward Fooding & Canadian Food Innovation Network’s Landmark Report Reveals Canada’s FoodTech Promise and Challenges

Forward Fooding is proud to share Canada’s inaugural Foodtech Ecosystem Report, developed in partnership with the Canadian Food Innovation Network (CFIN). This groundbreaking report offers insights into one of the world’s most exciting FoodTech ecosystems. As the global FoodTech data intelligence partner for this landmark report, Forward Fooding provided in-depth analysis and ecosystem mapping into Canada’s evolving FoodTech landscape.

Investment Growth Amid Global Decline

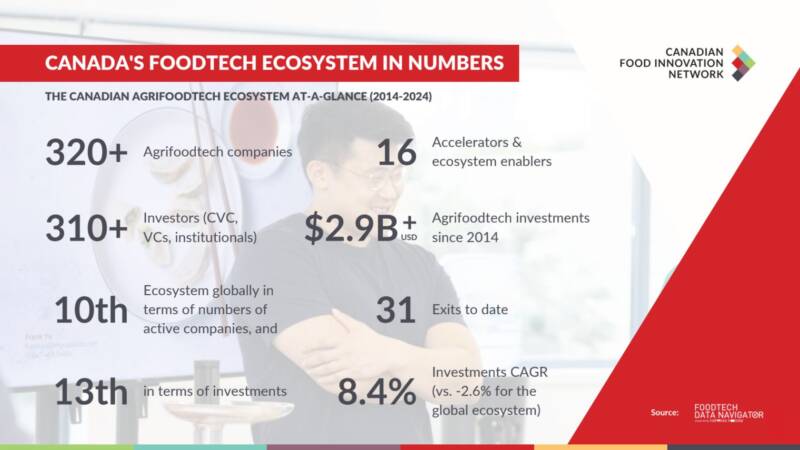

The report, which analyses data from over 9,950 global companies, including 320 Canadian FoodTech ventures, reveals that Canada’s AgriFoodTech sector attracted $4.1 billion CAD ($2.9 billion USD) in investment between 2014 and 2024. Of this total, $2.3 billion CAD ($1.6 billion USD) was specifically directed to FoodTech projects.

While global FoodTech investment has declined by 2.6% annually, Canada has bucked this trend with an impressive 8.4% annual growth rate. Our analysis shows that FoodTech now contributes a remarkable $102.6 billion CAD to Canada’s economy—more than three times the value generated by primary agriculture.

Despite this growth, the report uncovers an investment imbalance: while FoodTech represents 75% of Canada’s agriFoodTech companies, it receives only 56% of investments, compared to the global norm of 83%. This indicates significant room for targeted investment growth in the Canadian FoodTech space.

Canada’s Unique FoodTech Strengths

Our advanced domain analysis identified several sectors where Canada is establishing a competitive edge:

- Plant-based innovation: Now representing 26% of Canada’s Foodtech ecosystem (compared to the 14% global average), this sector has achieved a remarkable 49.5% five-year CAGR with innovators like New School Foods, No Meat Factory, and Smallfood leading the charge. Forward Fooding’s domain analysis reveals that Canada has positioned itself as a global leader in plant-based protein innovation, with concentration metrics significantly above global averages.

- Food waste solutions: Companies like Flashfood, Knead Tech, and Crush Dynamics are tackling Canada’s 21 million tonnes of annual food waste, contributing to a 40.7% five-year CAGR in this domain. Our analysis shows that Canadian innovators are pioneering circular economy approaches, with food waste solutions becoming one of the fastest-growing segments in the ecosystem.

- Biotech-enabled food processing: With an impressive 24.7% five-year CAGR, Canadian companies like Mara Renewables and Chinova Bioworks are pioneering nutrient-dense proteins and innovative ingredients. Forward Fooding’s comparative analysis demonstrates that Canada’s biotech innovation in food processing represents a significant competitive advantage globally, particularly in specialty ingredients and functional foods.

Regional Innovation Clusters

Forward Fooding’s geospatial analysis identified distinct regional innovation patterns across Canada’s FoodTech landscape. Ontario leads with the highest concentration of FoodTech startups (41%), followed by British Columbia (21%) and Quebec (19%). Each region displays unique specialization patterns – Ontario excels in digital food solutions, British Columbia in alternative proteins, and Quebec in food processing technologies.

Critical Challenges Facing Growth

Despite these promising trends, our comparative analysis identifies key challenges that must be addressed:

- Public vs. Private Funding Imbalance: Only 40% of Canadian FoodTech funding rounds are backed by venture capital, compared to 60% in both the UK and the US. Meanwhile, government grants make up 30% of funding rounds in Canada, significantly higher than the UK (5%) and the US (8%). Our funding flow analysis reveals that this overreliance on public funding may limit the sector’s ability to scale rapidly.

- Growth Capital Gap: While early-stage funding is competitive with global benchmarks, Series A and B rounds in Canada are approximately half the size of those in the UK and US, with US Series C rounds being three times larger than Canadian equivalents. Forward Fooding’s investment trajectory analysis reveals a critical “valley of death” for Canadian startups seeking to scale beyond initial market validation.

- Limited Investor Engagement: Of 311 total investors identified in the Canadian ecosystem, Forward Fooding’s investor activity matrix shows only 43 (14%) have made five or more agriFoodTech investments. This percentage matches the UK and US markets, but Canada’s total investment volume remains significantly lower, indicating a need for a larger and more engaged investor base.

- Workforce and Supply Chain Challenges: Labor shortages and supply chain complexities continue to hamper scaling efforts across the ecosystem. Our cross-sector analysis reveals these challenges disproportionately affect mid-stage companies attempting to scale production.

Investment Trends and Future Outlook

Forward Fooding’s longitudinal analysis of investment patterns revealed several important trends:

- Domain-specific funding acceleration: While overall investment has grown steadily, certain domains have seen investment spikes. Alternative proteins attracted 31% of total funding between 2020-2024, followed by food waste management (18%) and food safety solutions (12%).

- Strategic corporate investment: Forward Fooding identified increasing corporate venture capital activity, with a 76% increase in corporate participation in funding rounds since 2020. This trend indicates growing interest from established food industry players in accessing innovation through strategic investments rather than traditional R&D.

- International investment flows: The analysis revealed that 28% of investment in Canadian FoodTech comes from international sources, with US investors leading (63% of international investment), followed by European (24%) and Asian investors (11%). This demonstrates Canada’s growing attractiveness as a FoodTech innovation hub despite the overall funding challenges.

“Canada’s FoodTech ecosystem has made remarkable progress over the last decade, driving transformative innovations that enhance sustainability, boost economic productivity, and create jobs nationwide,” says Dana McCauley, CEO of CFIN. “However, to truly realize our potential as a global FoodTech superpower, we must address the pressing challenges that remain.”

“Our data-driven analysis reveals the untapped potential of Canada’s dynamic FoodTech sector,” adds Alessio D’Antino, Founder and CEO of Forward Fooding. “The key to unlocking Canada’s full potential lies in addressing the investment imbalance and creating more robust pathways to scale for innovative startups.”

This landmark report provides essential insights for investors, entrepreneurs, and policymakers looking to capitalize on Canada’s emerging position in the global FoodTech landscape.

For more information and to access the full report, visit: https://download.forwardfooding.com/en/FoodTech-in-canada-2025

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]