FORWARD FOODING

THE BLOG

Redefining Food Manufacturing with Biotech

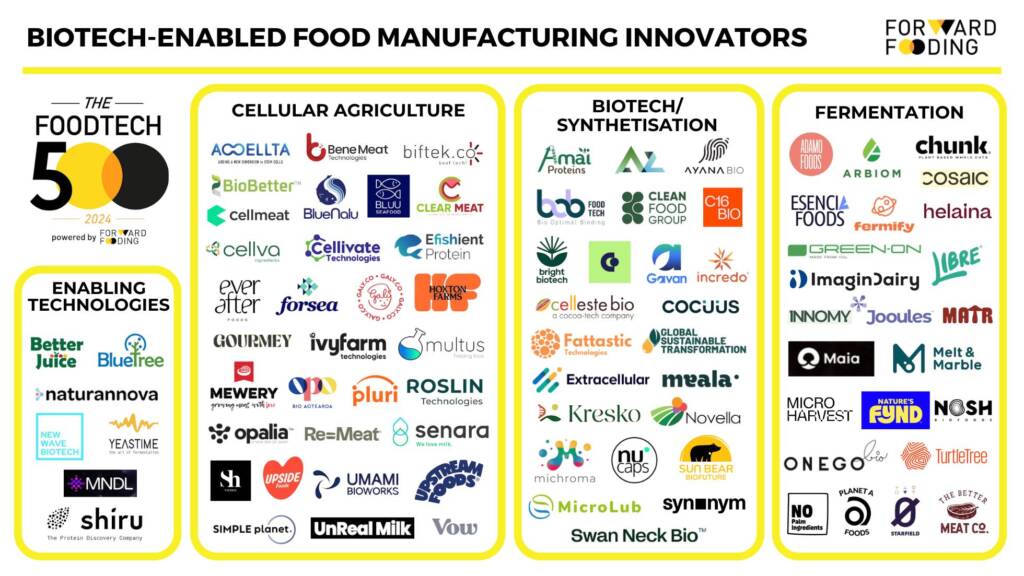

In a world facing mounting pressure to feed growing populations while addressing climate change, (Bio)tech-enabled Food Manufacturing has emerged as the most promising frontier in what we, at Forward Fooding, call Wave 3.0 of FoodTech innovation. This transformative wave, a key component of FoodTech 3.0, is redefining how food is produced, offering solutions that enhance sustainability, nutrition, and efficiency. As we continue to explore this new era of food, we are also highlighting the 2024 FoodTech 500 finalists who are harnessing the power of biology to reimagine our food systems.

The Food System Crisis and the Potential of Biotech Innovation

Our global food system stands at a critical inflexion point, facing unprecedented challenges. Agriculture currently contributes 19-29% of global greenhouse gas emissions while consuming 70% of freshwater withdrawals and degrading roughly a third of Earth’s soil. Despite producing more calories than ever, our food system has created a dual burden of malnutrition and obesity affecting over 3 billion people globally. Recent events have exposed critical vulnerabilities in the global food supply chain, all while population growth demands a 50-70% increase in food production by 2050. These converging crises demand transformative solutions beyond incremental improvements to existing systems – this is where biotech-enabled food manufacturing enters as a potential paradigm shift in how we produce food.

Re-imagining Food Production with Biotechnology

What makes (bio)tech-enabled food manufacturing truly revolutionary is its fundamental reframing of production by shifting from the extraction and processing of agricultural outputs to the precise programming of biological systems as manufacturing platforms. This approach represents a profound paradigm shift in how we conceptualise food production.

Biotech-enabled approaches use microorganisms, cell cultures, or enzymatic processes as their “factories,” often in controlled environments that require significantly fewer resources per unit of output.

Core Technologies Transforming Food Manufacturing

Biotech is changing how we make food, creating more sustainable, nutritious, and efficient ways to feed the world. Here are the key technologies driving this change:

- Cell culture: Cellular agriculture makes it possible to produce food or transform by-products from the food sector into high-value products like meat, dairy, coffee, chocolate, and other novel ingredients through cultivating cells isolated from animals, plants, or microorganisms.

- Fermentation technologies: While traditional fermentation is part of every food culture, other fermentation types make it possible to produce food and ingredients at scale. According to GFI, biomass fermentation leverages the fast growth and high protein content of many microorganisms to efficiently produce large quantities of protein. It is also used in enzyme production. Today, it is possible to produce enzymes from agroindustrial byproducts that can then be applied to biofuel and food processing. Biomass fermentation can be achieved without genetically engineering the strains used. On the other hand, precision fermentation leverages engineered microorganisms to produce food ingredients, such as proteins, fats, flavors, pigments, and vitamins.

- Synthetic biology: Researchers are leveraging synthetic biology to create and assemble new biomolecular components and pathways. This can improve food production, nutrition, and add new functionalities.

- Enabling tech: For example, computational biology, sensing technology, can help optimize bioprocesses and design new food components, such as proteins, by predicting protein sequences and optimizing genetic pathways, in particular with the support of AI

Market Landscape and Growth Trends

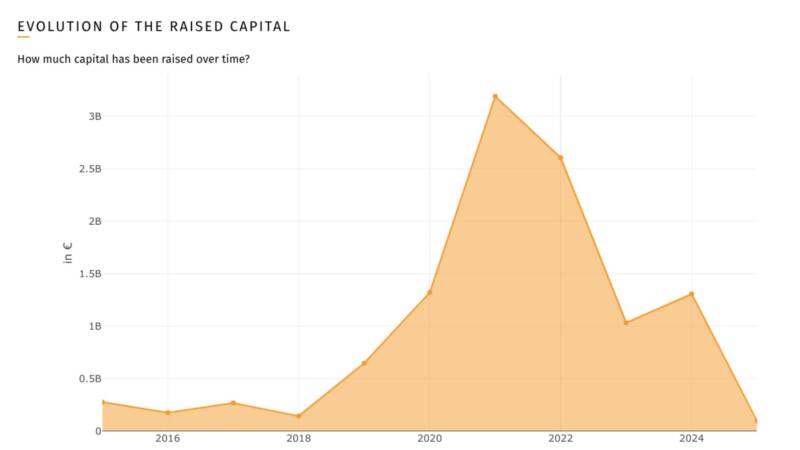

According to the FoodTech Data Navigator, there is a significant growth within the sector, which currently comprises over 480 companies and has attracted more than $1.19 billion in investment as of 2024. The sector exhibits a 23% compound annual growth rate (CAGR), indicating significant expansion and investor interest in its potential to transform food production.

Source: FoodTech Data Navigator

Navigating Regulations, Winning Over Consumers

Globally, regulatory frameworks are designed to ensure food safety, protect public health, and foster innovation, but they vary significantly in scope, stringency, and procedural requirements. In the EU, the regulation of novel foods produced by new production methods and technologies is governed primarily by the Novel Foods Regulation, and is regulated as genetically modified food and feed if genetic engineering was used.

Below is a comparative summary of regulatory timelines and approval pathways, revealing significant regional differences:

| Region | Regulatory Authority | Approval Pathway | Typical Timeline |

Key Characteristics |

| European Union | European Commission, EFSA | Centralized, science-based | 18 months to 3 years | Rigorous, transparent, precautionary |

| United Kingdom | Food Standards Agency (FSA) | Clear, innovation-friendly | aims for faster approvals (2 years) than the EU | Developing a hybrid regulatory framework, streamlined approvals |

| United States | FDA, USDA, EPA | Flexible, risk-based (GRAS, joint FDA-USDA for cell-cultured meat) | Variable (months to 2 years) | Industry-driven, adaptable, less centralized |

| Asia-Pacific (Singapore) | SFA (Singapore) | Clear, innovation-friendly | Months to 1 year | Proactive, supportive of novel foods |

| Latin America | National agencies | Diverse, evolving | Variable | Mix of EU/U.S. elements, local adaptations |

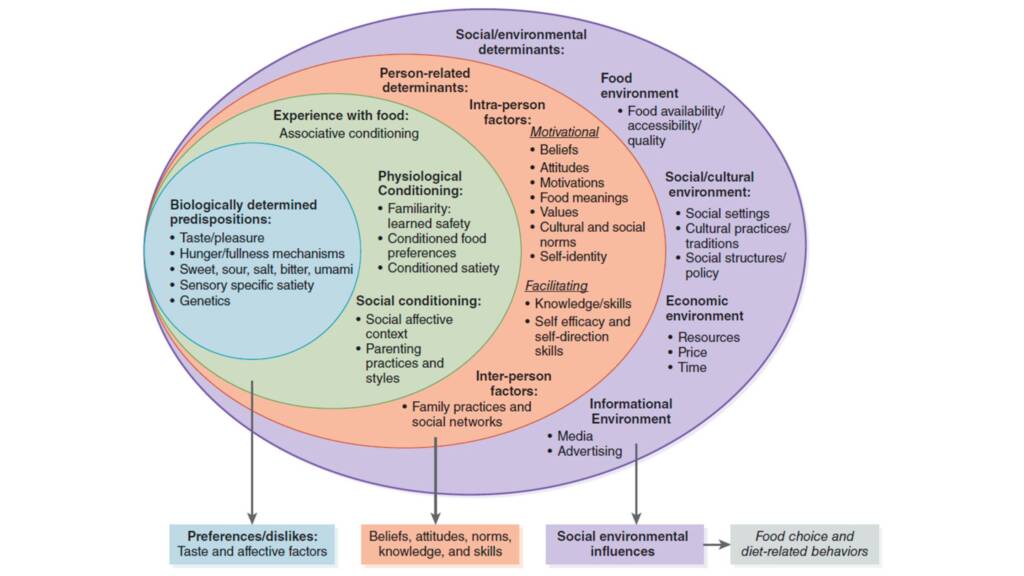

Consumer attitudes toward biotech-derived foods are complex and multifaceted, influenced by perceptions of risk and benefit, ethical and environmental considerations, and personal factors such as demographics and food neophobia. Despite the potential of innovative biotech applications to food, consumers often exhibit food technology neophobia (FTN), a reluctance towards novel food production methods and a preference for minimally processed, “natural” products.

Factors influencing food choices and diet-related behaviors. Source: Günden et.al

This aversion can hinder the adoption of these technologies and contribute to their high failure rates in the food market. In terms of demographics, younger, more educated, and environmentally conscious consumers are generally more open to novel foods, while older individuals and those with higher levels of food neophobia tend to be more skeptical. These results are consistent with a previous study high acceptance for novel food consumer cluster was characterized by individuals who were more likely to be male, younger, university-educated, following a flexitarian diet, exhibiting lower food technology neophobia, and demonstrating a higher concern for the environment.

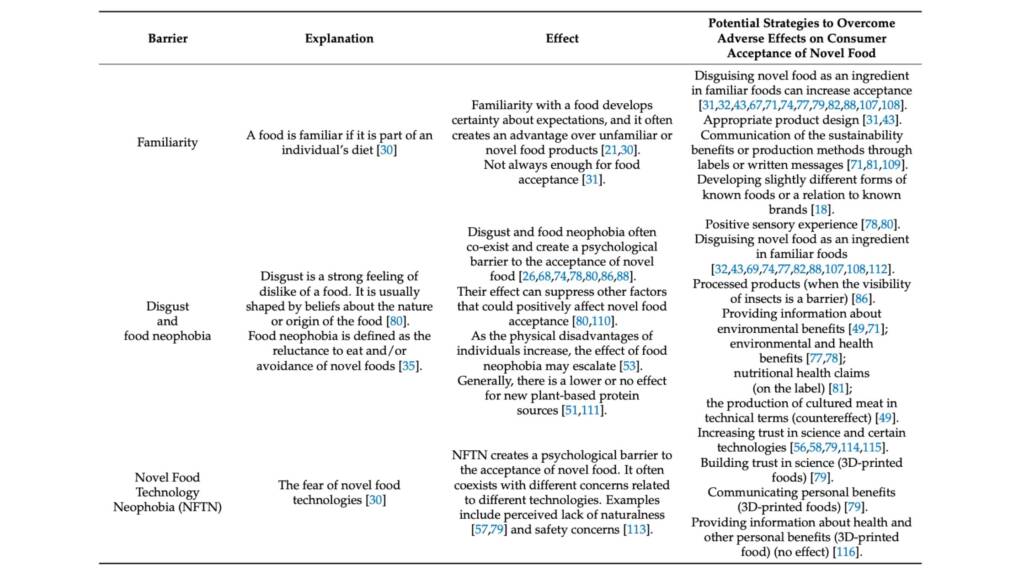

Major barriers to novel food acceptance and related strategies. Source: Günden et.al

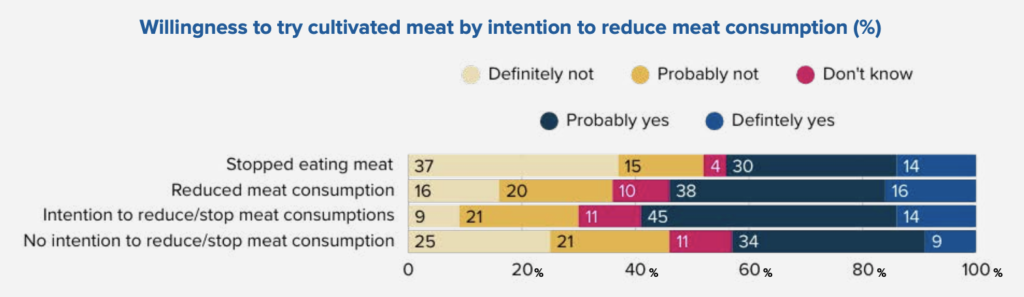

According to a GFI survey spanning 15 European nations, consumer preference leans towards having the option to eat cultivated meat once it receives safety approval from EU regulators. Consumer responses in a study by the FSA showed that 16-41% of people are willing to consume cell-cultivated meat in the UK, but the perceived risks/concerns about cell-cultivated meat are more prevalent than perceived benefits. A survey by Hartman Group revealed that 41% of US adults are willing to try precision fermented foods.

Meanwhile, a recent study by Euroconsumers found that 43% of consumers are willing to try cultivated meat. However, 51% are skeptical of cultured meat due to perceived long-term health risks. Still, 38% are willing to include the novel protein in their diet if it’s proven to be healthier than its conventional counterpart.

Source: Euroconsumers

Companies Leading the Biotech-Enabled Food Innovation – Selection from the 2024 FoodTech Finalists

Cellular Agriculture (33 companies)

Accellta (#429 in the 2024 FoodTech 500 | Haifa, Israel) | Revolutionizes stem cell cultivation with proprietary 3D suspension platform technology for cultured food industries.

Bene Meat Technologies (#416 in the 2024 FoodTech 500 | Prague, Czech Republic) | Develops technology for cultivated meat production without killing animals or harming the planet.

Biftek (#222 in the 2024 FoodTech 500 | Newark, United States) | Produces growth medium supplements to make cultured meat affordable.

Biobetter (#280 in the 2024 FoodTech 500 | Tel-Hai, Israel) | Utilizes plant-based platforms to produce cost-effective, high-quality growth factors essential for the cultured meat industry.

BlueNalu (#48 in the 2024 FoodTech 500 | San Diego, United States) | Specializes in cell-cultivated seafood, producing sustainable and high-quality products to support ocean health and meet global seafood demand.

Bluu Seafood (#382 in the 2024 FoodTech 500 | Hamburg, Germany) | Grows fish cells in fermenters to produce fish fingers and other seafood products.

Cellular Agriculture Ltd. (#452 in the 2024 FoodTech 500 | Pontnewydd, Llanelli, United Kingdom) | Revolutionizes cultivated protein production through innovative bioreactor and bioprocess technologies.

Cellmeat (#61 in the 2024 FoodTech 500 | Seoul, South Korea) |Creates a sustainable future through cell-cultured food technology.

Cellva (#135 in the 2024 FoodTech 500 | Sao Paulo, Brazil) | Develops innovative biotech solutions for food and nutrition, focusing on microencapsulation and cultivated fatty acids.

Cellivate Technologies (#262 in the 2024 FoodTech 500 | Singapore, Singapore) | Pioneers innovative, animal-free cell-based solutions for the pharmaceutical, agri-tech, and cosmeceutical industries.

ClearMeat (#294 in the 2024 FoodTech 500 | Noida, India) | Produces and sells cultivated meat and its ingredients globally.

E-FISHient Protein (#479 in the 2024 FoodTech 500 | Petah Tiqva, Israel) |Accelerates sustainable white fish meat production through nutritious, delicious, and ethical solutions.

Ever After Foods (#277 in the 2024 FoodTech 500 | Haifa, Israel) | Solves the scalability problem to make cultured meat a viable alternative for global food security.

Forsea Foods (#150 in the 2024 FoodTech 500 | Rehovot, Israel) | Develops breakthrough technology to produce cultivated fish and seafood at price parity.

GALY (#54 in the 2024 FoodTech 500 | Boston, United States) | Pioneers revolutionary agriculture through cellular technology.

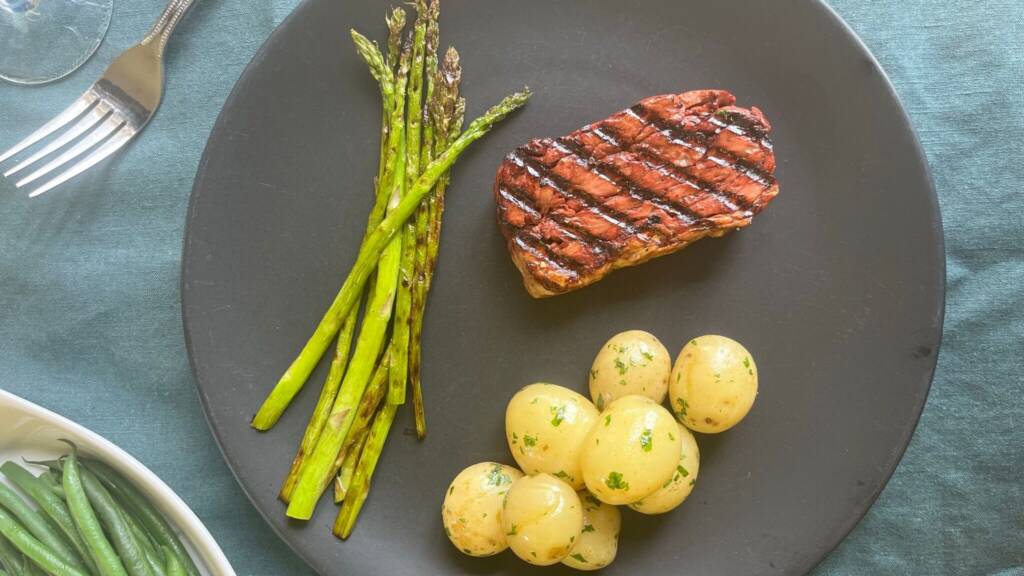

GOURMEY (#22 in the 2024 FoodTech 500 | Paris, France) | Leads as a global frontrunner in premium cultivated meat, aiming to accelerate the world’s transition toward ethical, sustainable, and healthy meat.

Source: Gourmey

Hoxton Farms (#179 in the 2024 FoodTech 500 | London, United Kingdom) | Grows real animal fat without animals using cell biology and mathematical modeling.

Ivy Farm Technologies (#206 in the 2024 FoodTech 500 | Oxford, United Kingdom) | Uses novel technology from the University of Oxford to grow real meat without antibiotics.

Mewery (#180 in the 2024 FoodTech 500 | Brno, Czech Republic) | Develops cell-cultivated meat products using a proprietary method of co-culturing animal and microalgae cells.

Multus (#196 in the 2024 FoodTech 500 | London, United Kingdom) | Enables cultivated meat companies to scale affordably and profitably by providing growth media solutions.

Opalia (#435 in the 2024 FoodTech 500 | Montreal, Canada) | Creates revolutionary technology to produce cell-cultured dairy.

Opo Bio (#447 in the 2024 FoodTech 500 | Auckland, New Zealand) | Develops enabling technology for novel biomanufacturing applications, including cultivated meat.

Pluri (#103 in the 2024 FoodTech 500 | Haifa, Israel) | Provides cell expansion solutions at scale for multiple sectors.

Re-Meat (#455 in the 2024 FoodTech 500 | Malmö, Sweden) | Enables turnkey solutions to catalyze the production of sustainable, affordable, high-quality cultivated meat protein.

Roslin Technologies (#171 in the 2024 FoodTech 500 | Edinburgh, United Kingdom) | Provides advanced cell-based solutions to cultivated meat producers.

Senara (#443 in the 2024 FoodTech 500 | Freiburg im Breisgau, Germany) | Develops continuous, high-throughput processes and bioreactors to produce sustainable, bioidentical milk from dairy animal mammary cells.

Simple Planet (#143 in the 2024 FoodTech 500 | Seoul, South Korea) | Revolutionizes meat production by growing it directly from animal cells.

Steakholder Foods (#248 in the 2024 FoodTech 500 | Rehovot, Israel) | Creates a new frontier in protein manufacturing through 3D printing technology.

Umami Bioworks (#55 in the 2024 FoodTech 500 | Singapore, Singapore) | Develops a platform for the scalable production of cultivated seafood, aimed at preserving endangered species.

UnReal Milk/ Brown Foods (#225 in the 2024 FoodTech 500 | Boston, United States) | Produces “real cow’s milk” without cows in a laboratory.

Upstream Foods (#404 in the 2024 FoodTech 500 | Wageningen, The Netherlands) | Grows the most valuable and delicious part of fish – the fat – directly from cells as flavor and health ingredients.

UPSIDE Foods (#10 in the 2024 FoodTech 500 | Berkeley, United States) | Specializes in developing meat produced directly from animal cells, eliminating the need to raise and slaughter animals.

Vow (#38 in the 2024 FoodTech 500 | Sydney, Australia) | Creates cultured meat products that meat-eaters choose selfishly.

Biotech/ Synthetisation (25 companies)

Amai Proteins (#69 in the 2024 FoodTech 500 | Rehovot, Israel) | Launches sweelin, the first computationally-designed serendipity berry hyper-sweet protein.

APEXzymes (#491 in the 2024 FoodTech 500 | Campinas, Brazil) | Pioneers affordable enzymes to make sustainability cost-effective.

Ayana Bio (#445 in the 2024 FoodTech 500 | Boston, United States) | Grows plants without growing them in the ground, using plant cell culture to sustainably deliver health-beneficial bioactive ingredients.

BOB FoodTech (#378 in the 2024 FoodTech 500 | Rehovot, Israel) | Ensures food safety and quality by removing harmful small molecules, maximizing resource efficiency, and reducing waste.

Bright Biotech (#467 in the 2024 FoodTech 500 | Manchester, United Kingdom) | Empowers the future of cellular agriculture through breakthrough chloroplast technology for protein production.

C16 Biosciences (#53 in the 2024 FoodTech 500 | New York City, United States) | Creates a healthier planet by producing next-generation oils and fats to decarbonize consumer products supply chains.

Cauldron (#67 in the 2024 FoodTech 500 | Orange, Australia) | Unlocks price parity for mainstream bio-manufactured goods through proprietary technology.

Celleste Bio (#108 in the 2024 FoodTech 500 | Misgav, Israel) | Specializes in employing cell culture techniques to produce high-value cocoa ingredients, removing the need for cocoa trees to be grown.

Clean Food Group (#173 in the 2024 FoodTech 500 | London, United Kingdom) | Provides sustainable alternatives to fats and oils, ranging from liquid oils like soybean to hard fats like palm oil, cocoa butter, and milk fat.

Cocuus (#341 in the 2024 FoodTech 500 | Pamplona, Spain) | Creates innovative culinary solutions and manufactures devices and formulations for alternative products.

EXOSOMM (#438 in the 2024 FoodTech 500 | Haifa, Israel) | Creates the first nutritional solution with natural miRNA for anti-inflammation.

Extracellular (#212 in the 2024 FoodTech 500 | Bristol, United Kingdom) | Operates as a contract research and manufacturing organization for the non-health biotech sector.

Fattastic Technologies (#463 in the 2024 FoodTech 500 | Singapore, Singapore) | Provides customizable, healthier, and sustainable fat solutions for food manufacturers, with up to 80% less saturated fat.

Source: Fattastic Technologies

Gavan (#168 in the 2024 FoodTech 500 | Acre, Israel) | Develops an alternative fat solution for the food industry using plant protein.

Global Sustainable Transformation (#154 in the 2024 FoodTech 500 | Munich, Germany) | Provides yeast butter as a sustainable equivalent to cocoa butter.

Incredo (#68 in the 2024 FoodTech 500 | Petach Tikva, Israel) | Offers a sugar-reduction technology that can deliver up to a 70% reduction in sugar.

Kresko RNAtech (#461 in the 2024 FoodTech 500 | Rosario, Argentina) | Pioneers dietary RNA ingredients to naturally boost cellular function and help consumers regain the full benefits of fresh foods.

Meala (#153 in the 2024 FoodTech 500 | Haifa, Israel) | Designs functional proteins for binding and gelling agents, improving texture and juiciness while cleaning up labels.

Michroma (#40 in the 2024 FoodTech 500 | San Francisco, United States) | Produces food dyes made from mushrooms.

MicroLub (#211 in the 2024 FoodTech 500 | Leeds, United Kingdom) | Improves human and planetary health by developing ingredient technologies that replace fat and oil with water, using advanced protein science.

Novella (#448 in the 2024 FoodTech 500 | Modiin-Macabim-Reut, Israel) | Pioneers sustainable plant-based ingredients with cellular agriculture.

Nucaps (#362 in the 2024 FoodTech 500 | Noain, Spain) | Develops next-generation functional ingredients that enhance the nutritional profile and taste of food and supplements.

Sun Bear Biofuture (#458 in the 2024 FoodTech 500 | Oxford, United Kingdom) | Produces alternatives to vegetable fats and oils, such as palm oil, using synthetic biology and precision fermentation.

Swan Neck Bio (#483 in the 2024 FoodTech 500 | Copenhagen, Denmark) | Provides fermentation solutions to enable food and biotech companies to scale, commercialize, and deploy microorganisms cheaper and faster.

Synonym (#136 in the 2024 FoodTech 500 | New York City, United States) | Builds and scales infrastructure enabling the commercialization and manufacture of bioproducts.

Fermentation (24 companies)

Source: Adamo

Adamo Foods (#90 in the 2024 FoodTech 500 | London, United Kingdom) | Develops innovative alternatives to meat whole cuts using fungal fermentation.

Arbiom (#72 in the 2024 FoodTech 500 | Paris, France) | Produces high-quality, sustainable proteins at impressive yields through unique fermentation methods.

Cosaic (f.k.a Cultivated Biosciences) (#23 in the 2024 FoodTech 500 | Horgen, Switzerland) | Develops specialized fat ingredients from oleaginous yeast to enhance plant-based dairy products.

Chunk Foods (#121 in the 2024 FoodTech 500 | New York City, United States) | Creates whole cuts that look, cook, and taste like beef through proprietary solid-state fermentation technology.

Esencia Foods (#463 in the 2024 FoodTech 500 | Berlin, Germany) | Uses mycelium solid-state fermentation to create 3D biomass for complex fish and meat alternatives with clean labels.

Fermify (#51 in the 2024 FoodTech 500 | Vienna, Austria) | Provides a holistic, scalable, and AI-driven B2B platform for casein production.

Green On (#489 in the 2024 FoodTech 500 | Gothenburg, Sweden) | Makes ultra-sustainable fats and oils without agriculture using only electricity, water, and CO2 as raw materials.

Helaina (#76 in the 2024 FoodTech 500 | New York City, United States) | Creates a new approach to wellness by replicating bioactive proteins produced by the human body.

Imagindairy (#191 in the 2024 FoodTech 500 | Haifa, Israel) | Develops 100% animal-free dairy proteins to create innovative dairy products.

Innomy Biotech (#242 in the 2024 FoodTech 500 | Bilbao, Spain) | Produces mycelium protein for sustainable food alternatives.

Jooules (#433 in the 2024 FoodTech 500 | Wellington, New Zealand) | Creates ethical protein ingredients from CO2 emissions.

Libre Foods (#414 in the 2024 FoodTech 500 | Barcelona, Spain) | Sells functional, fungi-based ingredients derived from biomass fermentation.

Maia Farms (#393 in the 2024 FoodTech 500 | Vancouver, Canada) | Provides pure and blended mushroom-based protein ingredients to enhance taste and texture for food manufacturers.

MATR Foods (#45 in the 2024 FoodTech 500 | Copenhagen, Denmark) | Applies innovative fungi fermentation technology using local crops to produce natural meat alternatives.

Source: Planet A Foods

Melt&Marble (#167 in the 2024 FoodTech 500 | Gothenburg, Sweden) | Designs innovative fats via precision fermentation.

MicroHarvest (#70 in the 2024 FoodTech 500 | Hamburg, Germany) | Develops the fastest protein production technology in the world to deliver better protein ingredients.

Nature’s Fynd (#3 in the 2024 FoodTech 500 | Chicago, United States) |Grows Fy, a nutritional fungi protein with origins in Yellowstone National Park, and transforms it into nutritious and planet-friendly vegan foods.

NoPalm Ingredients (#50 in the 2024 FoodTech 500 | Ede, Netherlands) | Creates environmentally friendly microbial oils to substitute palm and tropical oils in food, cosmetics, and detergents.

Nosh.bio (#112 in the 2024 FoodTech 500 | Berlin, Germany) | Harnesses non-GMO fungi to create nutritionally superior, clean-label solutions with high protein and fiber.

Onego Bio (#18 in the 2024 FoodTech 500 | San Diego, United States) | Builds a more resilient food system while catering to growing demand for reliable and sustainable proteins.

Planet A Foods (#13 in the 2024 FoodTech 500 | Munich, Germany) | Makes chocolate more sustainable by using proprietary technology to ferment plant-based ingredients as a replacement for cocoa.

Starfield (#7 in the 2024 FoodTech 500 | Shenzhen, China) | Leads as Asia’s premier plant-based protein food technology company and integrated solutions provider.

The Better Meat Co (#100 in the 2024 FoodTech 500 | Sacramento, United States) | Harnesses the power of fermentation to make versatile mycoprotein ingredients for blended and fully animal-free meats.

TurtleTree (#81 in the 2024 FoodTech 500 | Sacramento, United States) | Revolutionizes nutrition and the dairy industry by making milk and functional milk ingredients without animals.

Enabling Technologies (7 Companies)

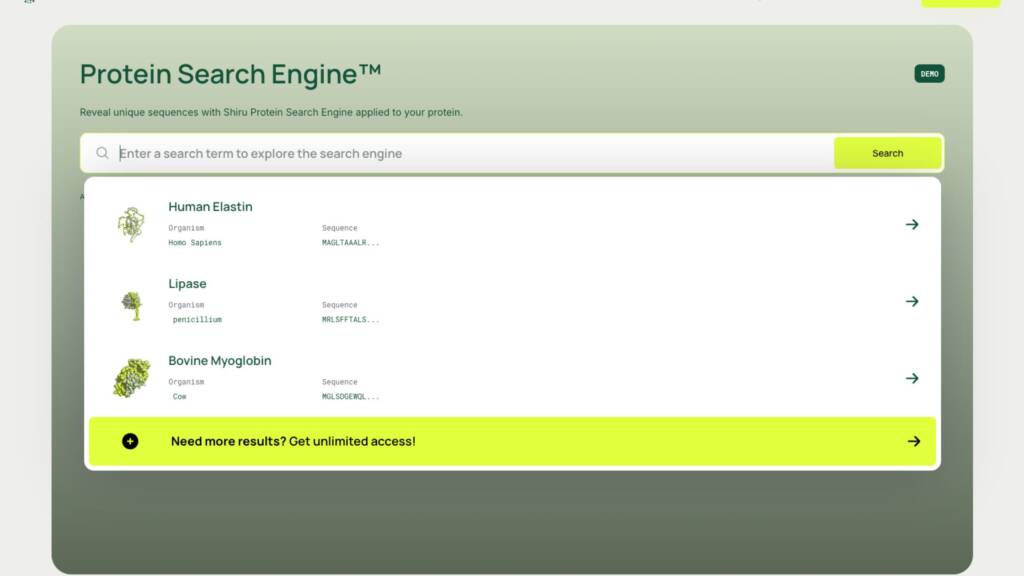

Source: Shiru

Better Juice (#208 in the 2024 FoodTech 500 | Ness Ziona, Israel) |Specializes in sugar reduction technology for fruit juice.

Bluetree (#432 in the 2024 FoodTech 500 | Kiryat Shmona, Israel) | Develops a platform to selectively reduce sugar content in natural beverages without affecting taste or nutritional value.

Naturannova (#346 in the 2024 FoodTech 500 | Santiago, Chile) | Discovers and creates plant-based active flavors.

MNDL (#275 in the 2024 FoodTech 500 | Tel Aviv, Israel) | Revolutionizes synthetic biology with an AI-powered gene expression optimization platform.

New Wave Biotech (#227 in the 2024 FoodTech 500 | Manchester, United Kingdom) | Accelerates alt proteins from lab to market with AI Bioprocess Simulation.

Shiru (#66 in the 2024 FoodTech 500 | Berkeley, United States) | Leverages computational design to create enhanced proteins that feed the world sustainably.

Yeastime (#496 in the 2024 FoodTech 500 | Rome, Italy) | Retrofits ultrasound solutions to reduce fermentation process duration and improve yields by up to 30%.

Ready to make your mark on the future of food? The 2025 FoodTech 500 is calling for applications from groundbreaking companies. Don’t miss your chance to be recognized, APPLY NOW.

Forward Fooding is the world’s first collaborative platform for the Food & Beverage industry via FoodTech Data Intelligence and Corporate-Startup Collaboration – Learn more about our Consultancy and Scouting Services and our Startup Network.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]