FORWARD FOODING

THE BLOG

FoodTech Wave 3.0: The Ag Biotech Revolution Transforming Our Food Future

Agricultural biotechnology (Ag Biotech) represents the convergence of biological sciences and technology, transforming food production systems. This emerging field encompasses genetic engineering, microbial solutions, and precision biological tools designed to enhance crop yields, improve sustainability, and address global food security challenges.

Ag Biotech is one of the key pillars of what we refer to as the ‘FoodTech Wave 3.0‘ with significant innovations having attracted growing investments in recent years

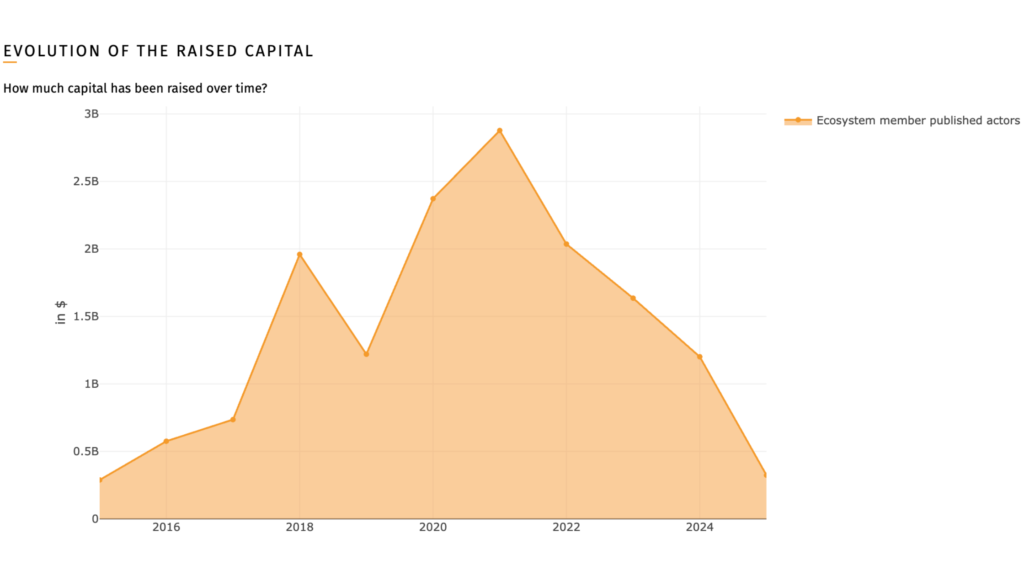

The numbers tell a compelling story. According to our FoodTech Data Navigator, over 520 companies are driving innovation in this space, and the sector has attracted $11.18 billion in investments from 2019 to 2025. Despite global economic headwinds, the Ag Biotech sector has demonstrated remarkable resilience, maintaining an 8% CAGR from 2019 to 2024—a stark contrast to the broader startup ecosystem’s 7.2% decline. Even as investment volumes naturally moderated from $1.16 billion in 2024 to $301 million through the first half of 2025, this reflects market maturation rather than diminished confidence.

The Perfect Storm Driving Ag Biotech Innovation

There are three key factors driving the unprecedented opportunity in Ag Biotech. First, the disruption of traditional farming patterns due to climate change, with extreme weather events, shifting precipitation patterns, andrising temperatures threatening crop yields worldwide. Second, the growing demand for a 70% increase in food production by 2050, driven by a rise in global population. Third, constraints in conventional agricultural expansion due to resource scarcity, particularly freshwater, arable land, and phosphorus.

These challenges have created a massive market opportunity for Ag Biotech solutions that can increase yields, reduce resource consumption, and enhance resilience to climate stress. The economic potential is staggering, with McKinsey estimating that bio-based innovations could generate $2-4T in direct economic impact annually within the next 10-20 years.

Breakthrough Technologies Reshaping Food Systems

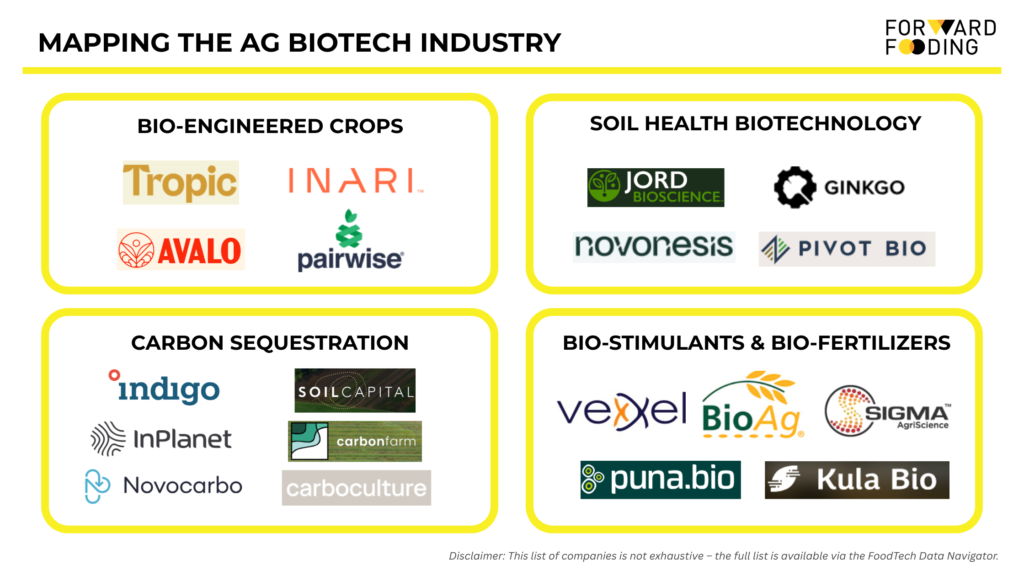

The Ag Biotech landscape covers a diverse range of biological technologies and applications, each addressing specific agricultural challenges through innovative scientific approaches. Below are the main technology clusters driving this transformation: carbon sequestration, soil health biotechnology, bio-stimulants and bio-fertilizers, and bio-engineered crops. Each cluster contains multiple specialised technologies that work synergistically to create more resilient and sustainable farming systems.

Carbon Sequestration: Turning Agriculture into a Climate Solution

Agricultural carbon sequestration represents one of the most promising opportunities to transform agriculture from a source of greenhouse gas emissions into a climate solution. This technology cluster includes several distinct approaches that work to capture and store atmospheric carbon in agricultural soils and biomass.

Key technologies within carbon sequestration include:

- Biochar application: Biochar (biological charcoal) draws carbon from the atmosphere, providing a carbon sink on agricultural lands, sequestering fixed carbon in the soil for centuries to millennia

- Cover crop integration: Cover crops are non-harvested plants grown to enrich soil health by improving nutrient cycling, reducing erosion, and suppressing weeds. They are crucial for improving soil fertility and reducing reliance on synthetic inputs by fixing nitrogen or building organic matter.

- Enhanced rock weathering: This is a carbon dioxide removal technology that accelerates natural silicate weathering by applying reactive silicate rock powders to soils, sequestering atmospheric CO2 as alkalinity and carbonate minerals.

Carbon sequestration could help achieve net-zero emissions in agriculture by 2050, while also providing producers with additional revenue of $375B.

Leading companies in the space include Soil Capital (Belgium), Carbo Culture (Finland), Indigo Agriculture, and CarbonFarm (United States).

Soil Health Biotechnology: Restoring the Foundation of Agriculture

Soil health biotechnology is addressing the critical challenge of soil degradation, which affects 40% of global agricultural land. This technology cluster focuses on restoring and enhancing soil biological activity through targeted microbial interventions and biological soil amendments.

Key technologies within soil health biotechnology include:

- Plant Growth-Promoting Rhizobacteria (PGPR): These are free-living bacteria that colonize plant roots, enhancing growth by improving nutrient uptake, promoting root development, and fixing nitrogen.

- Arbuscular Mycorrhizal Fungi (AMF): These fungi form symbiotic relationships with most land plants, significantly improving their growth, nutrient uptake (especially phosphorus and water), and resilience to abiotic stresses like drought and salinity.

- Microbial consortia: These combine multiple beneficial fungal and bacterial species that enhance plant health and promote biological equilibrium.

- Soil microbiome restoration: Technologies that focus on rebuilding the diverse community of bacteria, fungi, and archaea in disturbed soils to re-establish crucial ecosystem functions like nutrient cycling, water retention, and organic matter formation.

According to Technavio, the global microbial inoculant market size is expected to reach $303.2M from 2025-2029, with a CAGR of 7.8%, driven by increasing concerns over the use of chemical fertilizersand pesticides.

Some of the leading companies in the space include Novonesis (Denmark), Jord Bioscience (United Kingdom), Pivot Bio, and Ginkgo Bioworks (United States).

Bio-Stimulants and Bio-Fertilizers: Natural Performance Enhancers

Bio-stimulants and bio-fertilizers represent a rapidly growing segment that enhances plant growth, stress tolerance, and nutrient uptake through biological mechanisms rather than direct nutrient provision. This cluster encompasses various biological products designed to optimize plant physiological processes and soil-plant interactions.

Key technologies within bio-stimulants and bio-fertilizers include:

- Seaweed extracts and plant-based bio-stimulants: These are natural alternatives to chemical fertilizers that enhance plant growth, improve nutrient uptake, and increase resistance to pests, diseases, and environmental stress, as well as improve soil health by boosting moisture retention and beneficial microbial activity.

- Humic and fulvic acid formulations: These are organic compounds, derived from decomposed organic matter, that enhance soil health and nutrient availability when combined with organic fertilizers.

- Amino acid-based products: Amino acids enhance plant yield and quality by stimulating physiological and biochemical processes, aiding in protein and carbohydrate synthesis, and promoting natural growth hormones.

- Nitrogen-fixing biofertilizers: These are living microorganisms that convert atmospheric nitrogen into plant-available forms, acting as natural fertilizer factories for crops.

This market is projected to reach $7.84B by 2040 at a CAGR of 11.9%.

Companies innovating in the space include Puna Bio (Argentina), Kula Bio, BioAg, Sigma AgriScience, and Vexxel (United States).

Bio-Engineered Crops: Precision Agriculture at the Genetic Level

CRISPR and other gene editing tools are transforming crop development, enabling precise modifications that would take decades through traditional breeding. This technology cluster represents the most advanced applications of genetic engineering in agriculture, offering unprecedented precision in crop improvement.

Key technologies within bio-engineered crops include:

- CRISPR-Cas9 gene editing: This technology allows for the precise modification of plant DNA to develop crops with improved traits.

- Base editing technologies: These are next-generation genome editing techniques evolved from CRISPR/Cas9, which enable precise DNA modifications and offers unparalleled precision for introducing point mutations in genomic regions.

- Prime editing: This is a highly precise genome-editing system derived from CRISPR/Cas, which enables all 12 types of base-to-base conversions and targeted insertions or deletions without inducing double-strand breaks or requiring donor DNA.

- Epigenome editing: This approach precisely modifies epigenetic marks without altering the underlying DNA sequence, to regulate gene expression and improve crop traits.

- Synthetic biology approaches: Synthetic biology applies engineering principles to purposefully modify plants through “design, build, test, and learn” cycles, leading to improved bioproduction based on input genetic circuits.

Recent advances include projects harnessing CRISPR to engineer potatoes resistant to certain diseases, seedless blackberries, and non-browning bananas and avocados.

Some of the companies in the space include Tropic Biosciences (United Kingdom), Pairwise, and Inari (United States).

Case Studies: Pioneering Companies Scaling Solutions

CASE STUDY #1: NOVOCARBO

Source: Novocarbo

Source: Novocarbo

Focus: Transforms agricultural waste into biochar for carbon removal and soil enhancement

Novocarbo is transforming carbon capture through advanced pyrolysis technology that converts agricultural residues into biochar. Their Carbon Removal Parks not only sequester CO₂ but also produce renewable energy and soil amendments. Up to 95% of the CO₂ from biomass can be stored in biochar, creating permanent carbon sinks while converting 3,000 tons of plant biomass into 700 tons of biochar annually.

Their breakthrough extends beyond agriculture – a pioneering pilot project with Hansa Asphalt shows biochar-infused asphalt can capture 75kg CO₂ per ton while improving road performance, with commercial launch planned for fall 2025.

Key Features:

- Converts agricultural waste into valuable biochar

- Generates renewable energy as a byproduct

- Creates verified carbon removal credits

- Permanent CO₂ storage in soil applications

CASE STUDY #2: AVALO

Source: Avalo

Source: Avalo

Focus: Uses AI-powered genomics to accelerate climate-resilient crop breeding

Avalo is transforming plant breeding through explainable AI that identifies genes linked to complex crop traits. Their breakthrough approach enables developing crops five times faster and 50 times cheaper than competitors, while achieving four development cycles in a single year versus just one through accelerated breeding conditions.

Recent partnerships include working with Coca-Cola on climate-resilient sugarcane.

Key Features:

- Whole Genome AI for trait identification

- 5x faster development, 50x cost reduction

- Natural, non-GMO breeding process

- Complex multi-trait crop development

CASE STUDY #3: TROPIC

Source: Tropic

Source: Tropic

Focus: Develops climate-resilient tropical crops using advanced gene editing

Tropic specializes in improving staple tropical crops like bananas, coffee, and rice through cutting-edge genetic innovation. Their proprietary GEiGS® platform combines CRISPR gene editing with gene silencing to create crops that are more resistant to diseases, require fewer pesticides, and can withstand climate change impacts.

In a major validation of their approach, Tropic announced a strategic collaboration with Corteva Agriscience to develop non-transgenic disease resistance traits in corn and soybean using their GEiGS® technology.

Key Features:

- Proprietary GEiGS® gene editing platform

- Focus on critical tropical staple crops

- Reduced pesticide dependency

- Enhanced disease resistance and climate adaptation

CASE STUDY #4: INPLANET

Source: InPlanet

Source: InPlanet

Focus: Combines carbon removal with soil regeneration through Enhanced Rock Weathering

InPlanet pioneered the first agricultural application of Enhanced Rock Weathering in tropical soils, spreading basalt rock powder on farmland to naturally capture CO₂ while improving soil health. Their flagship Serra da Mantiqueira project spans 1,000 hectares of Brazilian sugarcane plantation, applying 10 tonnes of basalt per hectare.

They issued the world’s first enhanced rock weathering carbon removal credits and were recognized as a top 10 most innovative company in Latin America by Fast Company.

Key Features:

- Enhanced Rock Weathering technology

- Dual benefit: carbon capture + soil regeneration

- Scalable application across tropical agriculture

- World’s first certified ERW carbon credits

Scaling Challenges and Regulatory Landscape

Ag Biotech companies face a range of barriers that stifle innovation and hinder commercialization and widespread adoption.

Regulatory Barriers

The regulatory landscape for Ag Biotech, particularly for genetically engineered microbes and biofertilizers, is complex and fragmented. In the United States, products may be subject to review by the EPA, USDA, and FDA, each with its own pathway, rules, and definitions. There is no centralized process for simultaneous review by all relevant agencies, creating confusion and uncertainty for companies navigating approvals

Meanwhile, biofertilizers are hindered by the complexity and high costs associated with compliance with safety, quality, and labeling regulations. These products, being living organisms, require careful oversight to ensure viability and efficacy, adding another layer of regulatory scrutiny.

Scaling and Production Challenges

Scaling up the production of biofertilizers and microbial inoculants presents significant hurdles. Ensuring consistent quality, microbial viability, and efficacy at larger scales is difficult. Production costs can be high due to the specific nutrients and growth conditions required for beneficial microorganisms.

Developing robust microbial strains that can thrive in diverse environmental conditions is essential but requires substantial investment in research and development.

Field testing also represents a critical bottleneck in Ag Biotech commercialization, often requiring 3-5 years of multi-location trials to validate efficacy across different soil types, climatic conditions, and cropping systems. This extended timeline is necessary to demonstrate consistent performance and regulatory compliance, but significantly delays market entry and increases development costs for companies.

Another scaling challenge the sector faces comes from farmers who encounter practical hurdles in adopting new practices. Obstacles could arise from compatibility issues with new technology and their soil, crops, or machinery. Meanwhile, some producers wish to be compensated for their part in making their farming practices more sustainable. They say monetary payments will help increase the scale of their adoption, as they, too, believe in the importance of soil mitigation practices.

Consumer Acceptance and Societal Concerns

Social and cultural resistance to Ag Biotech remains a significant barrier to its adoption. Misinformation and mistrust about genetically modified organisms (GMOs) and engineered microbes can lead to consumer boycotts and create market disincentives for farmers to adopt these technologies.

Public skepticism is exacerbated by a lack of transparent regulatory frameworks and effective public education. Without clear communication of benefits and risks, negative perceptions can dominate, further hindering adoption and policy support.

While some Ag Biotech crops have seen rapid adoption by farmers due to clear benefits (e.g., herbicide-tolerant crops, virus-resistant papaya), consumer attitudes toward new breeding techniques and microbial products remain uncertain, especially outside major commodity crops.

Looking Ahead: The Future of Ag Biotech

The Ag Biotech revolution is accelerating, driven by technological advances and market demand for sustainable solutions. We anticipate several key developments in the coming years:

- International coordination on Ag Biotech regulations will reduce barriers to global commercialization.

- Continued innovation in production technologies will drive down costs, making Ag Biotech solutions competitive with conventional alternatives.

- Growing awareness of environmental and health benefits will drive mainstream adoption of Ag Biotech-derived products.

- Strategic acquisitions and partnerships will reshape the competitive landscape as technologies mature.

Forward Fooding is the world’s first collaborative platform for the Food & Beverage industry via FoodTech Data Intelligence and Corporate-Startup Collaboration – Learn more about our Consultancy and Scouting Services and our Startup Network.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]