FORWARD FOODING

THE BLOG

Food as Medicine in FoodTech Wave 3.0: The Pharmaceutical Disruption in Human Nutrition

The FoodTech landscape has undergone a remarkable transformation over the past decade, with 2025 marking a critical inflection point. While FoodTech Wave 1.0 focused on digitizing food services and distribution, and Wave 2.0 introduced novel foods and alternative proteins, Wave 3.0 represents a fundamental shift toward pharmaceutical-grade precision in nutritional therapeutics.

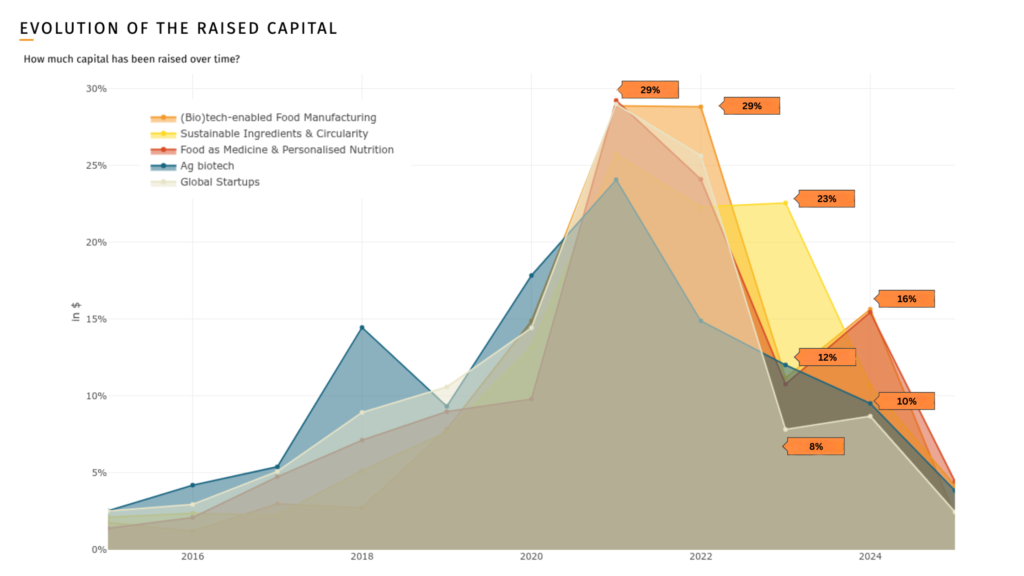

Based on recent numbers from our FoodTech Data Navigator, the Food as Medicine space has 947 companies, which have raised a total of $7.3 billion since 2017, with a 22.8% CAGR from 2019-2024.

The success of pharmaceutical interventions like GLP-1 receptor agonists has demonstrated the power of targeted, evidence-based approaches to health outcomes. The global GLP-1 receptor agonist market size was estimated at $53.46 billion in 2024 and is projected to reach $156.71 billion by 2030, growing at a CAGR of 17.46%. However, this pharmaceutical dominance has also illuminated vast opportunities where food-based interventions can provide unique therapeutic value—particularly in cognitive health, gut microbiome optimization, personalized nutrition, and advanced supplement delivery systems.

This new reality isn’t about food competing with pharmaceuticals, but rather about FoodTech finding unique value in food-based solutions that go beyond traditional drug capabilities, addressing areas where conventional medicines fall short or create new demands.

The Pharmaceutical Context: Lessons from GLP-1 Success

The meteoric rise of GLP-1 drugs like Ozempic and Wegovy has created a paradigm shift that extends far beyond weight management. While these medications have captured significant market share in metabolic health, they’ve simultaneously created new therapeutic needs and market opportunities:

The GLP-1 Effect on Consumer Behavior:

- Users reducing food purchases by up to 11% overall, according to a PwC research

- Total GLP-1 users in the U.S. may number 30 million by 2030 — or around 9% of the overall population

- Increased demand for nutrient-dense, small-portion foods

- Growing need for digestive support due to pharmaceutical side effects

- Rising interest in complementary cognitive and mood support

Industry Response Examples:

- Nestlé launched Vital Pursuit, a new line of frozen meals “intended to be a companion for GLP-1 weight loss medication users” featuring portion-controlled, high-protein offerings

- Danone is partnering with healthcare practitioners, marketing Oikos, Too Good & Co and other offerings as solutions for people taking GLP-1 medications

- General Mills, Conagra, and WK Kellogg are optimizing products for smaller portions and higher nutrient density

Rather than viewing pharmaceutical success as a threat, successful FoodTech companies are identifying areas where food-based interventions provide unique value:

- Cognitive Enhancement: Limited pharmaceutical options create space for nootropic foods

- Gut Health Support: Pharmaceutical side effects drive demand for microbiome restoration

- Personalized Nutrition: Individual variation requires tailored approaches beyond one-size-fits-all drugs

- Preventive Wellness: Food-based prevention before pharmaceutical intervention becomes necessary

Gut Health: The Microbiome Transformation

The gut health market, with 180 companies in the space, is projected to reach $270 billion by 2034, representing one of the most significant opportunities in FoodTech Wave 3.0. Current market size estimates show the digestive health products market valued at $51.7 billion in 2023, growing to $106.47 billion by 2032 at a CAGR of 8.2%. This growth is driven not just by pharmaceutical side effects, but by our expanding understanding of the gut-brain axis and the microbiome’s role in overall health. The gut supplement market alone is estimated at $14.43 million in 2025, with sales increasing at 7.6% CAGR between 2020 and 2024.

Several factors are helping propel the growth of the gut health market, including changing consumer preferences, a growing global working population, rising healthcare costs, demand for immune support, and high interest in a healthy diet for longevity.

Case Study: Ateria Health

Ateria Health exemplifies the sophisticated approach required in Wave 3.0. Rather than competing directly with pharmaceuticals, the company focuses on digestive wellness solutions that address the growing population experiencing gut health challenges from various sources—pharmaceutical treatments, stress, dietary changes, and aging.

Their personalized nutrition solutions target specific gut health conditions through:

- Targeted probiotic strains for specific digestive issues

- Prebiotic formulations that support beneficial bacteria growth

- Anti-inflammatory compounds that reduce gut irritation

- Digestive enzyme support for improved nutrient absorption

Case Study: Bifidice

Bifidice demonstrates advanced probiotic formulation technology that achieves pharmaceutical-grade precision in microbiome support. The company’s microencapsulated probiotics utilize spherification and controlled-release techniques to ensure therapeutic doses reach target areas of the digestive system.

Key innovations include:

- Acid-resistant encapsulation ensuring probiotic survival through stomach acid

- Targeted release mechanisms delivering specific strains to optimal gut locations

- Strain-specific formulations for different health conditions

- Stability optimization for shelf-stable therapeutic probiotics

Case Study: Genbioma Aplicaciones S.L.

Genbioma leverages cutting-edge microbiome research to develop targeted therapeutic interventions that work at the intersection of gut health and systemic wellness. Their approach recognizes the gut microbiome as a central hub affecting everything from immune function to mood regulation.

Their microbiome-based solutions focus on:

- Restoring beneficial bacteria populations disrupted by modern lifestyle factors

- Supporting the gut-brain axis for both digestive and cognitive health

- Developing personalized microbiome interventions based on individual testing

- Creating functional foods that feed beneficial bacteria while starving harmful ones

Cognitive Health: The Pharmaceutical Gap

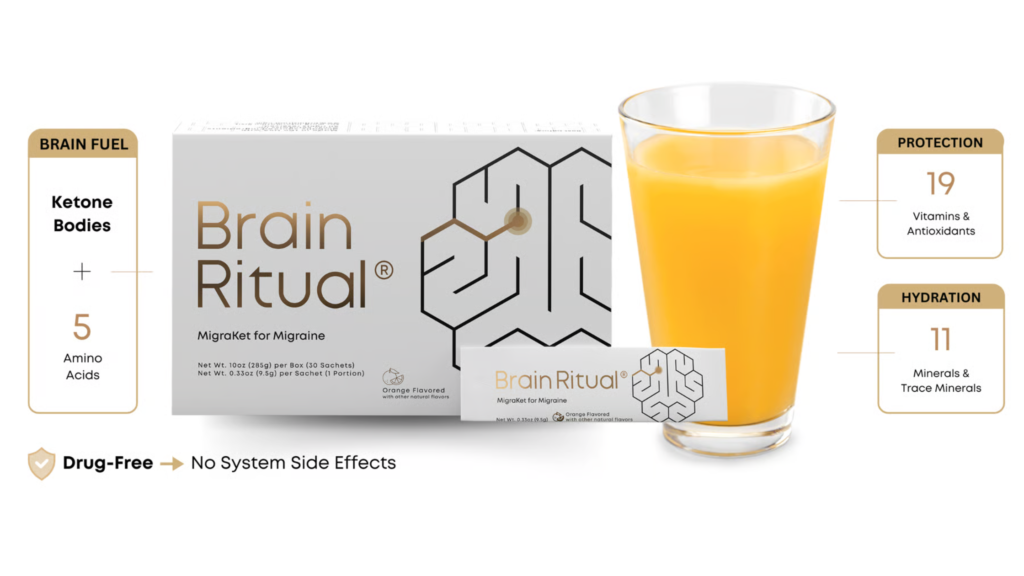

Source: Brain Ritual

Source: Brain Ritual

While pharmaceutical interventions dominate many health sectors, cognitive enhancement and brain health remain areas where food-based solutions can provide primary therapeutic value. The cognitive health sector offers significant opportunities for companies that can deliver bioactive compounds effectively to support brain function.

Case Study: Brain Ritual

Brain Ritual specializes in nootropic beverages designed to support cognitive function, memory, and mental clarity—areas where pharmaceutical options remain limited or carry significant side effects. The company’s approach utilizes advanced encapsulation techniques to ensure optimal bioavailability of cognitive-supporting nutrients.

Their formulations include:

- Nootropic compounds for enhanced focus and memory

- Adaptogens for stress resilience and cognitive protection

- Neuroprotective antioxidants targeting brain inflammation

- Neurotransmitter precursors supporting mood and cognition

Case Study: Brite Drinks

Brite Drinks creates functional beverages that combine palatability with therapeutic cognitive benefits. Their products demonstrate how FoodTech can succeed by targeting conditions where pharmaceutical solutions are either unavailable or carry unwanted side effects.

Technical innovations include:

- Advanced emulsification systems improving bioavailability of fat-soluble brain nutrients

- Controlled-release mechanisms providing sustained cognitive support throughout the day

- Synergistic compound combinations that enhance individual ingredient effectiveness

- Plant-based matrices that improve nutrient absorption and reduce cognitive fatigue

Personalized Nutrition: The AI-Powered Evolution

The personalized nutrition sector has evolved to address the reality that individual biochemistry, genetics, microbiome composition, and lifestyle factors create unique nutritional needs that mass-market solutions cannot address effectively.

Case Study: Edamam

Edamam provides comprehensive nutrition databases and AI-powered analysis tools that enable personalized dietary recommendations at scale. Their AI systems analyze nutritional data alongside individual health parameters, creating customized nutrition plans that optimize for specific health outcomes.

Their platform addresses:

- Individual metabolic variations affecting nutrient processing

- Genetic polymorphisms influencing nutrient needs

- Microbiome composition affecting nutrient absorption

- Lifestyle factors impacting nutritional requirements

Case Study: BeYou

BeYou addresses women’s health needs through personalized nutrition solutions that adapt to hormonal changes and life stages. The company’s focus on female-specific health needs demonstrates successful market positioning in areas where pharmaceutical solutions are less comprehensive.

Their approach includes:

- Hormone-balancing nutrients for different menstrual cycle phases

- Pregnancy and postpartum nutritional optimization

- Menopause support through targeted phytonutrients

- Stress management through adaptogenic formulations

Case Study: moderato

moderato offers targeted nutritional interventions for managing hormonal balance and wellness, particularly focusing on perimenopause and menopause—areas where pharmaceutical options remain limited or carry significant side effects.

Technical sophistication includes:

- Encapsulated bioactive compounds including phytoestrogens and adaptogens

- Timed-release formulations aligning with natural hormonal rhythms

- Personalized dosing based on individual hormone testing

- Synergistic ingredient combinations that enhance effectiveness while minimizing side effects

Supplements & Additives: The Molecular Gastronomy’s Evolution

Source: BioLumen

The supplements and additives sector has evolved beyond simple vitamin pills to incorporate sophisticated delivery technologies borrowed from molecular gastronomy and pharmaceutical science, creating products that can achieve therapeutic efficacy previously impossible with traditional formulations.

Case Study: Nutrition From Water

Nutrition From Water pioneers innovative nutrient delivery through enhanced water solutions, utilizing nanoencapsulation to protect bioactive compounds from environmental factors like light, oxygen, and pH changes.

Their technology addresses:

- Improved bioavailability of water-soluble and fat-soluble vitamins

- Targeted delivery of therapeutic compounds to specific body systems

- Enhanced stability of sensitive nutrients during storage and transport

- Optimized absorption timing for maximum therapeutic effect

Case Study: BioLumen

BioLumen combines biotechnology with nutrition science to create enhanced food products with therapeutic properties. Their approach represents the sophistication required to achieve pharmaceutical-grade precision in nutrient delivery.

Key innovations include:

- Controlled-release mechanisms ensuring sustained nutrient delivery

- Targeted delivery systems directing compounds to specific organs or tissues

- Bioactive peptide encapsulation for improved stability and absorption

- Synergistic formulations that enhance individual compound effectiveness

Case Study: Wonder Veggies

Wonder Veggies focuses on developing nutrient-dense vegetables with enhanced bioactive compound profiles through innovative growing techniques. Their approach represents preventive nutrition, creating foods with precisely targeted therapeutic properties.

Their biofortification techniques create:

- Enhanced antioxidant content for cellular protection

- Increased vitamin bioavailability through natural plant matrices

- Optimized phytonutrient profiles for specific health outcomes

- Sustainable growing methods that maintain soil health while maximizing nutrition

Regulatory Landscape and Challenges

The regulatory environment for food as medicine remains complex and evolving. Despite their potential, challenges such as compound instability, scalability issues, and regulatory constraints continue to hinder widespread adoption.

FDA Approval Processes: The FDA has created specific pathways for medical foods and dietary supplements, but the approval process for functional foods with therapeutic claims remains challenging. Companies must navigate between food regulations and pharmaceutical requirements, often requiring expensive clinical trials to support health claims.

Global Regulatory Differences: Different countries have varying standards for functional food approval. The European Union’s more stringent health claim regulations contrast with more permissive approaches in some Asian markets, creating complex challenges for global companies.

Evidence Standards: The potential effect of clinical trials was emphasized in establishing the therapeutic value of functional foods. Companies must invest in robust clinical research to support their health claims, which can be costly and time-consuming.

Consumer Perspective and Market Evolution

Today’s health-conscious consumers expect evidence-based solutions with clinical backing, creating opportunities for FoodTech companies that can demonstrate therapeutic efficacy through rigorous research.

Consumer Trends Driving Market Evolution:

- Preference for preventive over reactive healthcare approaches

- Interest in personalized solutions tailored to individual needs

- Demand for natural therapeutics with pharmaceutical-grade effectiveness

- Willingness to pay premium prices for proven health outcomes

- The global wellness market reached $1.8 trillion in 2024, indicating massive consumer investment in health optimization

Consumers need education about optimizing nutrition while on pharmaceutical treatments, creating opportunities for companies that can provide complementary solutions. The successful companies in Wave 3.0 are those that help consumers integrate pharmaceutical and nutritional approaches rather than choosing between them.

Future Outlook: Coexistence or Further Displacement?

The most successful FoodTech companies in Wave 3.0 are adapting through:

Complementary Positioning: Companies like Ateria Health and Bifidice focus on supporting pharmaceutical treatments rather than competing with them.

Unaddressed Markets: Brain Ritual and Brite Drinks target cognitive health where pharmaceutical options remain limited.

Specialized Demographics: BeYou and moderato serve specific populations with unique needs not fully addressed by mainstream pharmaceuticals.

Preventive Focus: Wonder Veggies and BioLumen emphasize prevention before pharmaceutical intervention becomes necessary.

Advanced Technology: All successful companies utilize sophisticated delivery systems borrowed from molecular gastronomy to achieve pharmaceutical-grade precision.

The future likely lies in integration rather than competition. Food structure confers specific functionalities to supplemented encapsulated bioactive compounds during processing and digestion, and this scientific understanding is enabling FoodTech companies to create products that work synergistically with pharmaceutical treatments.

Conclusion: The Evolution of Therapeutic Nutrition

FoodTech Wave 3.0 represents the evolution of food as medicine from simple functional foods to sophisticated therapeutic systems that achieve pharmaceutical-grade precision in targeted health outcomes. The success of companies like Ateria Health, Brain Ritual, Edamam, and BioLumen demonstrates that the future belongs to those who can combine scientific rigor with technological innovation to create solutions that address unmet medical needs.

The key success factors for FoodTech Wave 3.0 include:

Scientific Foundation: Rigorous clinical research demonstrating therapeutic efficacy comparable to pharmaceutical standards

Technological Sophistication: Advanced delivery systems and molecular gastronomy techniques ensuring optimal bioavailability and targeted action

Personalized Approaches: AI-driven customization addressing individual genetic, microbiome, and lifestyle factors

Complementary Positioning: Strategic focus on areas where food-based interventions provide unique value alongside pharmaceutical treatments

Consumer Education: Clear communication about appropriate use cases and integration with existing healthcare approaches

As we move forward, the most successful FoodTech companies will be those that can demonstrate not just what they can do, but why their approach provides unique value in a world where pharmaceutical interventions continue to advance. The opportunity is vast for those who can navigate this complexity with both scientific rigor and innovative thinking.

Forward Fooding is the world’s first collaborative platform for the Food & Beverage industry via FoodTech Data Intelligence and Corporate-Startup Collaboration – Learn more about our Consultancy and Scouting Services and our Startup Network.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]