FORWARD FOODING

THE BLOG

Top FoodTech trends to Watch in 2021 | Foods & Drinks of the Future Series

Welcome to Forward Fooding’s Foods & Drinks of the Future Series, where we will explore a list of 10 food and beverage trends to watch in 2021.

What’s on the plate?

Are you one of those FoodTechies who never miss a beat on the Food & Beverage sector’s latest trends? Do you love to stay on top of what’s hot when it comes to startups shaping the future of food? At Forward Fooding, we sure are. Stay tuned and keep reading our predicted food and beverage trends to watch in 2021!

Plant-Based foods (with meat and dairy leading the way)

In 2019, UBS estimated the plant-based-protein to reach €70B in 2030, with a 28% year-on-year growth. It’s therefore no surprise that in 2021, we will continue to see alternative meat solutions as a major frontrunner. Nowadays, the range of options is immense. HaoFoods made peanuts a source of plant-based chicken meat. All sorts of seaweed (e.g. duckweed) is used as a source ingredient. Even wood (yes, you’ve read it right) is substituting its meaty counterparts like Arbiom’s Sylpro high-protein product.

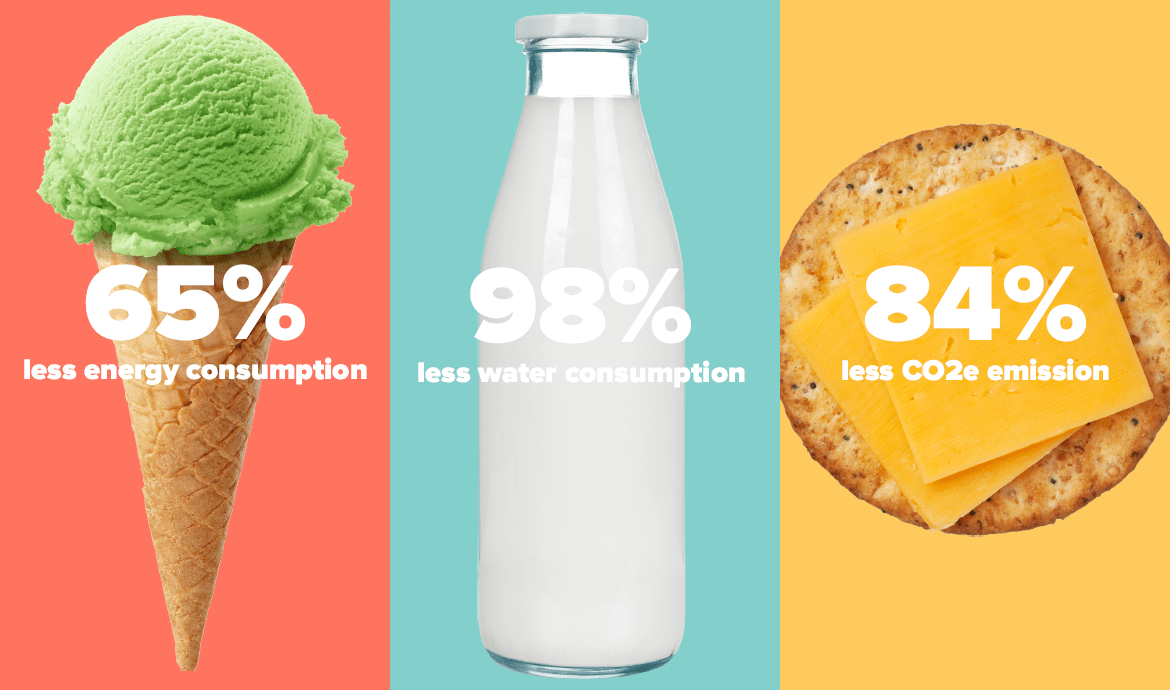

A similar situation is the case for alternative dairy products as well, with unicorn companies like Oatly achieving great success globally. Multinational FMCG giants have also entered the space by launching more plant-based dairy products. Danone launched Silk vegan milk products. Unilever launched its vegan Magnum. Nestlé started a vegan Nescafé line and the first ever vegan condensed milk under their Carnation brand. The source ingredients of alternative milk products are also changing. While soy, oat and almond are still category leaders, split pea, hemp seeds and barley milk have entered the stage. All these facts make us think, the global demand for plant-based alternatives is very likely to grow well beyond 2021.

Air and CO2 Protein

There’s been an enormous interest in air and CO2 protein recently with startups raising big rounds of funding. Solar Foods, raised a total of €18.5M for its Series A. Similarly, Air Protein raised €26.5M in its Series A in the first week of 2021. Another company active in the field, NovoNutrients, is progressively achieving commercialisation through partnerships. Using renewable energy and a probiotic production process where cultures convert elements into nutrients, this futuristic trend is scaling at an incredibly fast rate.

Precision fermentation

2020 saw the “marriage” of cell and plant-based companies – in 2021, they’re going on a honeymoon. Precision fermentation and renewable and upcycled proteins are helping cell and plant-based companies to develop and improve their products. With companies such as Planetarians, Better Dairy, Nature’s Fynd and The Protein Brewery leading the way, this was a big trend in 2020 and one to watch in the new year.

Market-wise, fermented drinks as a wider category (which has nothing to do with precision fermentation tech) will keep growing as demand increases for gut health and functional products. With people spending time home in 2020, homemade kombuchas and pickling have increased dramatically. We’ve already seen a hint of the growing interest in pickling and fermenting when mason jar lids saw a global shortage in October.

Seaweed and microalgae

Food made from or enriched with micro-algae will be more under the spotlight than ever before. Harnessed from seaweed, microalgae are a nutritious and vegan source of protein. Many startups, such as NovaMeat, Trophic and Algaia, are working on creating meat alternatives from seaweed. In July, Unilever announced a partnership with microalgae biotech startup Algenuity to discover potential food applications, especially as a sustainable and rich protein source.

Dark kitchens shine bright

The delivery industry is booming with the increased number of people staying at home due to Covid-19. The amount of orders has more than doubled in the first nine months of 2020 compared to the year before. This increase in demand has paved the way for the next generation of delivery-focused businesses: dark kitchens. Dark kitchens (or cloud kitchens) are not a new concept but will be more prominent in the coming years. Karma Kitchens in the UK, has raised €283M in its Series A in July 2020 to fund its European expansion and opened its second location in November. In 2019 Uber’s Travis Kalanick-backed Cloud Kitchens had received €330M from Saudi Arabia Public Investment Fund, making it the first dark kitchen unicorn.

Fungi

The fungi space is growing. More and more startups are entering the field with mushroom-based food, packaging and clothing products. MushLabs, the fungi biotech company producing alternative protein from mushrooms, has raised €8.2M (in their Series A) in August 2020. Bolt Threads, a startup producing animal-free leather from mycelium, has recently partnered with Adidas, Stella McCartney and Gucci to improve production. They predict 2021 will see mushroom leather products in the market.

Non-alcoholic drinks

Demand for healthy alternatives to food and drinks is growing across categories. This shift in consumer preferences has given birth to a whole new segment of alcohol: non-alcoholic spirits. The non-alcoholic spirits category has substantially grown across EU in the last 5 years. In 2019, UK sales had reached €42M, more than quadrupling since 2014. Estimates for 2020 exceed that, with UK sales increasing 30% during the lockdown. Brands that stand out in the industry, are Seedlip, which was acquired by Diageo in 2019, Australian company Lyre’s and UK-based Borrago among others. More brands are entering the field, especially in the no-alcohol beer segment and with more emphasis on sustainable packaging.

Personalised nutrition and tracking solutions

Personalised nutrition platforms and products are becoming more popular and will see further growth as a segment in the upcoming years. At home testing and algorithm-powered personalisation software have given startups the ability to pinpoint exact customer needs and develop personal nutrition programmes or products. Consumer apps allowing users to track nutrition, allergens and restrictionsin their diets are proliferating. 2021 will see more startups gaining traction. Startups to watch are personalised stress-reducing nutrition bar company myAir, health tracking grocery assistant Ipiit and personalised drink startup Mixfit.

Lab-Grown Meat

The future is now. Lab-grown meat is officially becoming an everyday reality, with Singapore regulating it in December, and some restaurants already serving it. Companies in this space are collaborating very closely to build a resilient supply chain and scale faster. As they grow, we encourage you to watch them in 2021. Some startups leading the way in the field are Mosa Meat, Memphis Meats and Aleph Farms with other companies such as Shiok Meats and Higher Steaks and many others becoming the front-runners

D2C is the New Black

Big companies are rallying to buy the best D2C meal-kit companies with the most robust and scalable e-commerce platform. While millennials and Gen Z are the growth drivers of this trend, many other groups had the chance to try out this type of service during lock-down times. You can read more of our thoughts about this topic here.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]

/cdn.vox-cdn.com/uploads/chorus_image/image/64898259/shutterstock_674369497.7.0.jpg)