FORWARD FOODING

THE BLOG

2022 – A Turning point for FoodTech?

It’s no secret that 2022 was a challenging year for the food system. Following the shockwaves of Covid-19, supply chains were once again tested and made to bear the weight of the war in Ukraine. The global economic crisis also impacted Venture Capital markets and the FoodTech sector was no exception. We look back on what we’ve learned in the past 12 months and think about what it all means for the year to come.

Looking back at 2022: key learnings

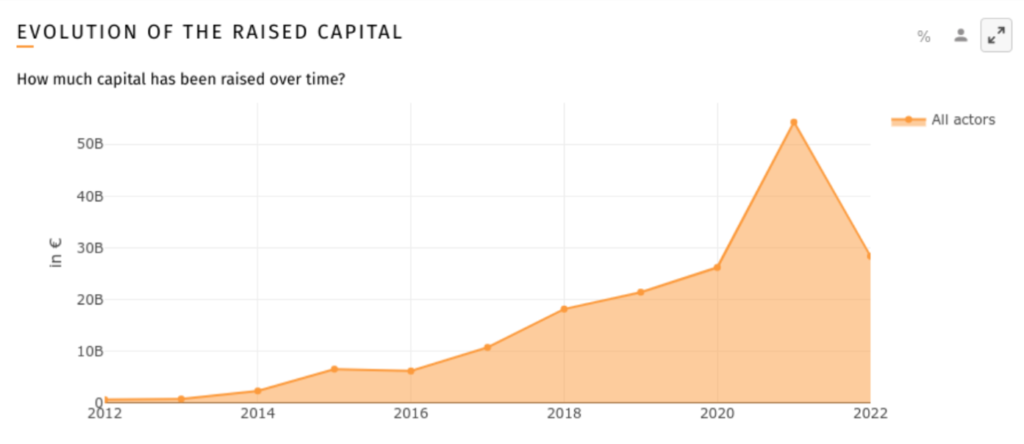

After a record 2021, Global FoodTech Investments cooled down

According to the FoodTech Data Navigator, global FoodTech investments dropped 50% YoY, from €54B in 2021 to €28B in 2022*. Despite this fall-off, they were still 20% higher than in 2020.

What caused this drop? The Financial Times also highlights a 44% funding slump between 2021 and 2022, and attributes it to rising interest rates and questions over startup business models. VC valuations were also impacted: in the US, the median late-stage valuation of VC funding across all sectors fell to $71 million, marking a 29% drop from Q1. As a result, only 9 FoodTech companies achieved Unicorn status in 2022, compared to 35 in 2021. Among the companies that achieve unicorn status, some have no revenue yet, a sign that the market still needs to go through a profound correction.

* (so far as 2022 deals information keep coming in)

Source: FoodTech Data Navigator

Declining markets are affecting startups valuations, disincentivizing IPOs and SPACs as an exit strategy

After the “SPAC” frenzy of 2021, current economic conditions have dampened enthusiasm for new IPOs in the sector. To name a few examples, Instacart recently pulled the plug on its planned IPO, none of the companies that were rumoured to go public in June 2021 by FoodHack has followed through (including Impossible Foods), and none of the seven companies listed in the FoodTech 500 as IPO candidates have made moves towards going public either.

Capex intensive segments like eGrocery, Delivery services and Vertical farming are struggling more than ever to reach profitability

These actors have been facing a lot of challenges in the past few months: Starship Technologies is cutting 11% of its workforce, Nuro is laying off 20% of its workforce, JOKR will exit two South American markets, and Getir cut 14% of its staff back in May, amongst other examples. The steep rise in energy costs affected vertical farming companies the most: Infarm announced it would lay off +50% of its staff, while Fifth Season and Glowfarms are the latest vertical farming companies to declare bankruptcy.

We expect more companies to experience difficulties in the new year, and we think the wave of M&A consolidation will continue (see our recent articles on food delivery and vertical farming).

Getir acquired Gorillas in 2022

Investors are reviewing the growth expectations of the plant-based protein market

Over the past few months, we’ve seen investors starting to become more doubtful about the opportunities offered by the plant-based protein sector. With inflation ramping up and consumers less and less inclined to pay a premium, plant-based sales stagnated in 2022: Beyond Meat stock fell more than 83% over 2022 due to poor sales performance, and Oatly’s dropped by 73% for the same reason. Concern also arose when Brazilian meatpacker JBS announced it would pull the plug on its plant-based brand Planterra, although this could be explained by the decision to put more focus on Vivera, another plant-based business JBS acquired in 2021. Moreover, it’s worth noting that major food companies are still investing significantly in plant-based foods.

In our opinion, the sector is simply going through the ‘disillusion phase’ of the Gartner Hype Cycle. Plant-based products have not yet clearly defined their position on retail shelves, and the category has yet to be consolidated. This ‘crisis’ might prompt investors to turn their attention towards enabling technologies and ingredients in order to produce more scalable meat alternative products. This might entail looking at fermentation and cellular agriculture technologies to create ‘hybrid’ products, as opposed to pure plant-based (more about this in this blogpost).

Ultimately, it will be only once alternative protein products are as close in taste, nutrition, and price to their animal-based counterparts that we can understand the actual size of the plant-based market. Until then, in my humble opinion, we’re comparing apples and oranges.

Should we be concerned about the future of FoodTech?

It’s hard to tell what 2023 has in store for FoodTech, but I doubt investment trends will change dramatically. That said, every crisis brings about new opportunities.

First of all, the crisis that some segments of FoodTech are experiencing will encourage investors to broaden their scope and seek out investment opportunities across the entire food supply chain. As a result, sectors like Ag biotechnology, Food waste and sidestream optimization, and Farm robotics might get a further boost. The growing presence of more and more specialized VCs and impact-driven funds might contribute to this shift and help the industry resolve some of its unaddressed challenges. I talk more about this in this article about the greatest innovation “blind spots” of the decade.

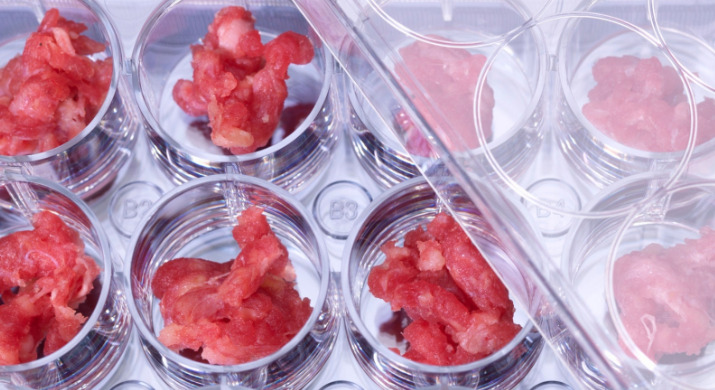

Last but not least, one of the biggest news of 2022 was, without a doubt, FDA’s approval of Upside Foods’ cell-based meat products, which marked an important milestone for the sector. In only a few months from this event, other companies will start commercializing their products in US (e.g. Wildtype, BlueNalu).

FDA Gives Safety Green Light to Lab-Grown Meat Startup Upside Foods

What we have been up to at Forward Fooding

Based on the interactions we had with our clients and the sheer amount of work we have delivered on the consulting side this past twelve months, we remain quite optimistic about the future. More than ever, food companies are eager to turn around their long-term strategy towards sustainability & efficiency, embracing FoodTech and working hand-in-hand with startups, with no fear of engaging early on.

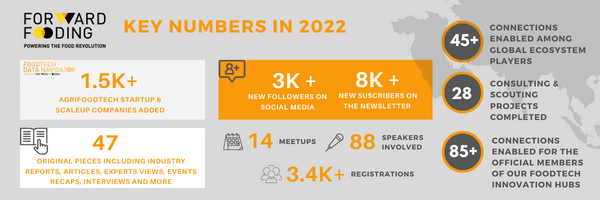

Last year, our company supported the innovation strategies of 15 corporate and investor clients, including Fortune 500 companies such as General Mills, Dole, and Cargill among others. We delivered more than 28 consulting & scouting projects, sparked 45+ introductions among global ecosystem players and enabled 85+ connections off the back of 1-to-1 meetings with official members of our FoodTech Innovation Hubs in London, Barcelona, and Milan. In addition, we published 11 FoodTech reports (you can download them here free of charge), and 36 original articles on our blog.

While investments were lower last year when compared to 2021, the number of new companies entering the FoodTech scene kept growing. In the past twelve months, we added 1500+ companies to our FoodTech Data Navigator. It now counts almost 20,000 ecosystem actors across the globe!

Furthermore, we received more than 2,000 applications for the FoodTech 500, including applications from 380+ companies founded in the past two years. Stay tuned as we are heads down working on building the ranking to be announced on March 1st, 2023!

In this new ‘post-Covid era’ (hopefully, we can call it so), 2022 felt like a breath of fresh air as we were finally able to resume our live events. Last year, we organized 14 events across our FoodTech hubs and online. These gatherings attracted 3,400 registered participants, 88 speakers and sparked meaningful connections and conversations worldwide (if you missed them, you can check out the recaps here).

Forward Fooding FoodTech Meetups 2022 in Barcelona, London & Milan

Forward Fooding FoodTech Meetups 2022 in Barcelona, London & Milan

We will carry on doing this (and a lot more) in 2023, starting with our 2022 FoodTech 500 European Unveiling tour, where we will allow everyone access to the FoodTech 500 list and connect local ecosystem champions. We will be in Barcelona on March 1st, 2023 and will continue the tour with three meetups in London (March 22nd), Berlin, and Paris (dates TBC).

BTW, we want to double down on impact so we’ve devised a new format to allow new partners to bring awesome content to their cities – to learn more email us at info@forwardfooding.com 🙂

Let’s get to work, and we look forward to powering the FoodTech revolution together in 2023!

Happy New Year to all!

Max & the Forward Fooding Team

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]