FORWARD FOODING

THE BLOG

Alternative Coffee and Chocolate Market Update: 2025 State of Play

Source: Planet A Foods

2025 marks a significant commercial turning point for alternative coffee and chocolate markets. Companies in these sectors have collectively secured over €300M in funding and are scaling globally through major B2B partnerships, as chocolate alternatives achieve substantial retail penetration across Europe. The validation from major food companies like Cargill and Lindt, achieved through various partnerships, signals a strong move towards mainstream acceptance; however, challenges related to pricing and consumer education still need to be addressed.

Market Performance Update

Our global food and beverage industry is currently facing significant challenges. The long-term sustainability of our current practices is in question, leading to an urgent need for innovative solutions. It’s a critical moment for disruption and new approaches to how we produce and consume food.

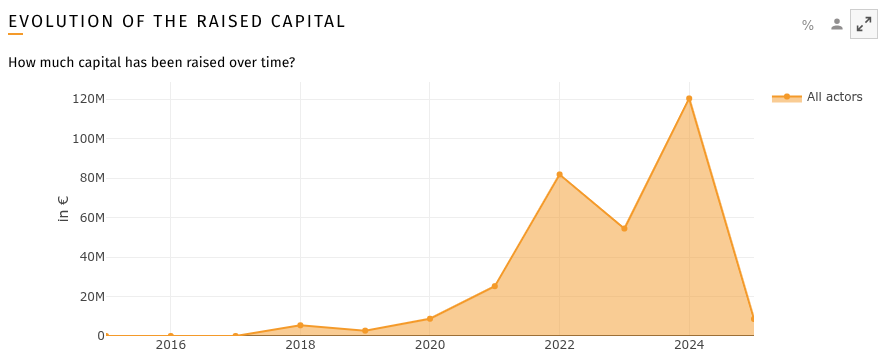

In this evolving landscape, the alternative coffee and chocolate sector is emerging as a remarkable area of growth and investment, poised to offer viable new paths forward. According to data from the FoodTech Navigator, this vibrant market comprises 38 companies and has attracted significant investment, with €120 million in funding in 2024 alone, and a total of €307 million since 2015. These numbers showcase an impressive 113% CAGR from 2019-2024.

Source: FoodTech Data Navigator

This significant influx of capital represents a strong vote of confidence in these sectors, particularly as the prices of conventional cocoa and coffee beans continue to rise due to factors such as climate change and supply chain volatility.

This funding surge underscores the growing interest in sustainable and ethical alternatives to traditional commodities. Some notable companies that have raised substantial investments include:

- Endless Food Co., makers of chocolate alternative THIC (This Isn’t Chocolate), raised €1M in pre-seed funding.

- Nous Energy successfully raised €2M in funding for its sustainable caffeine alternative Koncentra.

- Foreverland also raised €3.4M in a seed round to further develop its carob-based chocolate alternative.

- Celleste Bio has closed a $4.5M seed funding round participated in by chocolate giant Mondelēz International.

- Food Brewer AG raised $5.6M from big food companies Lindt & Sprüngli and Sparkalis to scale its plant cell-based cocoa and coffee platform.

- Atomo Coffee also raised $7.8M in Series B funding, bringing its total funding to nearly $59M.

- Planet A Foods, creators of cocoa-free ChoViva, secured $30M in Series B funding.

The Technology Powering the Change

Source: California Cultured

The innovation underpinning these alternatives is diverse and dynamic. Three primary technological approaches are gaining traction:

1. Cellular Agriculture

Growing cocoa and coffee plant cells in bioreactors under controlled conditions to produce cocoa butter, cocoa solids, or real coffee without traditional farming. This method uses cell cultures and fermentation to replicate flavors and textures sustainably, with scalability as a key focus.

Companies: Food Brewer (Switzerland), Celleste Bio, Kokomodo, PluriAgtech (Israel), California Cultured (USA)

2. Precision Fermentation and Traditional Fermentation

Using fermentation processes to transform plant-based ingredients (e.g., oats, sunflower seeds, carob, fava beans) into chocolate and coffee-like products, sometimes combined with precision fermentation to produce fats or flavor compounds.

Companies: Planet A Foods (Germany), Win-Win and Nukoko (UK), Prefer (Singapore), Minus and Mez Foods (USA), Green Spot Technologies (France)

3. Plant-Based Cocoa and Coffee Alternatives from Upcycled Ingredients

Using upcycled plant byproducts (grape seeds, sunflower seeds, carob, date seeds) and plant proteins to mimic chocolate and coffee flavor profiles without traditional crops.

Companies: Voyage Foods and Atomo Coffee (USA), Cellva Ingredients (Brazil), Delica AG (Switzerland), Foreverland (Italy), Northern Wonder (Netherlands), Fermtech (UK)

Disclaimer: This list of companies is not exhaustive and only features certain products for demoing purposes – the full list is available via the FoodTech Data Navigator.

Big Food Takes a Seat at the Table

Source: Endless Food Co.

The engagement of major food corporations is a strong validation signal for the alternative coffee and chocolate sector. These industry giants are increasingly partnering with and investing in innovative startups.

Planet A Foods has secured impressive brand partnerships across European markets. Planet A Foods collaborates with leading brands such as Deutsche Bahn, Griesson – de Beukelaer, Lambertz, Lindt, Lufthansa, Peter Kölln, Piasten (Treets), and Stella Bernrain.

In Denmark, Endless Food Co. partners with 7-Eleven for some sustainable treats. The company’s upcycled, cocoa-free chocolate, THIC, is now an ingredient in a delectable cookie available on the shelves of 180 7-Eleven stores nationwide.

Meanwhile, foodservice partnerships are scaling globally for coffee alternatives. Atomo’s espresso is available at all Bluestone Lane locations across the U.S, with global expansion underway. Atomo also entered the Japanese market through partnerships with Ash Coffee and PostCoffee, and debuted in London at Hagen Espresso Bar.

A Reality Check: The Road Ahead for Alternative Coffee and Chocolate

Source:

Despite exciting technological breakthroughs and growing consumer interest, the journey toward mainstream adoption of alternative coffee and cocoa-free chocolate faces significant challenges.

Pricing Challenges

Alternative products often carry a premium price compared to traditional coffee and chocolate. For instance, lab-grown chocolate from companies like Food Brewer and Celleste Bio currently costs substantially more due to the complexity of cellular agriculture and limited production scale. Similarly, plant-based coffee substitutes, such as those from Atomo Coffee and Prefer, are priced higher than conventional brews, which limits accessibility in price-sensitive markets. This price gap remains a key barrier to widespread consumer adoption.

Consumer Adoption and Behavior

While blind taste tests and consumer studies have shown promising acceptance, for example, Planet A Foods’ fermented cocoa-free chocolate has been well received in European markets, shifting entrenched consumer habits is challenging. Familiarity with traditional flavors and the cultural significance of coffee and chocolate consumption means that convincing average consumers to switch requires not only comparable taste but also strong brand trust and education. The success of brands like Voyage Foods, which have secured shelf space in major retailers like Walmart, demonstrates progress but also highlights the uphill battle to scale beyond early adopters.

Strategic Business Shifts

Many startups initially targeting direct-to-consumer sales are pivoting toward business-to-business (B2B) models to stabilize revenue streams. For example, Minus have focused on supplying ingredient solutions to food manufacturers and bakeries rather than solely selling finished products to consumers. This shift enables startups to leverage established distribution networks and reduce customer acquisition costs, allowing for more sustainable growth amid market uncertainties.

Looking Forward

Though still in the early stages, the alternative coffee and cocoa-free chocolate sectors are poised for transformation. The convergence of cutting-edge technologies—such as cellular agriculture by Food Brewer and fermentation innovations by Planet A Foods—combined with increasing investments from major players like Mondelēz International and Lindt, is accelerating progress. As consumer awareness around sustainability and ethical sourcing grows, these alternatives have the potential to become not only delicious but also mainstream choices that reduce environmental impact and support resilient supply chains.

Forward Fooding is the world’s first collaborative platform for the Food & Beverage industry via FoodTech Data Intelligence and Corporate-Startup Collaboration – Learn more about our Consultancy and Scouting Services and our Startup Network.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]