FORWARD FOODING

THE BLOG

Capital Efficiency in Vertical Farming: Innovating for Scalable Growth

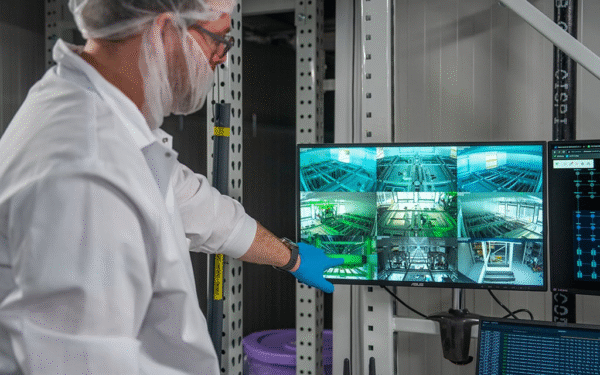

Vertical farming promised to rewrite the rules of agriculture: fresh produce, grown anywhere, 365 days a year, with minimal water, no pesticides, and a fraction of the land footprint. Investors loved it — billions of dollars poured into startups building climate-controlled towers of greens.

Yet here we are, a decade into the hype cycle, and many of the early stars are facing headwinds. Yet here we are, a decade into the hype cycle, and many of the early stars are facing significant challenges.Infarm, once hailed as a $1bn vertical farming pioneer, has now effectively disappeared from the market after filing for insolvency and shutting down operations across Europe. The company has since exited the European market entirely. Plenty, another prominent player, filed for Chapter 11 bankruptcy in March 2025, citing a failed expansion strategy and mounting losses. Bowery Farming, which had raised over $647 million, ceased all operations in November 2024 after failing to secure additional funding or find a buyer. The issue isn’t whether vertical farming can work—the core technology is sound—but whether it can scale profitably, which ultimately comes down to solving one of agtech’s toughest challenges: capital efficiency.The issue isn’t whether vertical farming can work — the core technology is sound — but whether it can scale profitably, which ultimately comes down to solving one of agtech’s toughest challenges: capital efficiency.

Let’s unpack where the costs really sit, the technologies and models that are starting to bend the economics, and the companies proving that smarter design — not just bigger fundraising — is the way forward.

Vertical Farming: Rapid Growth and Investment

According to our Food Data Navigator (FDN), the vertical farming sector has experienced significant growth over the past decade. Globally, there are approximately 500 startups operating in this space, which have collectively raised over $8 billion in funding since 2015.

The vertical farming industry has attracted much interest from investors over the last few years. The industry raised over $1 billion in 2021, a record high that exceeded the combined funding generated in 2018 and 2019. In 2022, the indoor vertical farming sector attracted substantial funding of $2.4 billion. Yet, only a few years later, many companies have faltered or gone bankrupt. Nasdaq (2024) reports a similar trend: shares of certain vertical farming firms that once traded at $50–$80 now linger at just a few cents. While investors were initially captivated by the promise of a tech-driven agricultural revolution, the sector has since plunged into a severe downturn.

The vertical farming market, currently valued at USD 6.9 billion (2024), is projected to reach USD 8.5 billion by 2025 and then accelerate at a 28.8% CAGR through 2032, hitting USD 50.1 billion. This trajectory highlights how vertical farming is rapidly moving from niche to mainstream, fueled by its promise of sustainable, high-tech urban agriculture solutions.

The Cost Reality Check

Vertical farming’s allure hides a hard truth: growing indoors is expensive, especially at scale. The main cost pillars are clear:

- Infrastructure — LED lighting, HVAC systems, shelving, irrigation, sensors, and automation don’t come cheap. Building a high-spec, food-safe facility can cost anywhere from $1,000 to $2,500 per square meter, depending on the setup.

- Energy Consumption — Lighting and climate control account for 40–70% of OPEX in many farms. Even with LEDs getting more efficient, the energy bill is a serious drag on margins.

- Labour — While automation helps, many farms still rely on significant human input for planting, harvesting, and packing.

- Crop Portfolio Limitations — Most vertical farms focus on leafy greens and herbs, high-value crops with fast turnover but limited market size compared to staples.

The result? Long ROI horizons and fragile unit economics.

Where the Bottlenecks Are

- High Upfront CAPEX – Even container-based systems can require millions in investment before the first head of lettuce leaves the farm.

- Energy Dependence – Rising electricity prices directly hit profitability, especially in regions without renewables integration.

- Market Ceiling for Current Crops – Competition with low-cost greenhouse imports makes price parity difficult.

- Slow Payback Periods – With payback often stretching beyond 7–10 years, investor patience wears thin.

What’s Changing: Enabling Technologies for CAPEX Reduction – Case studies

The vertical farming sector is tackling its biggest challenge — high upfront capital requirements — through a combination of technology and innovative business models.

Modular Design & Scalable Infrastructure — OnePointOne

Rather than committing to massive facilities from day one, OnePointOne deploys modular farming units equipped with integrated robotics and automation. Farms can start small, adapt to local conditions, and scale incrementally as demand grows, reducing financial risk and avoiding stranded capital. This modular approach also allows rapid replication across multiple locations without significant redesign, making it easier for startups and mid-sized operators to expand efficiently.

Co-Location & Partnership Models — Square Roots

Square Roots places container farms adjacent to grocery distribution centers, cutting logistics costs and shortening supply chains. By embedding production within the retail ecosystem, the company taps into a ready customer base while improving product freshness. This co-location model also spreads CAPEX costs with retail partners, lowering financial exposure and accelerating time-to-market for leafy greens.

AI-Driven Crop Optimization — iFarm

iFarm leverages advanced AI algorithms to manage lighting, nutrient delivery, and climate conditions across its vertical farms. This real-time optimization increases yield per square meter, reduces wasted energy and inputs, and allows precise forecasting of production volumes. The result is higher CAPEX utilization and improved operational efficiency, giving growers better control over both costs and output.

Large-Scale Operational Efficiency — Spread

Japan’s Spread demonstrates that large-scale, profitable vertical farming is achievable. Its flagship Techno Farm Keihanna produces around 30,000 heads of lettuce per day using a fully automated, streamlined system that minimizes manual labor. Spread combines high-volume output with energy-efficient technologies and lean operational practices, proving that vertical farms can scale sustainably without sacrificing profitability.

Energy-Generating Greenhouses — MPW Technologies

Singapore-based MPW Technologies is redefining greenhouse farming with VertSol, a patented system that converts excess green light into red to boost photosynthesis while simultaneously producing solar energy inside the structure. This innovation directly addresses one of the sector’s biggest challenges—high energy costs—by making greenhouses more self-sufficient and climate-smart. A long-running pilot with China’s Ministry of Agriculture now spans 4,000 m², growing tomatoes, watermelons, and strawberries with impressive efficiency. With proven results in one of the world’s most competitive agri-tech markets, MPW is preparing for global expansion across North America, Europe, the Middle East, and Southeast Asia, positioning its technology as a cost-effective alternative to energy-hungry vertical farms.

Energy Recovery & Renewables Integration

Many farms are also adopting waste heat recovery, on-site solar, and other renewable energy solutions to offset recurring costs. These integrations improve operational efficiency, reduce dependence on grid power, and enhance ESG credentials — often unlocking access to green financing.

Together, these approaches — modular infrastructure, strategic partnerships, AI-driven management, large-scale automation, and energy optimization — are redefining how vertical farms can scale sustainably, efficiently, and profitably, offering clear examples of companies that have successfully navigated the sector’s capital and operational challenges.

Emerging Trends Shaping the Next Phase

The vertical farming sector is evolving rapidly, with several emerging trends pointing to how the next phase of growth may unfold.

Hybrid Models

Many operators are combining vertical farms with greenhouse systems, leveraging natural light where possible to reduce energy costs while maintaining controlled environments for precision farming. These hybrid setups allow farms to optimize CAPEX and OPEX simultaneously, balancing scalability with operational efficiency. Companies like Spread and iFarm are experimenting with hybrid approaches to maximize yield while lowering energy intensity.

ESG-Linked Financing

Sustainability is increasingly shaping access to capital in vertical farming. Farms that can demonstrate measurable energy efficiency, water savings, or circular waste management are now able to secure lower-interest loans or green financing, linking environmental performance directly to financial advantage. For example, Spread Co., Ltd., a leading Japanese vertical farm, secured $4.6 million through the country’s first sustainability-linked loan, with interest rates tied to improvements in labor productivity and energy efficiency. This trend is opening new funding pathways for startups and mature operators alike, incentivizing the adoption of clean technologies, renewable energy integration, and more sustainable farming practices.

Biotech Integration

Vertical farms are moving beyond leafy greens into high-value crops, including medicinal plants, nutraceuticals, and even molecular farming applications. Here, the higher margins justify the significant CAPEX, and the controlled environment allows precise quality and bioactive compound optimization.

Global Policy Push

Government support is needed in vertical farming as part of broader food security strategies. Incentives include subsidies, tax breaks, and infrastructure support for localized production, encouraging operators to establish facilities closer to urban centers. These policy frameworks are helping reduce entry barriers, de-risk investment, and accelerate sector adoption.

The Scalability Debate

Some critics argue that vertical farming will never compete with field-grown staples because the physics of photosynthesis indoors will always favour niche, high-margin crops. Others believe technology will keep bending the cost curve — especially as LEDs, automation, and AI continue to advance.

The likeliest scenario? A diversified future, with vertical farms playing a strategic role in urban food systems, high-value specialty crops, and food security plans, rather than replacing traditional agriculture wholesale.

Our Take

The vertical farming sector has matured past the “grow big fast” narrative. The winners won’t just be those with the most funding — they’ll be the ones who master modularity, automation, co-location, and energy integration to get more yield from every dollar spent.

Ready to explore the next generation of vertical farming?

For Corporates and Investors, book a demo of the Food Data Navigator or learn more about our tailored Consultancy and Scouting Services.

For Startups, apply to the Food Data Navigator, join our community, and come meet us at our next event.

About the Writer

Giuseppe Monaco is a Food Science student focused on sustainable food systems innovation. Beyond his academic pursuits, Giuseppe volunteers with organizations addressing the social and nutritional aspects of food security. He is deeply committed to understanding agri-food policies and their role in creating a more sustainable food future.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]