FORWARD FOODING

THE BLOG

Cracking the Cost Code: Scaling Insect Farming Through CAPEX Innovation

From protein-packed cricket flour to black soldier fly larvae converting food waste into valuable feedstock, insect protein offers a sustainable, circular protein source that could feed our pets, fish, livestock, and even ourselves with a fraction of the environmental footprint of traditional meat. However, the industry is still grappling with one big, hairy challenge: high capital costs.

For insect protein to transition from niche novelty to global staple, the industry needs to crack the CAPEX code. High upfront costs are limiting scale, deterring investors, and keeping production volumes below market demand. This article examines the source of these costs, which tech innovations are changing the game, and how enabling technologies are rewriting the rules for scalability across the sector.

Why Insect Farming Is Still a Capital-Hungry Bet

According to data collected through the Food Data Navigator (FDN), the insect farming sector has seen significant growth over the past decade. Currently, there are approximately 200+ startups operating globally in this space, collectively raising over $2.13 billion in funding since 2015. The industry’s expansion is reflected in its projected CAGR of 4.3% from 2023 to 2033, with vertical insect farming segments expected to grow even faster at around 25.3% CAGR between 2024 and 2031.

This growth requires substantial upfront investment. Insect farming relies on a biologically complex supply chain, including climate-controlled environments, biosecure infrastructure, and automation systems capable of managing millions, or even billions, of insects.

Take Ÿnsect as an example. Founded in 2011, the company, supported by over $600 million in funding, developed Europe’s largest vertical insect farm in Poulainville, near Amiens, France. The 48,000 m² facility employs AI-driven monitoring, robotics, and vertical farming techniques to produce mealworms for animal feed, aquaculture, human food, and organic fertilizers.

Despite advanced technology and multi-million-dollar investments, scaling such operations presents significant challenges. In 2024, Ÿnsect entered safeguarding procedures due to financial pressures, and operations at Amiens were temporarily suspended. By mid-2025, the company was still under court-supervised receivership, but instead of collapsing outright it sought to reinvent itself through leaner production models combining traditional farming with automation. The company restructured its sites, including Damparis, and reduced its workforce by over 100 employees. It also secured €8.6 million from shareholders to stabilize operations, support debt restructuring, and secure partnerships in animal feed.

This illustrates a key industry dynamic: even with advanced facilities and multiple product streams, high capital expenditure, complex operations, and a fragmented market make achieving a return on investment a gradual and sometimes precarious process.

The Market Applications: Who’s Eating What

The insect protein market currently serves several key applications:

- Animal feed dominates the market, accounting for 40-83% of total usage, depending on regional and methodological differences. This is particularly evident in the aquaculture and pet food sectors, where insect protein benefits from lower consumer acceptance barriers, high nutritional value, and the ability to position itself as a premium sustainable ingredient.

- Fertilizers, particularly frass-based products derived from insect waste, are gaining traction in sustainable agriculture as eco-friendly soil conditioners and nutrient sources.

- Human food applications remain relatively small but are growing steadily, fueled by innovative products like energy bars, pasta, and protein powders targeting health-conscious consumers and novelty seekers. Specialty industrial uses, such as chitin extraction, are emerging but currently represent a minor share of the market.

The overall insect protein market is projected to expand dramatically, with the animal feed segment alone expected to reach $3.42 billion by 2032, growing at an 11.8% compound annual growth rate.

This surge in demand is fueled by the need for sustainable protein sources to address global food security challenges, reduce environmental impact of traditional protein production, and meet growing consumer awareness of alternative protein benefits.

Technology Overview: From Bugs to Big Business

Species in focus: The black soldier fly (BSF) is the industry’s workhorse — fast growth, high protein, and efficient waste conversion. Mealworms follow closely for both feed and food markets, while crickets dominate in human-grade products.

Breeding systems: Current setups range from stacked trays in climate-controlled warehouses to fully automated vertical farms. Breeding and rearing phases are often separated to maximize efficiency.

Processing methods: Once harvested, larvae or adult insects are either sold whole (dried or frozen) or processed into meal, oil, and frass. Each step — drying, grinding, oil extraction — adds equipment, energy costs, and regulatory compliance layers.

The CAPEX Anatomy: Where the Money Goes

- Facility construction & biosecurity – Insect farms need tightly controlled environments to avoid contamination and escape risks. Air filtration, climate systems, and food-safe building materials aren’t optional.

- Automated rearing & harvesting – From conveyor-fed trays to robotic arm sorting, automation is both a CAPEX sink and a long-term labor saver.

- Feedstock sourcing & pre-processing – Many players integrate on-site pre-processing of food waste or ag by-products, adding machinery and energy costs.

- Energy consumption – Heating, cooling, humidity control, and lighting can swallow up to 30% of operational costs.

- Labor & compliance – Skilled staff for breeding, tech maintenance, and regulatory paperwork add up.

Current Bottlenecks

Building more production units should theoretically increase protein output, but several structural obstacles slow progress:

Equipment costs

The industry pays premiums for specialized equipment since custom machinery for feeding, sorting, and processing insects lacks mass-market production scale. Each facility requires bespoke systems, driving capital expenditures higher.

Operating Expenses

A single insect farm faces annual costs between $203,000 and $610,000, including $50,000-$150,000 for facility rent, $100,000-$300,000 for salaries, $10,000-$30,000 for utilities, $20,000-$50,000 for feed and inventory, and $23,000-$80,000 for marketing, insurance, and maintenance combined. These expenses cascade across expansion projects, turning each new site into a major financial commitment rather than a straightforward scale-up.

Regulatory Uncertainty

While some markets like the EU have begun approving specific species and applications, the approval process remains slow, fragmented, and geographically inconsistent. For companies aiming to sell globally, navigating this patchwork of rules adds both time and legal expense.

Automation Limitations

While progress is being made, truly seamless, real-time monitoring of insect health, growth, and environmental conditions remains out of reach for most operators. Without robust data-driven systems, scaling becomes a balancing act between cost and quality control.

Modular Scalability Challenges

In theory, building smaller, standardized “plug-and-play” units should allow farms to grow incrementally in line with demand. In reality, the lack of standardization means each scale-up phase still carries the headaches and inefficiencies of a custom build—undermining the very flexibility modularity promises.

Enabling Technologies That Are Shifting the Economics

Several enabling technologies are already tackling the CAPEX challenge head-on, with real-world examples worth watching.

Protix – Modular & Containerized Farms

Dutch leader Protix has been pioneering modular BSF farming, designing systems that scale in predictable, cost-controlled increments. By combining feedstock circularity—using local agri-waste—with smaller, repeatable units, Protix reduces upfront risk and makes expansion less capital-intensive. Their modular design philosophy allows each farm to adapt to local feedstock availability and demand, showing that standardized units can be deployed across multiple geographies without reinventing the cost structure or driving up costs.

Hexafly – Advanced Automation & Robotics

Irish innovator Hexafly integrates robotics for automated larva separation, feeding, and environmental management. This lowers labor costs, improves precision, and enhances biosecurity, reducing the need for oversized facilities. By automating repetitive, high-risk tasks, Hexafly can maintain compact facility footprints while avoiding costly overcapacity for peak labor demands.

Entocycle – AI-Driven Breeding & Monitoring

UK-based Entocycle uses AI-powered camera systems to monitor BSF colonies in real-time, detecting uneven growth or contamination early. This enables leaner staffing, higher yields, and more predictable output—a key advantage when seeking investor funding and planning the next scale phase.

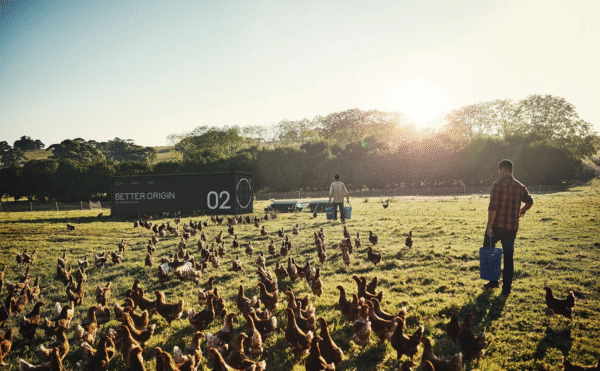

Better Origin – Circular Feedstock Integration

Better Origin’s X1 unit converts local food waste into insect protein for chicken farms. By situating production directly where the protein is needed, they cut logistics costs and avoid constructing central mega-facilities, making localized production economically viable.

Our Take

We’re at an inflection point in the insect protein industry. The core science works—these species can deliver high-quality protein sustainably—but the bottleneck is economics, and the lever is CAPEX innovation. Public-private partnerships and green financing initiatives are helping offset this challenge: the European Union has supported programs like Horizon Europe, funding collaborative projects such as Horizon4Proteins, SUSINCHAIN, and LIFE Waste2Protein to enhance sustainability, scale the value chain, and optimize production. At the same time, major agribusiness companies are investing strategically: in 2022, Cargill and ADM led a $250 million investment into Innovafeed to expand insect meal for aquaculture feed, while in 2023. Tyson Foods acquired a minority stake in Protix and plans a U.S.-based facility for pet food, livestock, and aquaculture.

On the technology side, companies like Protix (modular farms), Hexafly (robotics), Entocycle (AI monitoring), and Better Origin (circular feedstock integration) are reducing CAPEX risk, improving operational efficiency, and enabling agile, scalable production models. At the same time, large-scale partnerships are validating the commercial viability of insect protein in aquaculture: BioMar, Innovafeed, and retailer Auchan recently announced at the Global Shrimp Forum a collaboration to integrate black soldier fly meal into Ecuador’s shrimp feed sector, combining BioMar’s nutritional expertise, Innovafeed’s production capacity, and Auchan’s retail supply chain to create a scalable pathway from feed to consumer. As BioMar’s Global R&D Director, Anders Aarestrup, put it, the project demonstrates “how insect meal can be successfully scaled in shrimp feed without compromising performance, while also enabling retailers to offer consumers a more sustainable choice”. Together, these financing, partnership, and enabling technology strategies are critical to overcoming economic barriers, scaling production sustainably, and meeting the growing global demand for alternative protein sources.

Ready to help shape the next generation of sustainable protein?

For Corporates and Investors, book a demo of the Food Data Navigator or learn more about our tailored Consultancy and Scouting Services.

For Startups, apply to the Food Data Navigator, join our community, and come meet us at our next event.

About the Writer

Giuseppe Monaco is a Food Science student focused on sustainable food systems innovation. Beyond his academic pursuits, Giuseppe volunteers with organizations addressing the social and nutritional aspects of food security. He is deeply committed to understanding agri-food policies and their role in creating a more sustainable food future.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]