FORWARD FOODING

THE BLOG

2020 Food Tech Trends in Europe: What does the future of food look like?

Discover the leading Food Tech trends in Europe in 2020

It’s 2020 and Covid-19 has shaken up our lives for good.

The sudden and significant spread of Coronavirus has thrown the food industry into a state of flux. And that’s mainly because of the fluctuating demand for food supplies that arose from it.

All the while, as an industry, we are still wondering how to apply tech innovations, such as precision farming techniques, tech-driven waste management solutions, biotech, or big data, to a mass scale.

The need for change comes at the time when ‘Big Food’ is already on a pretty unsustainable path. How will this additional pressure help or hinder what happens next?

In this post, we are going to take a look at what the leading Food Tech trends will be in 2020, and how Europe is playing a crucial role in the global Food Tech ecosystem.

Changing the Future

The challenges that the entire Food and Beverage sector is facing are numerous. They extend far beyond what is happening right now. In fact, the current situation is highlighting the need for the global food system, from farm to fork, to commit to change.

These challenges are inextricably linked to how F&B companies are planning to produce more food and to do it more sustainably, in order to meet the global demand of the growing population.

Why you ask?

Well, we already knew before Covid-19 struck that 50% of food production is at risk due to climate change. Also, 20% of agricultural land is classified as degraded, and we expect a 70% increase in food demand by 2050. (Source: Inside Climate News)

The hard truth is that we have fewer than 60 harvests left to get this right, based on FAO’s estimates on soil degradation. (Source: FAO, Scientific American)

This was all before a global Coronavirus pandemic hit, countries and communities faced lockdowns on an unprecedented scale; and people started stockpiling basic human resources, particularly food and drink (and toilet paper), thus creating even greater instability in an already unsustainable supply chain.

Sustaining Sustainability

Moreover, the United Nations introduced the Sustainable Development Goals (SDG) to unify efforts to address the main challenges facing the planet. The following list includes some of the key sustainability challenges we face as humanity:

- The global Agrifood industry consumes 30% of the energy we create and accounts for 22% of the total greenhouse emissions.

- We waste one-third of the food we produce every year.

- About one-third of the world’s population is suffering from obesity or excessive weight.

There is clearly a big job to do.

Yet, this isn’t just a case of asking “how do we get through and adapt to our new normal?” There are greater forces at play here.

The role of Food Tech

At Forward Fooding, we see the role of the Food Tech industry as leading the charge to address some of these issues and create a brighter and more sustainable future of food.

Our definition of Food Tech is:

“Food Tech (or Agri-Food Tech) is the emergent sector exploring how technology can be leveraged to improve efficiency and sustainability in designing, producing, choosing, delivering & enjoying food”

You can read more about our definition of Food Tech in our blog.

By tapping into the FoodTech Data Navigator, our data intelligence platform for the AgriFoodtech ecosystem, we see that European Food Tech companies are playing a crucial role in the current and future development of this sector.

Europe: the new forefront of Food Tech trends

The European Food Tech sector is at the forefront of innovation. Europe pioneers new technologies and ways of producing, manufacturing, ordering, creating and consuming food; with the aim of creating mass adoption of change at pace.

We see the role these Food Tech companies play as crucial to the change being driven at a consumer level. And just as importantly, they put pressure on large food manufacturers to innovate quicker and smarter to adapt their offerings, improve their sustainability efforts and to meet the needs of ever more demanding consumers that are increasingly seeking healthier and more sustainable food options.

These days, technology is by far the most sought-after ingredient in our diet. And this is visible in the growing investment in innovation projects such as for example personalised nutrition.

We used our data intelligence tool, the FoodTech Data Navigator, to better define the European innovation landscape and identify the rising Food Tech trends in Europe.

So this is what we have discovered about the role of European Food Tech companies in shaping the future of food.

European Food Tech trends to watch

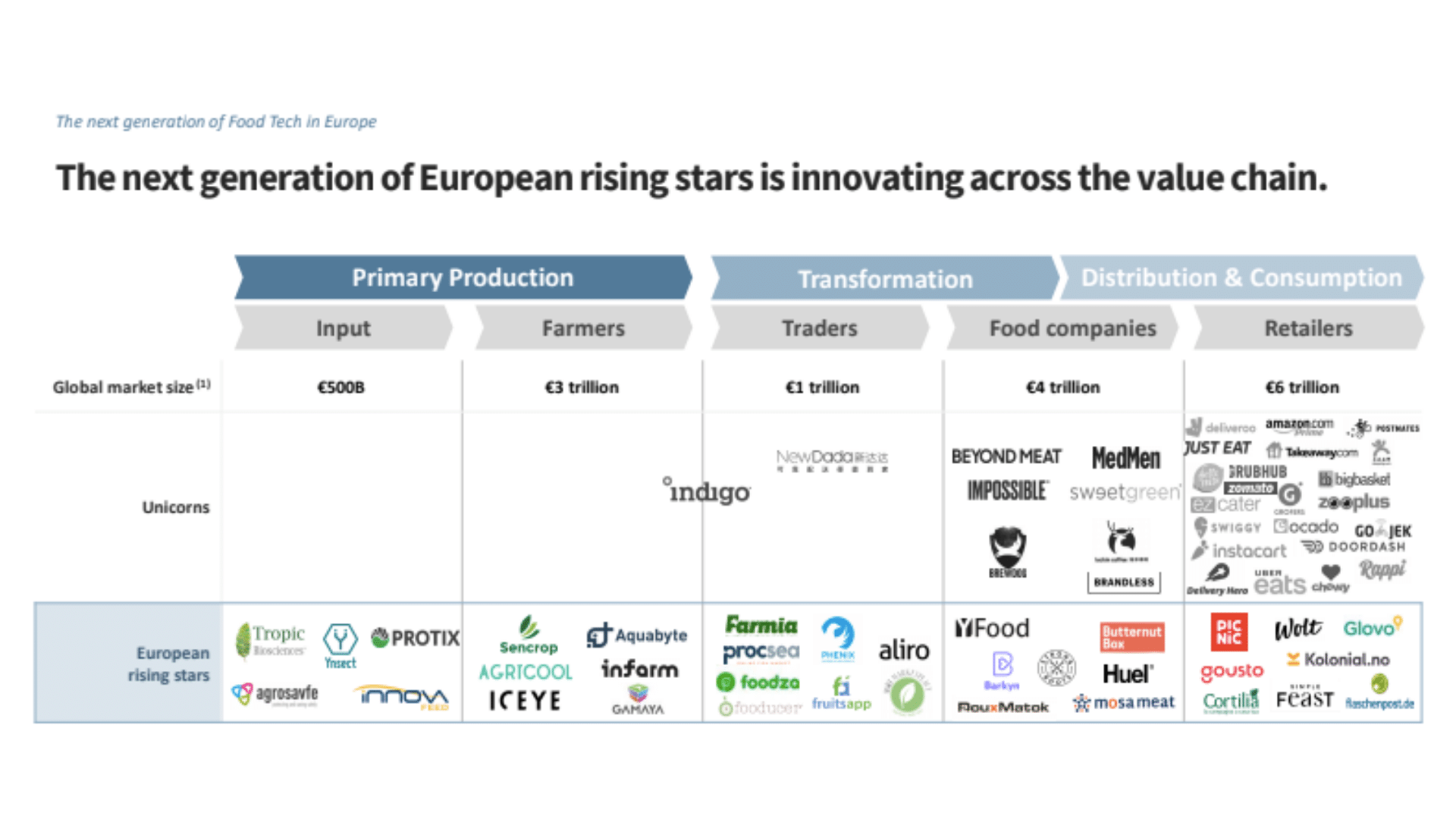

According to the 2019 Five Seasons Ventures report, the number of Food Tech unicorns in Europe hit 9 in 2019. Combined, those are valued over €43bn +39% YoY.

These front runners have focused on e-commerce and delivery as segments of the food industry to leverage and improve with new technologies. However, the food delivery sector only ‘disrupts’ less than 1% of the total food retail market.

As for the ‘next generation’ of Food Tech entrepreneurs, they are specifically focusing on the remaining 99% of the industry. That’s predominantly agriculture, food production, and food consumption.

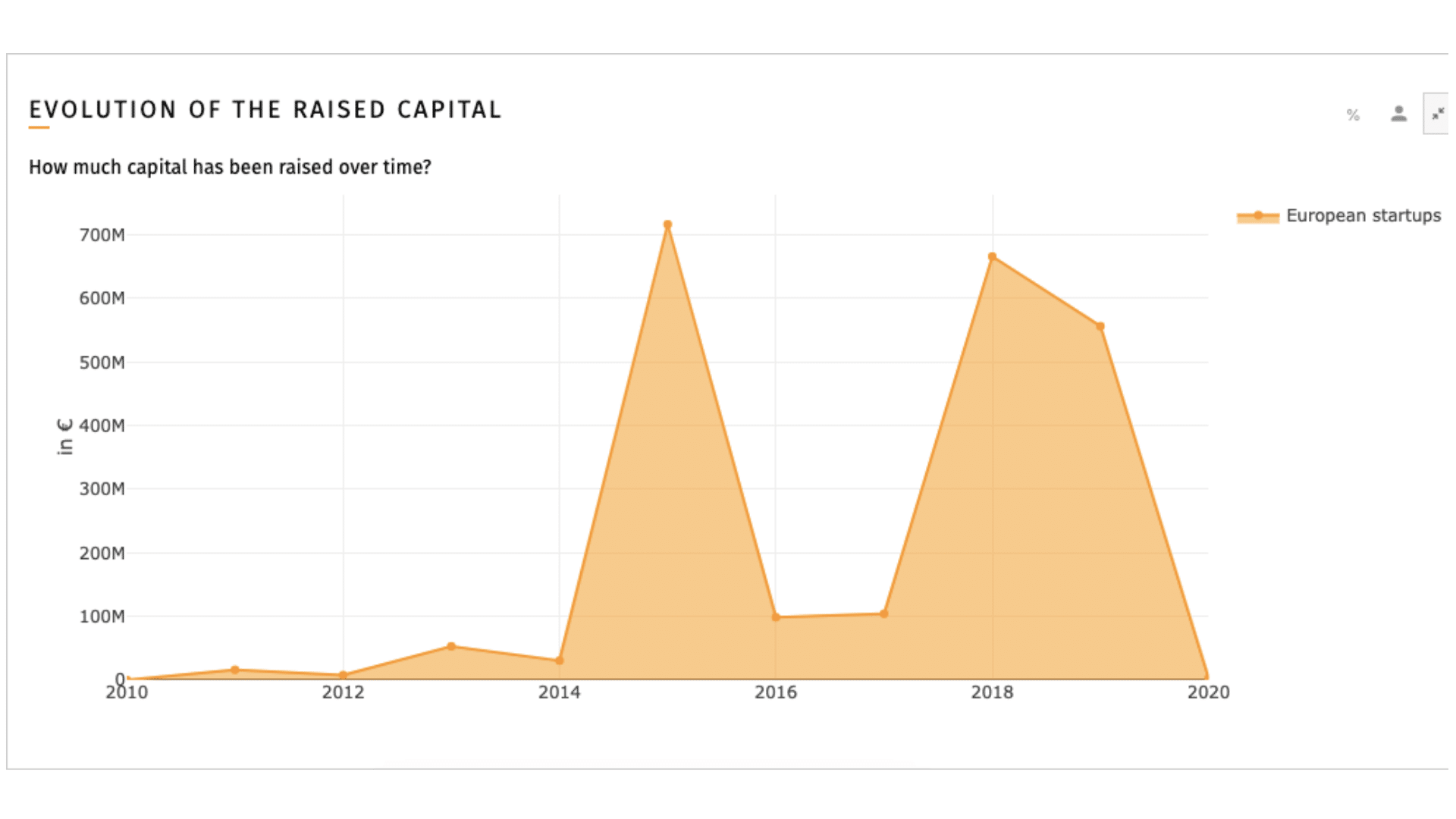

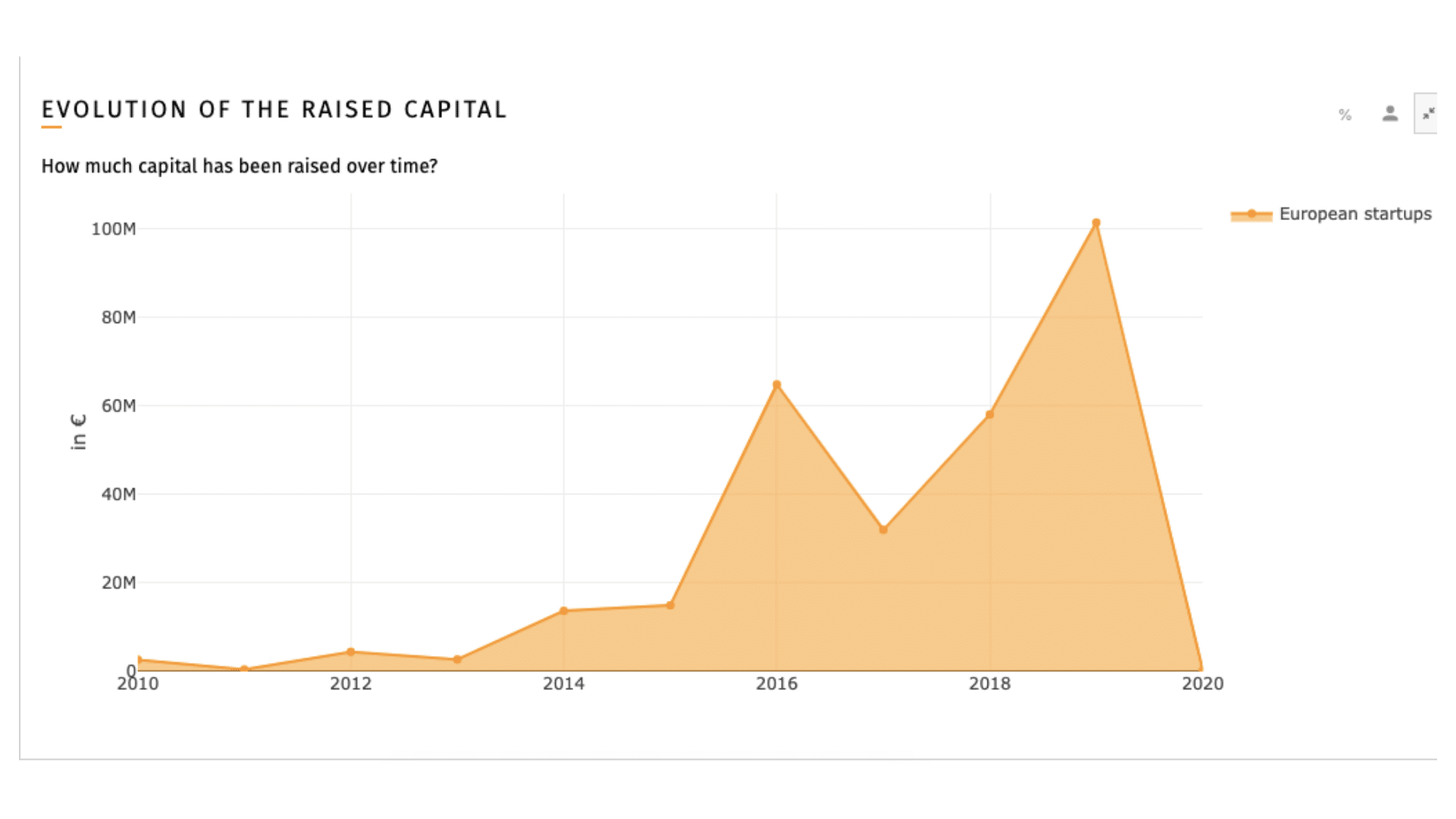

The FoodTech Data Navigator shows that while investment in Food Delivery is significantly above other AgriFoodTech categories, the trend for investment growth continues and is significantly accelerating across the following sub-sectors:

Source: The FoodTech Data Navigator

AgTech

Although funding has dropped 11% vs. 2018, AgTech remains an investment opportunity and a growth sector in 2020 and beyond. This is because of the growth and continued investment we are witnessing in areas such as biotechnological agriculture, agricultural product trading platforms, bioenergy and biomaterials, agricultural robotics, organic foods and new crop systems.

The Precision farming market is expected to reach $7.8 billion by 2022, registering a CAGR of 14.9 % during the forecast period 2016 – 2022 (source: Allied Market Research).

With European AgTech startups like XFarm having raised 3M series A in December, in 2019, the importance of Europe as part of AgTech’s growth and investment trajectory sees it becoming a close second to the US market.

Source: The FoodTech Data Navigator

Source: The FoodTech Data Navigator

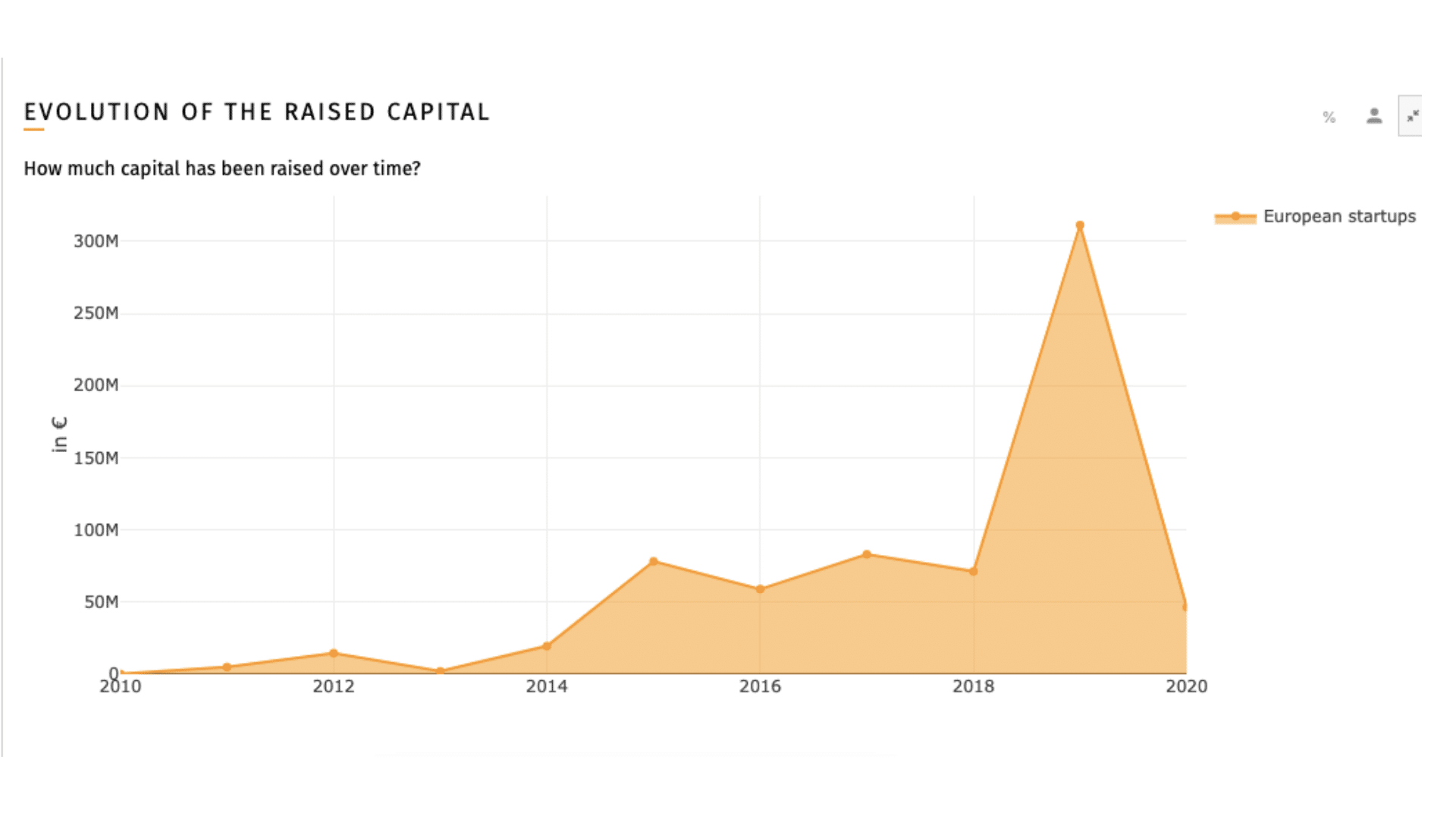

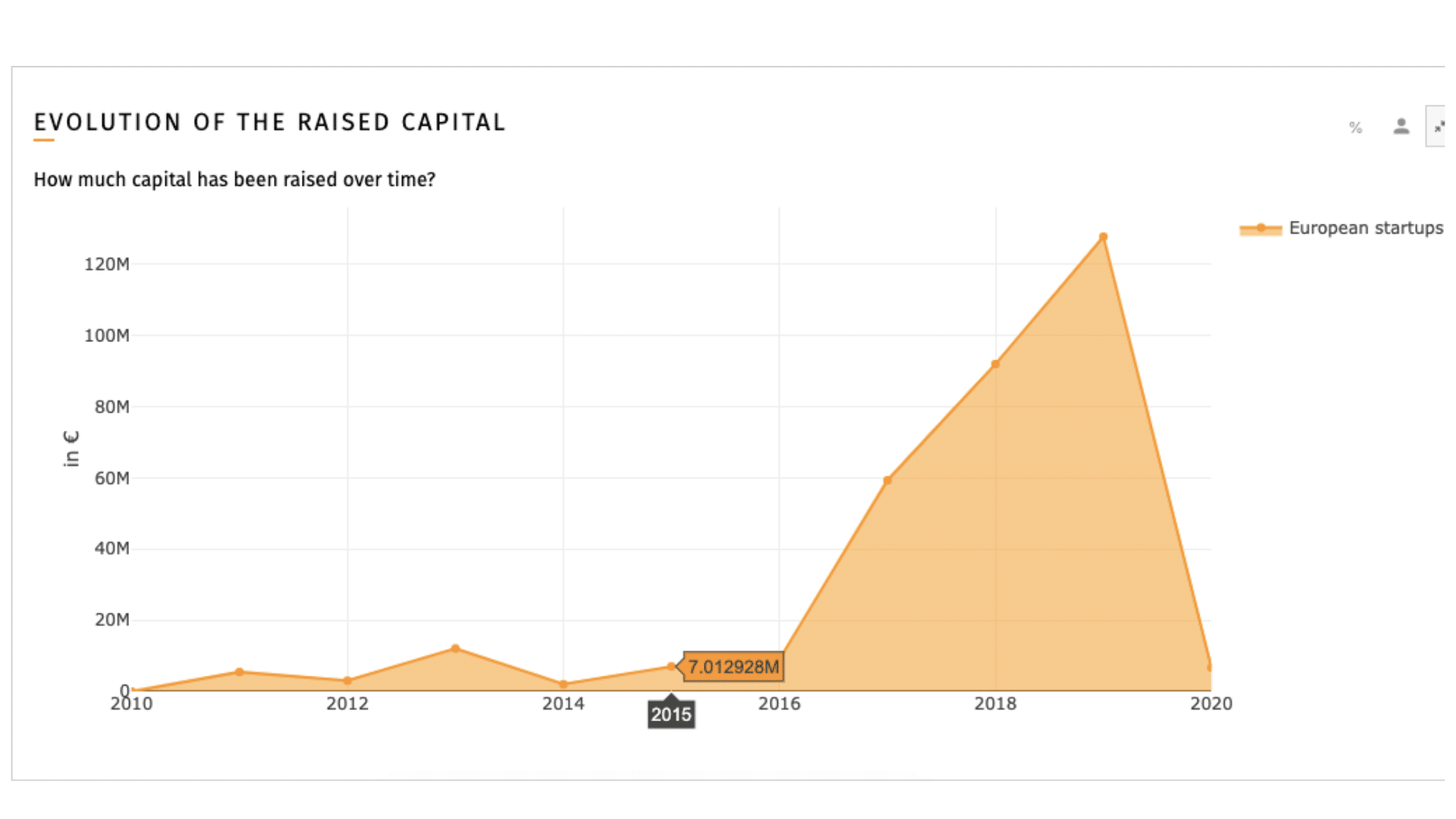

Consumer Apps

Witnessing a 348% increase in the evolution of capital YOY, means that consumer apps are really going to take off.

FoodVisor, an app that can calculate the nutritional value of your plate from a photo, raised €3.9M in November 2019

Another example from France is Lunchr . Having raised €40m, Lunchr is reinventing the corporate lunchtime experience. And they’re doing that with group ordering, couponing, and payment app. Their mission is simple: to make the lunch break a pleasant, simple and effective moment.

Source: The FoodTech Data Navigator

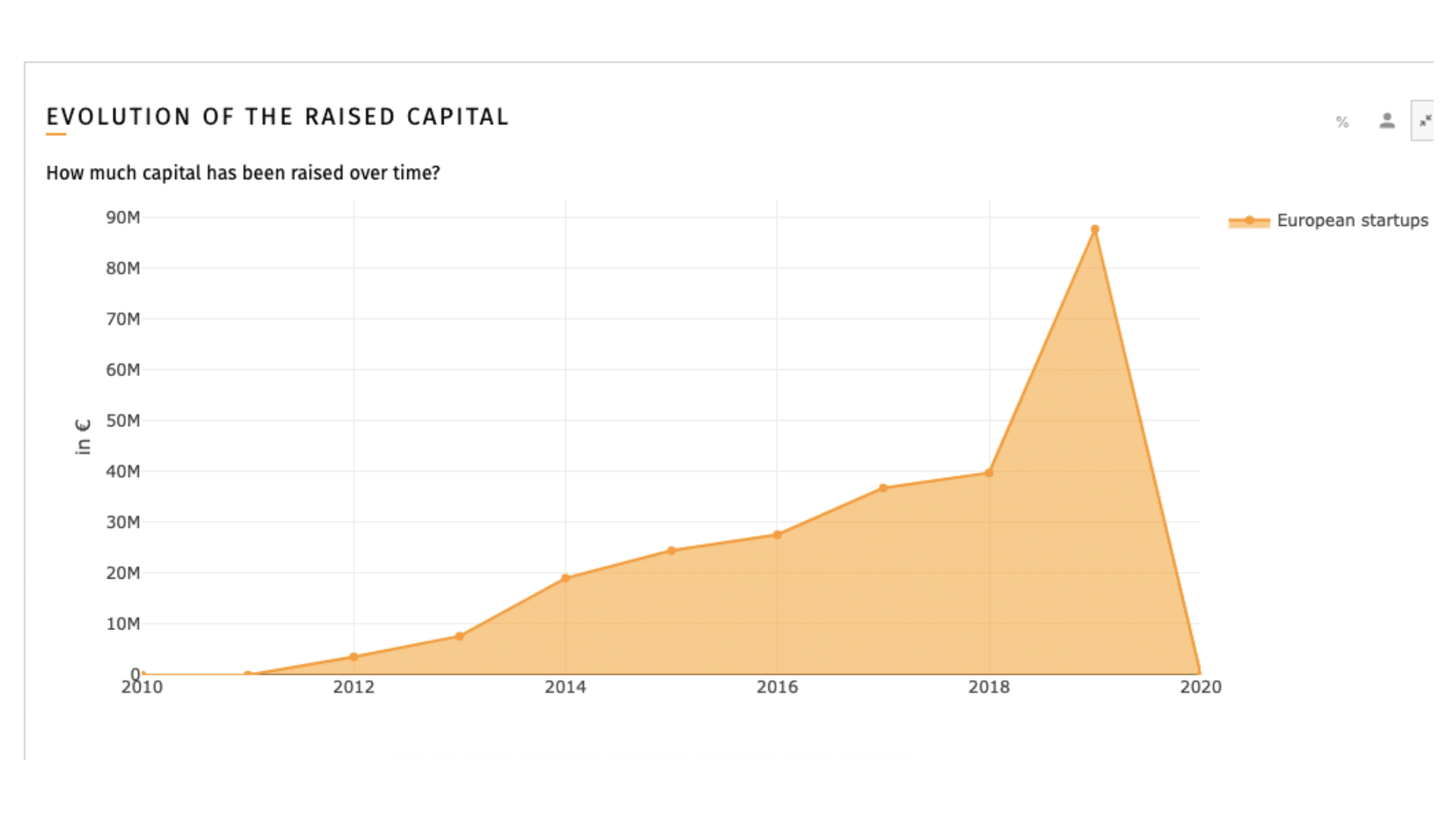

Kitchen and Restaurant Tech

We’re seeing new types of tech popping up all over the place when it comes to food. But what gets us excited is the way we can use tech to evolve our existing kitchens.

First up on our list is Millo. Yes it is a blender, but reimagined. With its patented Magnetic Air Drive & timeless design, Millo is a blender that is quiet, portable & smart. It’s the first blender to adapt to your lifestyle, with its fast and silent user experience housed in a minimal design. Move over Apple.

Flatev, who’ve raised €4.7m is also one to watch in this space. Flatev is your very own personal baking system, and you can use it at home or in bigger kitchens. This closed baking system expertly prepares single servings of fresh tortillas, rotis, flatbreads, cookies and more with no fuss and no mess.

We were also excited to see the rise of apps to help restaurants reduce the climate impact. An example of that can be seen with the startup Klimato.

We think this is just the beginning of where this sector can go, and we’re watching this space with interest.

Source: The FoodTech Data Navigator

Next Generation Food and Drinks

Alternative Proteins have been a growing trend for some time, and it is showing no signs of slowing. Across the pond, we’ve seen the likes of Impossible Foods raising another $500M in investment rounds. And notably in Europe, we’re now seeing this sector gaining momentum.

London-based THIS is a new vegan food brand of plant-based meat–alternative products with industry-leading realism to meat in taste, appearance, and texture who raised €5.5M in January 2020.

Meatable aims to satisfy the world’s appetite for meat without harming people, animals or the planet. This Netherlands-based meat alternative also undertaken a big raise in December 2019 with €2.71M. Another Netherlands-based actor, Protifarm saw their last big round in November 2019 with a €9.8M series B raise.

As plant-based meat adoption steadily grows, the European market is shifting as big players and established food corporations are coming into play in this sector.

With regard to ‘novel ingredients,’ we also see a proliferation of new ‘upcycling technologies’. These are for example air protein startup companies such as Finland-based Solar Foods raising €300k in September 2019. Or protein synthesis companies such as 3F Bio which create sustainable protein from renewable sources and raised €16M in July 2019.

These signals show that these alternatives are becoming technically and commercially viable. We believe in 2020 more and more major players and established food organisations will start acquiring existing players as well as directly investing in this space too.

We also take a closer look at the new ingredients trends we are witnessing. Read mode about it our Food & Drinks of the Future Series.

Source: The FoodTech Data Navigator

Another trend Europe is witnessing is a surge in food personalisation.

This is now popping up in various aspects of our food ecosystem. From using AI to predict taste trends, tailoring meal kits based on purchasing habits, to using DNA testing to determine dietary requirements. We see that food personalisation solutions like Kafoodle and wearable devices like BitBite are here to stay.

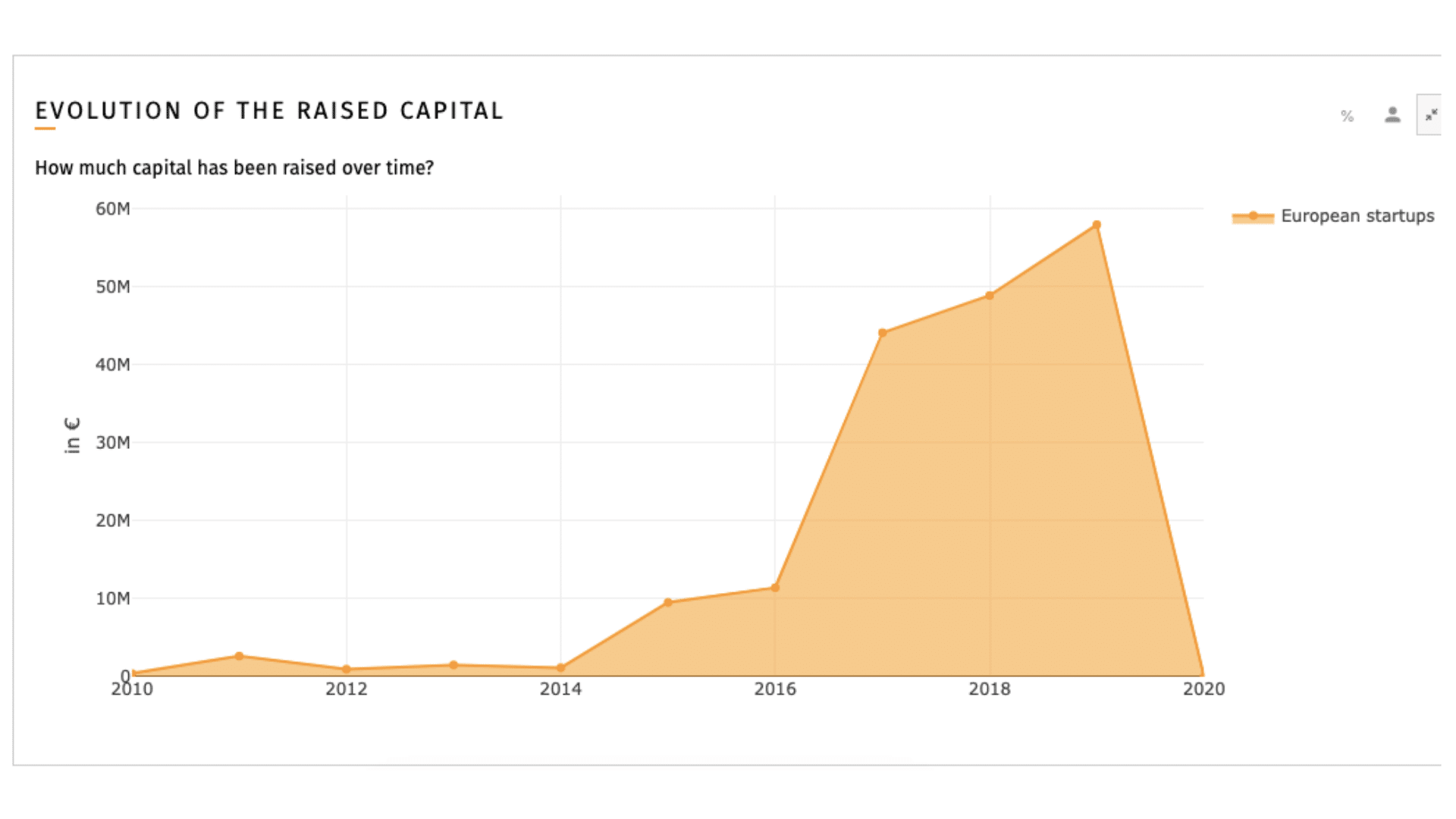

Food Waste

Companies like Winnow Solutions, who are producing technology to help chefs measure, monitor and dramatically reduce food waste, mean that we are starting to see Food Waste becoming a big deal.

Winnows are also using AI to accurately and profitably reduce food waste in commercial kitchens. Moreover, as they have raised over €28.3m, restaurants and hospitality are no longer just using sustainability as a buzz word, but as an entire ethos to attract sustainability-conscious consumers.

Sulapac®, is another example, having raised €15M in December 2019. A microplastic-free and fully biodegradable alternative to traditional plastics which is used in straws and food packaging, they have quickly become the world’s most sustainable mass-producible straw, which is user friendly and ocean safe.

Likewise, with smart kitchen food waste apps like Kitche helping you reduce food waste at home, saving up to £70 of food per month; and food sharing app Olio having recently raised €6.8m, the signs are starting to signal that Food Waste is a new trend on the rise.

Source: The FoodTech Data Navigator

Food Processing

Technology is turning the art of processing food into an actual art-form. Natural Machines, who have raised €4.7m, have created a 3D Printer for food called The Foodini. Foodini is billed as a new generation kitchen appliance that combines technology, food, art, and design.

While Ripples have developed the Ripple Maker, a product designed to embed images or text into the foam layer of coffee or beer beverages. The Ripple Maker combines patented 3D printer mechanics with inkjet printing technologies to create designs that you can print on foam in 10 seconds.

Turning food into an art-form by using technology seems to be the next big trend in food processing. And one we will be keeping a close eye on.

Source: The FoodTech Data Navigator

What next?

Europe’s Food Tech companies now represent almost 55% of the global AgriFoodTech ecosystem. This means that Europe is leading the charge of new ideas, technologies, and innovators within food and Food Tech trends.

The potential of the Food Tech industry, and the opportunities it offers are convincing even the global market analysts. In fact, platforms like Research and Markets have estimated that the sector’s total value will be over 250 billion dollars in 2022.

We believe this is partially thanks to the adoption and growth of e-commerce, and the penetration of smartphones. But it’s also thanks to the innovators and ideators of the Food Tech world. They are the ones who are leading the charge for Europe when it comes to shaping the future of the food industry.

We hoped you enjoyed reading about the leading 2020 European Food Tech trends. If you’d like a deeper dive into the ‘signals of disruption’ and signs of AgriFoodTech growth in Europe you can access our Global FoodTech Trends report.

Alternatively, you can book in a free demo to experience the FoodTech Data Navigator directly and request a trial period to see how it can benefit your organisation.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]