FORWARD FOODING

THE BLOG

Is meat a dead industry?!

The last few years have seen a range of meat alternatives evolving, each aiming to challenge the multi-billion-dollar meat industry. With the global population projected to increase to around 10 billion by 2050, a massive amount of food and land space is required. According to the Food and Agriculture Organization of the United Nations (FAO), nearly half of the worldwide harvest is required to feed the livestock population. The current agricultural production for human consumption is seen to only account for 37%. Thus the current chain is very inefficient — most of the world’s harvest is fed to animals to produce meat, then the meat is consumed by humans. This has created the rise of plant-based meat, looking towards a more sustainable future with a more efficient value chain.

Plant-based meats are made to mimic properties found within natural meats and are considered to be meat substitutes. They are designed to offer consumers a sustainable and environmentally friendly line up of meat alternatives, without having to compromise on taste, texture and appearance. The primary ingredients in plant-based meat substitutes are typically soybeans (and other legumes), wheat gluten, lentils, and tofu, yuba, tempeh, and a variety of nuts.

It is crucial to note that a plant-based diet can not only provide the same calories needed but also the same nutritional value if crops are chosen accordingly to consist enough protein. Some believe that we could feed around twice as many humans with today’s global harvest if we did not feed livestock but rather consumed the yield ourselves. Based on the current worldwide population of 7.6 billion humans, we would have food for an additional 7 billion people. This number would increase even further if less of the harvest ended up in biofuel and industrial use or if waste could be reduced.

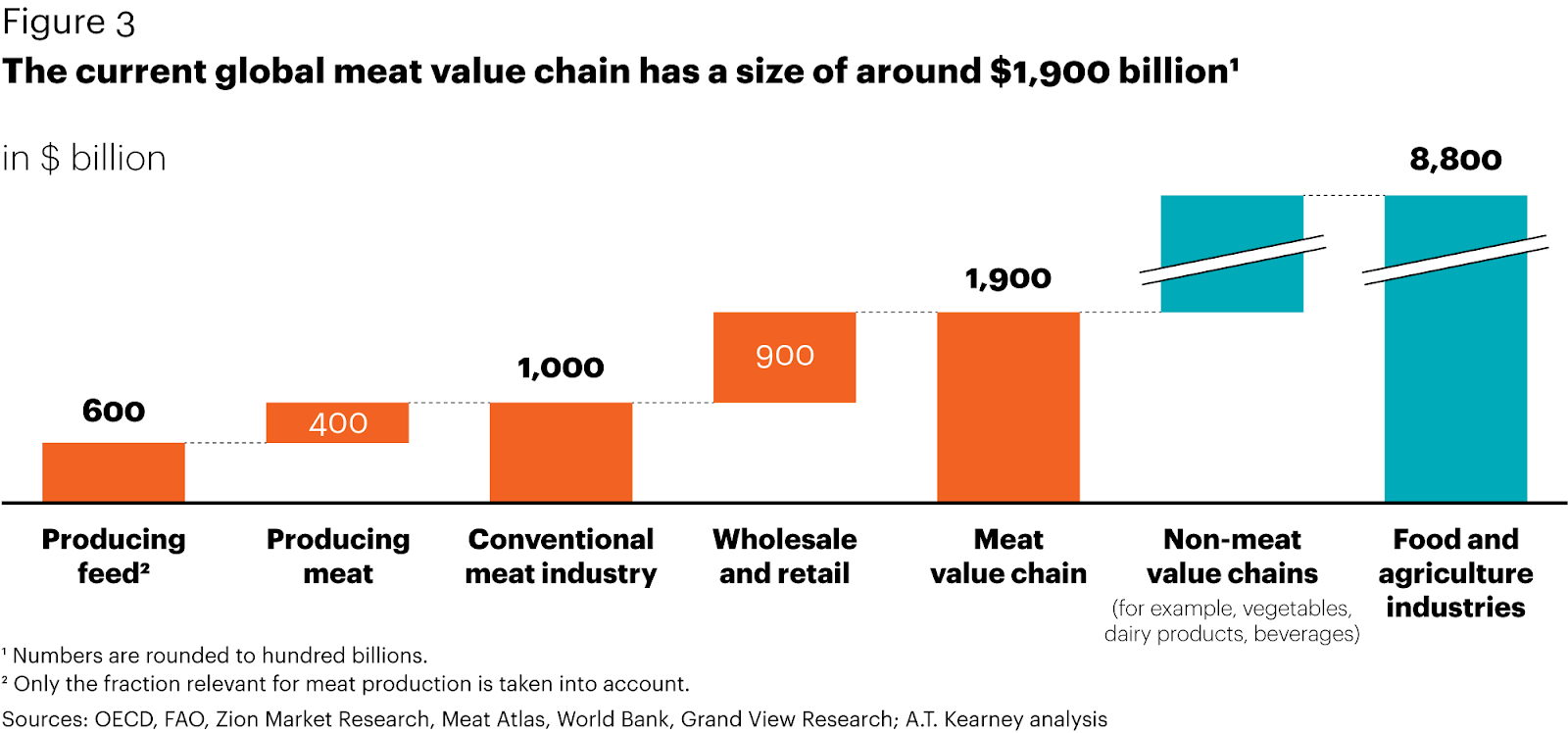

Given the enormous global harvest needed to feed our livestock, the size and impact of the global meat industry should not come as a surprise. Ultimately, the meat chain is part of the global food chain, which has an estimated value of 10 percent of global GDP or $8.8 trillion for 2018 in absolute numbers.

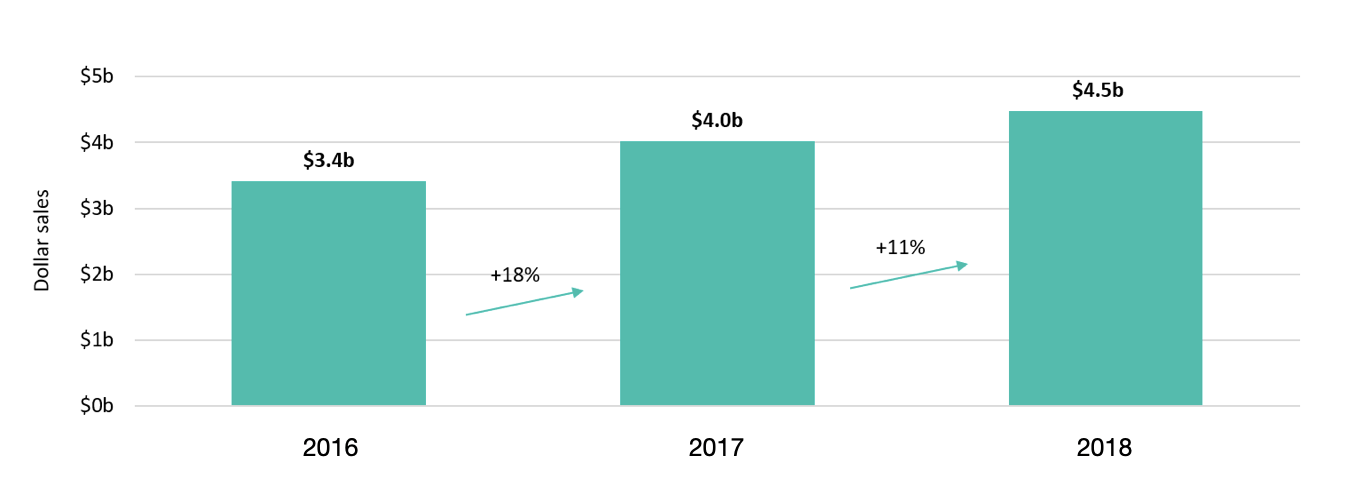

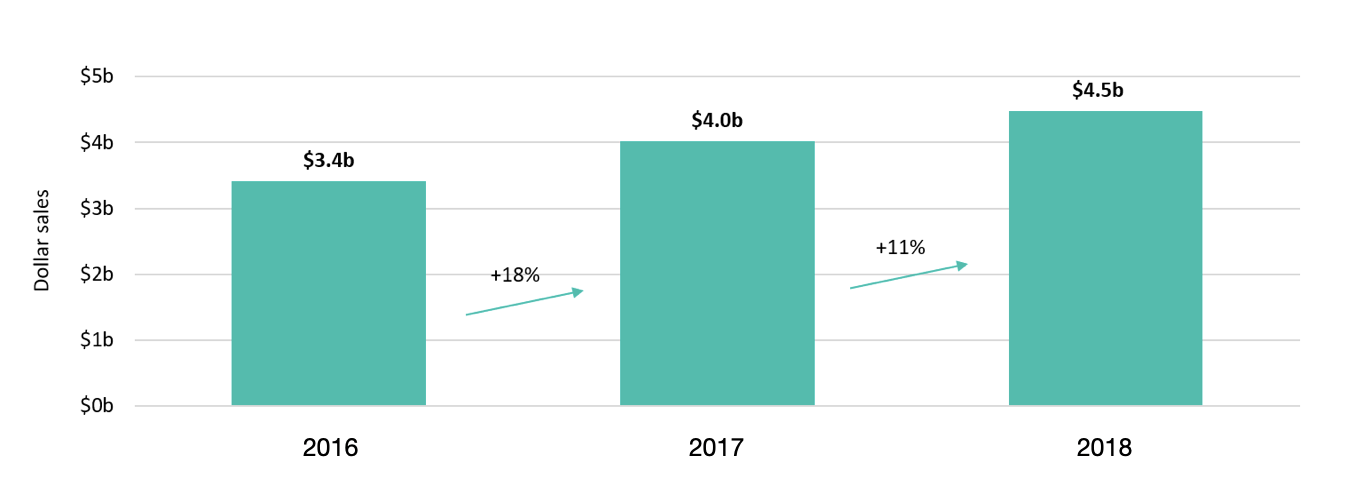

As per a range of figures the total market value for plant-based meats was around $4.5 billion in 2018, an 11% increase from the previous year. In addition there is a growth projection of 20–30% per year (varying by region) for the next few years. As this represents a minute fraction of the $1000 billion global meat market, there is a huge upside potential.

Since 2010, startups in this field — including Impossible Foods, Just and Beyond Meat — have received substantial funding (around $900 Million up to 2018), enabling them to scale up faster. However the trend isn’t solely from one side, although startups are predominantly pushing the agenda, several large manufacturers are jumping on board the plant-based products bandwagon.

Tyson Foods will debut meatless protein products later this year, and Nestlé will roll out a cook-from-raw plant-based burger this fall in the U.S. Impossible Foods, which has predominantly focused on restaurants, plans to launch its burger in retail outlets later this year. Perdue is taking the hybrid route by offering chicken products mixed with vegetables. Sainsburys has just launched the first plant based butcher in the UK. In addition, large non-FMCG companies are also recognising the importance of the space, with tech giant Samsung getting involved.

“This is just the beginning of a massive growth period for plant-based foods,” said GFI associate director of corporate engagement Caroline Bushnell. “Consumer appetite for plant-based foods is surging as consumers increasingly make the switch to foods that match their changing values and desire for more sustainable options. This growth will continue as more companies bring next-generation innovations to market that really deliver on the most important driver of consumer choice: taste.”

In addition Julie Emmett, PBFA’s senior director of retail partnerships called plant-based foods a “growth engine” outperforming overall grocery sales. She said the expansion shows that the industry is at a tipping point, emphasising the need for retailers to offer variety and maximize shelf space.

So what does the future hold?

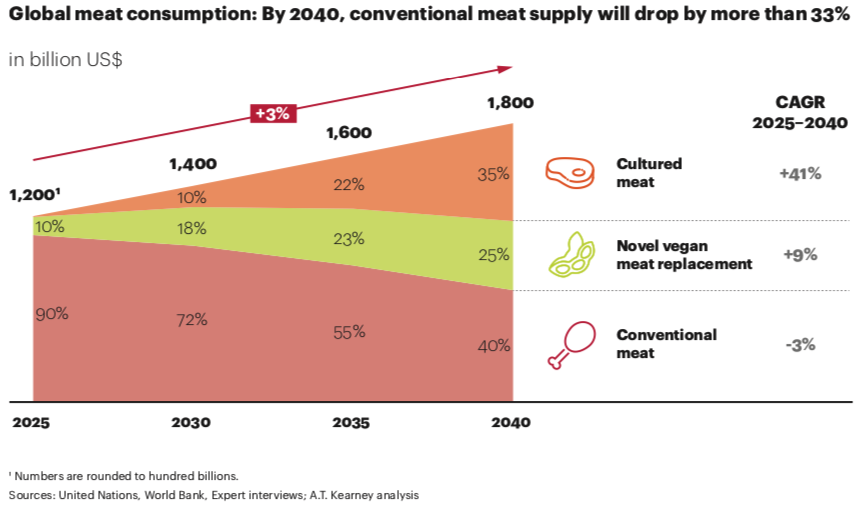

According to Zion Market Research, the global plant based meat market is expected to generate around $21.23 billion by 2025. In addition, Market Insider predicts a year on year growth of 25% giving the industry a $85 billion valuation by 2030. Although these may be a bold predictions as it is hard to completely predict the future. However, at the current growth rate isn’t hard to conclude that plant based meat market will definitely exponentially grow over the next few years. It is also important to note that plant-based foods are not the only alternative growing. The other largest growing alternatives include insect based foods and cultured meat.

A.T. Kearney predict that by 2040 conventional meat supply will drop by more than 33%:

To summarise, the $1000 billion conventional meat industry will be disrupted by new meat replacement alternatives, be it plant-based meat, cultured meat or something completely new. There is a clear trend in the industry showing that plant-based foods are on the rise and don’t seem to be slowing down. However only time will tell what the future holds!

If you are interested in learning more about the variety of FoodTech companies and plant-based products, check out our Global FoodTech Map

Alternatively if you are interested in gaining data driven insights about the FoodTech ecosystem, check out our FoodTech Data Navigator. Our state-of-the-art data platform captures and monitors the evolution of interconnected AgriFoodTech startup companies, investors and accelerators globally. With a limited time launch offer, expiring on the 31st of September.

To learn more about the plant-based revolution check out some of our other articles on the topic — https://medium.com/forwardfooding

Sources: A.T. Kearney, The Good Food Institute, Zion Market Research and FoodDive

Written by Armaan Dobberstein — Marketing Associate at Forward Fooding

This article has been written by Armaan Dobberstein

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]