FORWARD FOODING

THE BLOG

Precision farming – what’s next?

How AI, Big Data and Sensing technology can make agriculture more sustainable and efficient

Agriculture is perhaps the sector that has been and will suffer the most from climate change. With 72% of all water withdrawals used by agriculture and 12 million hectares of land lost to desertification, land degradation and drought every year, a revolution in the primary sector is needed in order to be able to face upcoming difficult years.

Considering the past summer’s drought in the northern hemisphere, which in Europe it was categorized as the worst in 500 years, many scientists already warned that this trend is likely to get worse, with the ultimate risk of putting global food security at risk.

From this scenario, Agtech proposes a range of solutions to alleviate the pressure on agriculture, both in terms of novel methods of cultivating (such as indoor farming), via plant science aimed at making crops more resilient, or by making a more efficient use of resources.

An Elaisian system deployed in an olive grove

We set out to shed light on the role that Precision farming plays in this space, considering that our FoodTech Data Navigator reports 800+ Agtech companies, and with almost half of them operating using this approach.

In terms of funding and the number of companies, Agtech accounts for a great sector of the whole AgriFoodTech, with over 1/4 of all companies, and 16% of the whole ecosystem’s raised capital. In this, Precision farming represents 40% of all Agtech companies, while accounting for 23% of the total funding of the vertical.

In this article, we are going to discuss what are the different approaches, and what the future may look like. Let’s begin.

Tech overview

As mentioned, Precision farming falls within the broader umbrella of Agtech. In particular, this sub-segment looks at all methods, both via sensors or cloud systems, to manage the field and the farm in a much more efficient manner, allowing also a higher degree of automation in daily operations and supporting farmers in decision-making processes.

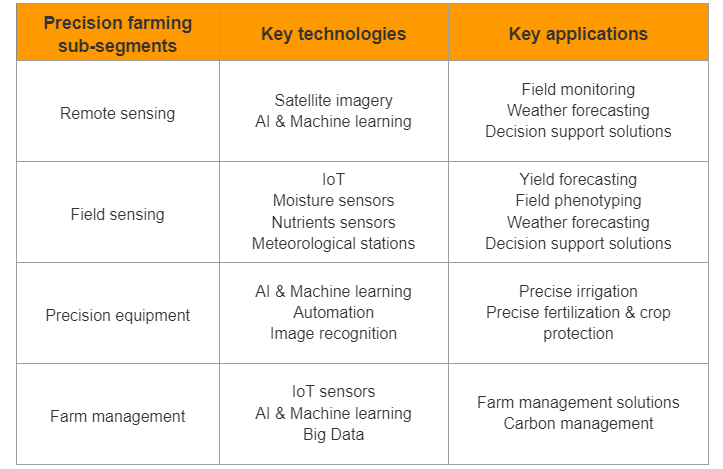

In order to simplify the understanding of the different nuances within Precision farming, here is table with the various approaches and the different technologies and applications:

Please note that despite our attempt to cluster companies, many of them apply a mix of technologies and these sub-segments should be considered only as indicative.

Ranging from pure software solutions as can be the case with farm management, to field sensing which has at its core smart sensors applied in the field, the area is greatly varied and even among companies, substantial differences emerge.

Let’s now dive into some companies that best exemplify the various applications we can find in Precision farming.

Companies examples

Remote sensing

Hydrosat

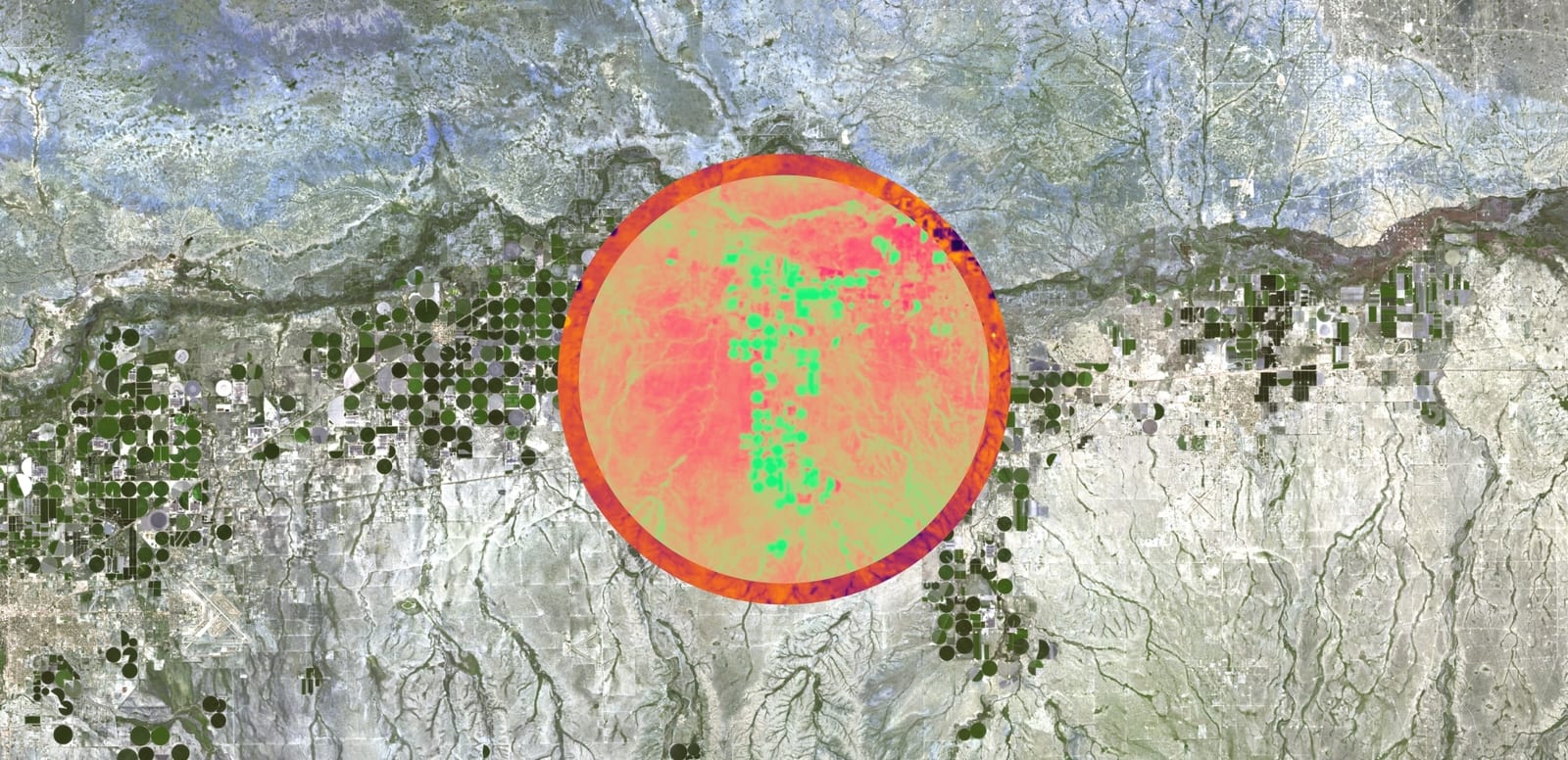

The American Hydrosat provides daily, high-resolution thermal and multispectral infrared imagery of the entire Earth. By leveraging its thermal capabilities, the company can provide analytics solutions to solve climate and agriculture issues.

The peculiarity of this system relies on the fact that the software solution can be used by both growers and insurers alike, in order to obtain crop yield forecasting and irrigation insights.

Sample image from Hydrosat showing the specifications of the images

Hummingbird (#51 of the 2020 FoodTech 500)

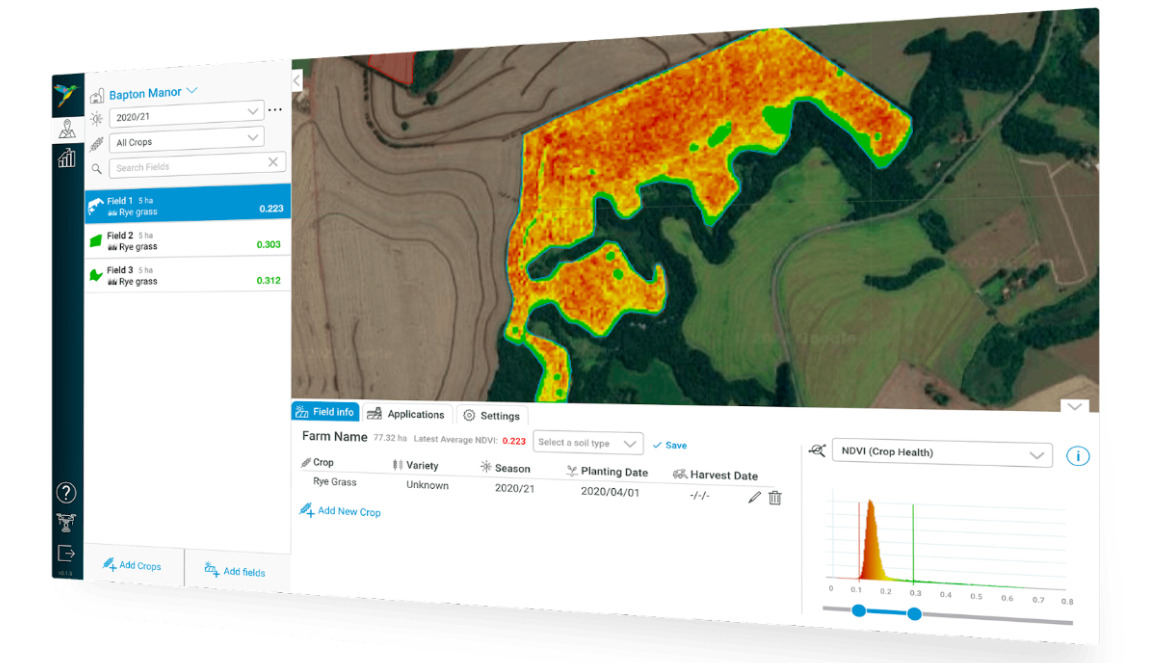

Hummingbird Technologies is a UK-based AI SaaS platform using the latest deep learning and computer vision techniques along with proprietary algorithms to analyse remote sensing data and provide actionable intelligence such as crop health, disease risk & detection, weed mapping and yield prediction as well as valuable information such as canopy coverage, plant counting, size and biomass estimation.

The company has experienced market success already, with current operations and clients across Latam, North America, Europe and Russia, and Australia and in the past received investments from BASF Venture Capital among others. Moreover in July 2022 Hummingbird agreed to be acquired by carbon marketplace operator Agreena to bring rigorous standards to the verification of the carbon certificates emitted by Agreena.

Example of a Hummingbird dashboard with field information and insights

Field sensing

CropX (#27 of the 2021 FoodTech 500)

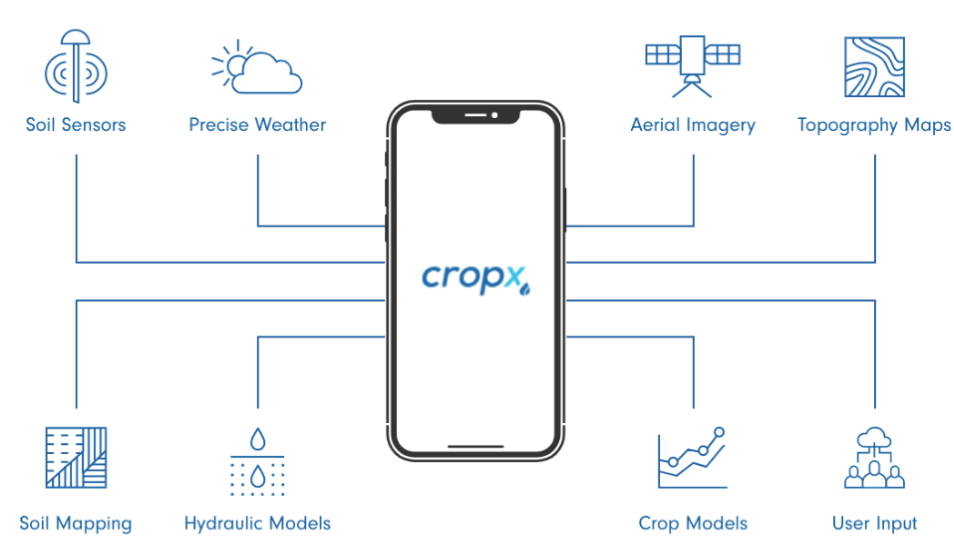

The Israeli CropX, founded in 2015, offers an integrated hardware and software system with a suite of decision and planning tools based on continuous monitoring of soil and crop conditions. The technology leverages soil sensors, weather forecasting, aerial imagery, topography maps, soil mapping and an AI engine for crop yield modelling.

So far, the company has raised a total of €9.5M and its latest funding round was supported by NEC, a Japanese multinational IT and electronics corporation. Moreover, in March and April 2022 CropX established partnerships with German-based HELM, one of the world’s largest chemicals marketing companies, and with Belgian Alixis, a global leader in fluid management systems for building, infrastructure, industrial and agriculture applications

Array of services and tools used and outputs generated by CropX

Teralytic

The American Teralytic, founded in 2016, developed the world’s first IoT-enabled NPK sensor. A single probe has 26 sensors reporting information on soil moisture, salinity, and NPK at three different depths, as well as aeration, respiration, air temperature, light and humidity. For reference, our estimates indicate only another couple of companies with a similar product, and still far in R&D.

On the other hand, upon releasing their technology to the public in 2018, the company stated that over 150 clients were interested in running pilots using Teralytc sensor.

A Teralytc sensor deployed in a field

Elaisian (#185 of the 2021 FoodTech 500)

The Italian Elaisian, founded in 2016, has developed a decision support system that allows farmers to monitor the health status of their crops and prevent illnesses widespread. The company is focused on tracking crops such as olive groves, vineyards, almonds and fruit trees thanks to its IoT-enabled sensors.

To date, the company has seen good commercial results, with over 30,000 hectares monitored in 15 countries globally. In this, the company has raised over €2M in funding to date.

Precision equipment

N-drip

This Israeli company, founded in 2017, is the developer of a gravity micro-irrigation system that can utilize existing flood irrigation infrastructure to provide efficient drip irrigation. The system uses pressure lower than 0.06 bar and is compatible with dirty water, thus requiring no filters.

So far the company has raised over €56M in what can be considered a great market success so far. As a testament to this, after PepsiCo piloted N-Drip’s technology with a handful of farmers in India, Vietnam, and the US, and saw improved crop yields with less fertilizer input and 50% less water consumed versus flood irrigation, in March 2022 the food giant agreed to deploy the technology on 10,000 hectares (25,000 acres) by 2025.

N-drip system deployed in a field

Greeneye Technology (#340 of the 2020 FoodTech 500)

The Israel-based Greeneye utilizes AI and deep learning technology to revolutionize the pest control process in agriculture. Greeneye’s proprietary selective spraying (SPP) system turns every sprayer into a smart machine with seamless integration, enabling farmers to save up to 90% of their chemical cost. In addition to the substantial savings, the system also captures and analyses sub-mm images directly from the field.

Retrofitting capability and AI deployment are among the leading factors that define the company’s success, which indeed raised over €40M to date. In this, In late 2021 the company raised $22M from Syngenta Group Ventures and leading agriculture machinery manufacturer AGCO among others, underscoring the echo its solution is having among established incumbents

An example of retrofitting by Greeneye Technology

Farm management

Xfarm Technologies (#158 of the 2021 FoodTech 500)

The Italian Xfarm, founded in 2017, has developed a suite of products ranging from software to IoT sensors on the field, designed to help farmers make informed and smart decisions regarding their crops. In particular, the system is particularly geared towards pest control and mitigation, notifying potential attacks and their entity.

Recently Xfarm acquired fellow Precision farming company Farm Technologies, in order to reinforce its IP portfolio and foothold in Italy. Moreover, the company is on track to engage with 100K+ farmers in 100+ countries thanks to the digitalization of Lavazza and Barilla supply chains and has recently raised a €17M Series B to fuel its international expansion.

Example of an Xfarm dashboard and implementation

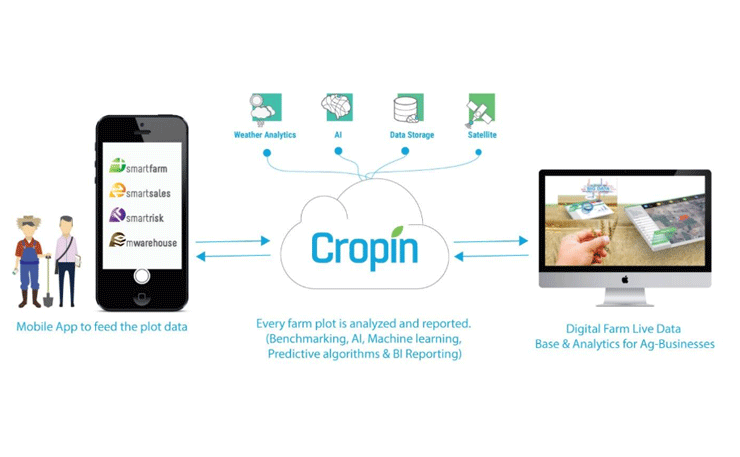

Cropin

India-based Cropin has developed a suite of products that enables the various stakeholders in the agri-ecosystem, including financial services providers, to adopt and drive digital strategy across their agricultural operations. Using technology like AI, machine learning, and remote sensing, Cropin creates an intelligent, interconnected data platform that can digitize operations from farm to fork.

So far the company has managed to raise €23M and has Partnered with True Digital Group (a Southeast Asia telecommunication company) to implement tech-enabled development to its $7b agriculture export sector, while counting Italian confectionery manufacturer Loacher among its corporate clients.

Example of processes and advantages of Cropin system

How does the industry reacts and what the future has in store

Agriculture is undergoing a deep transformation, and hopefully will have another ace up its sleeve for when(if) even harder effects of climate change will take place.

Two scenarios for this seem reasonable to expect in the near future, considering the number of actors starting to pay attention to this segment, the interest is attracting on a global scale and the number of new technologies and tools emerging.

Big data implementation will become easier and more widespread

Based on the industry signals it seems plausible that Big Data implementation will eventually overcome current infrastructural obstacles (such as standardized operational frameworks) and become an essential decision support technology for sustainable farm activities. This scenario seems particularly realistic when considering that it was forecasted that farms will produce on average 4.1 million data points per day in 2050 (up from 140,000 in 2014). Moreover, entities like the FAO getting involved in big data and agriculture signal a paradigm shift that will likely concern all actors in the space.

And Big Tech is moving into agriculture

It seems highly likely to expect the majority of big technology & chemicals corporations to develop a suite of offerings for Precision farming practices, targeting especially regenerative agriculture. Indeed, Microsoft, AWS, IMB, and other corporations have all introduced offerings designed for Precision farming and leveraging Big Data. Similarly, Bosch and BASF launched a smart farming joint venture recently that is set out to set the two conglomerates as predominant players in the Precision farming space.

But challenges remain

The rate of adoption of Precision farming technologies is still relatively low on a global scale. According to CID Bio-science, the adoption rate of farms in US and Europe is estimated at 15-40% and 68% respectively. In the global south, where the majority of farms are family-owned small entities, this rate is much lower because large farms only tend to adopt Precision farming technologies.

This issue is also tightly bound to the fact that 40% of the total land area has been degraded. In order to slow down this trend there would need to be an adoption rate in the range of 15%-25% for farms globally, which would cause GHG emissions and water use to be reduced by 10% and 20% respectively.

The technology is here, now is a matter to put it into use at scale.

Do you want to learn more about the food waste space, its challenges, and opportunities you can harness? Keep following our page to keep up to date with our latest posts, access our Food Data Navigator HERE to discover more about the companies analysed in this blog post, or get in touch HERE for a tailored consultancy.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]