FORWARD FOODING

THE BLOG

The Bioreactor Revolution: Transforming Food Processing and Flavor Development

According to a report by the World Resources Institute, our current global food system is not going to be able to feed 10B people sustainably by 2050. The FAO estimates that livestock production accounts for 14.5% of global greenhouse gas emissions and with the continued rise in global demand for meat and dairy, this number is only set to go up.

Enter cultivated meat, a FoodTech innovation that many believe to be a promising solution to the environmental and ethical challenges posed by conventional animal agriculture. Its production has been proven to be far more efficient as it uses significantly less resources and land, and therefore reduces pollution and GHG emissions.

There’s been much clamor about cultivated meat in the press recently, from Vow’s cultivated mammoth meatball to the approved sale of GOOD Meat’s and Upside Foods’ cultivated products in Singapore in the USA. But what about the process involved in culturing animal cells to create this alternative protein?

It’s been 10 years since the first cell-based burger was created by Dutch scientist Mark Post. He made use of large chambers called bioreactors, which provide the necessary conditions for cell growth and proliferation. However, despite the advancement in technology, many companies are still unable to scale their cultivated products for mass consumption.

Image from Believer Meats

IT ALL STARTS WITH A STRAIN OF CELL AND A BIOREACTOR

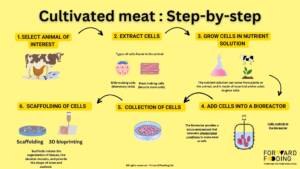

To understand the role bioreactors play in the production of cultivated meat, it’s important to get a better grasp of the process of cultivated meat

The first step in cultivating meat is selecting the animal and the strain of cells that will be used to cultivate the meat. Theoretically, cells from any animal can be used, but most companies focus on those from cows, pigs or chickens.

Next, the cells have to be isolated and expanded in a cultivator called bioreactor- that is a vessel that provides optimal conditions for cells to grow. Bioreactors have a heating and cooling system to control temperature, piping to deliver nutrients and oxygen and remove waste products, and sensor systems to monitor the environment and to measure things like pH and oxygen.

Inside the bioreactor, cells are duplicated and fed with growth media and oxygen to help them multiply. Once the cells have reached a sufficient density, they are induced to differentiate into muscle, fat, and connective tissues that make up meat.

The last production step is food processing. The differentiated cells are then harvested and processed, much in the same way as conventional agriculture. Processing can include grinding, mixing and shaping the meat into various forms. The cultivated meat product is then packaged, and ready for consumption.

COMPANIES IN THE SECTOR

The bioreactor industry is a burgeoning space, and based on recent industry data from our FoodTech Data Navigator, 57 companies are active in this very sector. There is also growing support for technologies enabling the production of cultivated meat, such as bioprocessing, online sampling systems, and automated dispensing systems, as the industry raised €1.1B since 2013, with 57% of it raised in 2022 alone (€634.5M). The market’s CAGR from 2019-2022 is 201% and it’s projected to reach $7328.4M by 2030, according to a report by Allied Market Research.

Despite the potential of cultivated meat, startups continue to face the challenge of scaling up. Some of the factors contributing to this hurdle include high costs, production efficiency, and regulatory approval.

To help solve the challenge of high costs, companies like Geneva-based Planetary Group are able to grow protein entirely on locally-produced carbon sources or sugars, limiting the impact of geopolitical instabilities and turbulence. The company is tapping into an $8M cash infusion to construct an industrial-scale production facility so that its customers leveraging fermentation technology can create and scale their alternative proteins quicker.

Germany-based Ospin Modular Bioprocessing helps with monitoring cell growth by providing automated and digitized bioprocessing solutions to labs and companies involved in the production of cultured meat. The company’s bioreactor systems can provide a controlled environment for the growth and development of animal cells, which is a crucial step in the production of cultivated meat. Its commitment to designing and producing automated bioprocessing systems for the cultured meat industry can help address the challenges of cost reduction and scale-up, which are critical for the commercial viability of cultivated meat.

Although manufacturers of cultivated meat are facing the challenge of scaling production, developments in the sector are geared towards providing both bioreactors and resources to enable the mass production of cultured meat. One of which is US-based Nth Bio, a new enterprise biology business launched by precision fermentation leader Perfect Day. It provides bio-engineers with access to critical tools, expertise, infrastructure, and technology needed to create impact in the food sector and beyond. The company’s focus is on accelerating the development of more responsibly sourced food, pharmaceuticals and textiles using the power of precision fermentation.

Recently, it announced a partnership with Food Tech startup Onego Bio, which specializes in egg white proteins. Through this collaboration, Nth Bio was able to accelerate Onego Bio’s process to commercialize animal-free ovalbumin by offering the former strain engineering, bioprocess development, regulatory support, and scale-up services.

Due to company concerns about keeping their trade secrets safe, some cultivated meat companies have resorted to renting out bioreactors. US-based Culture Biosciences has been buying and renting equipment since its foundation to help entrepreneurs who cannot or do not want to invest in such costly technology. Some alt protein companies they have partnered with include The EVERY Company and Geltor among others.

But, the biggest challenge yet is the disparity between the supply of optimized bioreactors and the growing demand for cultivated meat Players in the cultivated meat industry currently rely on pharma-grade bioreactors, which cannot support the production of cultured meat at large scales.

“There is a general supply bottleneck in the industry for bioreactors because cultivated meat products require massive bioreactor volumes to meet the target percentage share of the meat industry,” Eyal Rosenthal, CEO Ever After Foods.

With continued developments and innovations, a number of companies rose to the challenge of addressing these hurdles. Their solutions not only allow cultivated meat startups to focus on R&D efforts, it’s also a step towards the scaling and price parity of cultivated meat.

One bioreactor company that is helping cell-based companies optimize their bioreactors is Spain-based biotech Cultzyme. They have developed advanced bioreactors that enable the production of high-quality biosynthetic tissues. In fact, one of the main challenges in creating cultivated meat is replicating all the features of conventional animal meat, such as color, smell and cooking properties. Cultzyme’s advanced bioreactors and expertise in tissue engineering can help address these challenges and work towards achieving a product that matches or surpasses the taste and texture of conventional meat.

Since its foundation in 2022, Cultzyme has raised a total of $250K in funding. It is also part of the From Green to Healthy consortium, which aims to establish Spain’s food industry as a European leader in healthy eating by creating an integrated value chain through innovative, digitized, and sustainable processes.

INNOVATIONS AND COLLABORATIONS

FoodTech companies hard at work building a more sustainable global food system, are met with innovations in the bioreactor space. A company worth noting is Spain-based Cocoon Bioscience, which uses looper moth caterpillars as bioreactors for its cultivated meat production. This innovative approach allows the company to inject each cocoon with a small amount of Baculovirus, a type of virus that is a popular tool in biotech research for protein expression or delivery. Once this virus is injected into the cocoons, it encodes the desired growth medium for cultivated meat. The use of caterpillar bioreactors is claimed to be a lower-cost production route compared to traditional bioreactor-based methods.

Earlier this year, Cocoon Bioscience raised €15M to scale its technology, as well as develop a new production facility in Spain set to be fully operational by 2024.

Aside from such innovations, the space is also ripe with collaborations to build infrastructure that would further help companies scale their processes. In 2021, food giants Givaudan, Bühler, and Migros established The Cultured Food Innovation Hub in Zurich, a platform that provides startups with state-of-the-art scale-up facilities, technologies, and expertise to accelerate the development of their cultured food products.

Meanwhile in Asia, ScaleUp Bio has partnered with A*STAR’s Singapore Institute of Food and Biotechnology Innovation to build a joint lab in Singapore’s Food Tech Innovation Centre. Startups can use the lab’s facilities and technical know-how to produce alternative protein solutions and meet their increasing demand. To ensure commercial success, startups will also have access to resources to help them understand unfamiliar markets in Asia and navigate through various regulatory processes.

The future of cultivated meat is inevitable, and bioreactors are an important piece of the puzzle to propel food tech companies into building a more sustainable food system. With exciting innovations and impactful collaborations on the horizon, we could expect cultivated meat products on supermarket shelves sooner than we thought.

Access our Food Data Navigator to discover other bioreactor companies, or contact us for a tailored consultancy.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]