FORWARD FOODING

THE BLOG

The Unicorns of the Food Tech Industry in 2021

Where they are, what they do, and who are the next ones?

Two years ago, we created the FoodTech 500, the world’s first definitive list of the global entrepreneurial talent at the intersection between food, technology, and sustainability, with the aim of shining a light on the top innovators who are reshaping our Food System.

Although the FoodTech space has been enjoying quite a bit of hype in the last few years as we start seeing quite a few IPO’s (Eg.Beyond Meat, Oatly, Meatech) and the first wave of consolidation via SPACs (e.g Aerofarms, App Harvest, Benson Hill), we still need to keep in mind Food Tech (or AgriFoodTech) is still a relatively new sector which is now starting to capitalise its human and financial potential.

Yet, as consumers, corporations, institutions and investors start realising the need and urge to make our food system more sustainable and resilient, capital has been pouring into the sector. As a matter of fact, about 75% of the €82B raised by startup and scaleup companies since 2011 has been raised in the past 3 years only (source: FoodTech Data Navigator). This ‘phenomenon’ has allowed more and more AgriFoodTech companies innovating all across the supply chain to enter what is commonly called the ‘Unicorns’ club, as they get valued at more than $1B, amongst which a few FoodTech 500 companies.

Who are the unicorns?

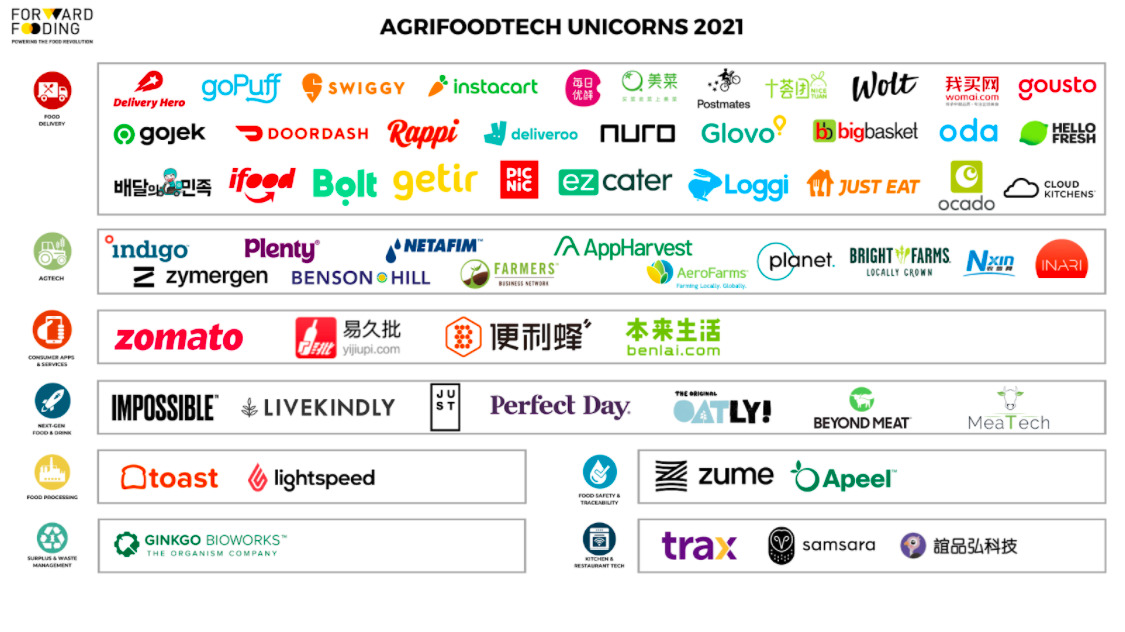

Delivery giants like Delivery Hero, JustEat & DoorDash, just to name a few, were the first-comers in the club. However, the latter now gathers companies across different verticals from Food Delivery to Agtech (cf.Forward Fooding taxonomy), and all across the globe.

As of today, thanks to our proprietary databases, we were able to identify 64 companies globally with a valuation of over $1B. Since 2010, if treated as a cluster, they have raised more than €47B, which represents more than 50% of the total funding invested in the whole AgriFoodTech sector.

In addition, we think it’s worthwhile highlighting the following:

- The number of companies which have gained the ‘unicorn status’ in the world has almost doubled since early 2020.

- The estimated aggregated valuation of these 64 unicorns is about €313B

(Disclaimer: these figures take into consideration public and private market valuations as ‘rough estimates’ which were sourced from various data sources including Pitchbook, Bloomberg, public markets listings. Thus, they only serve as estimations and can vary significantly on a daily basis).

Where are the unicorns?

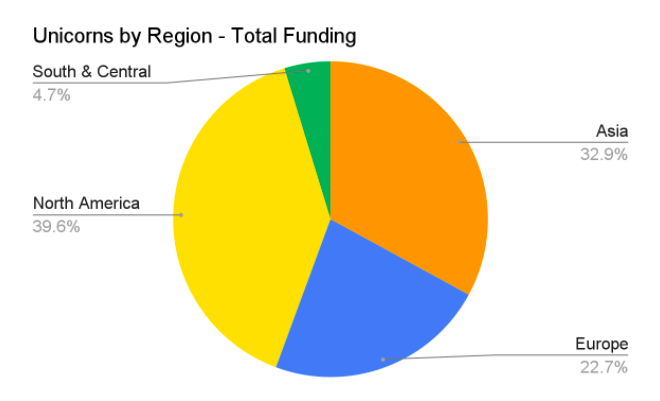

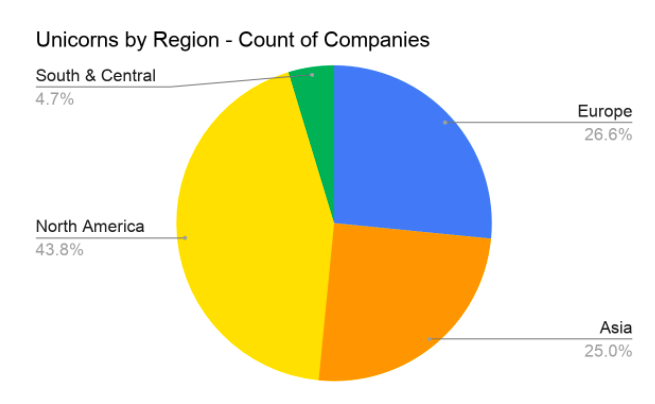

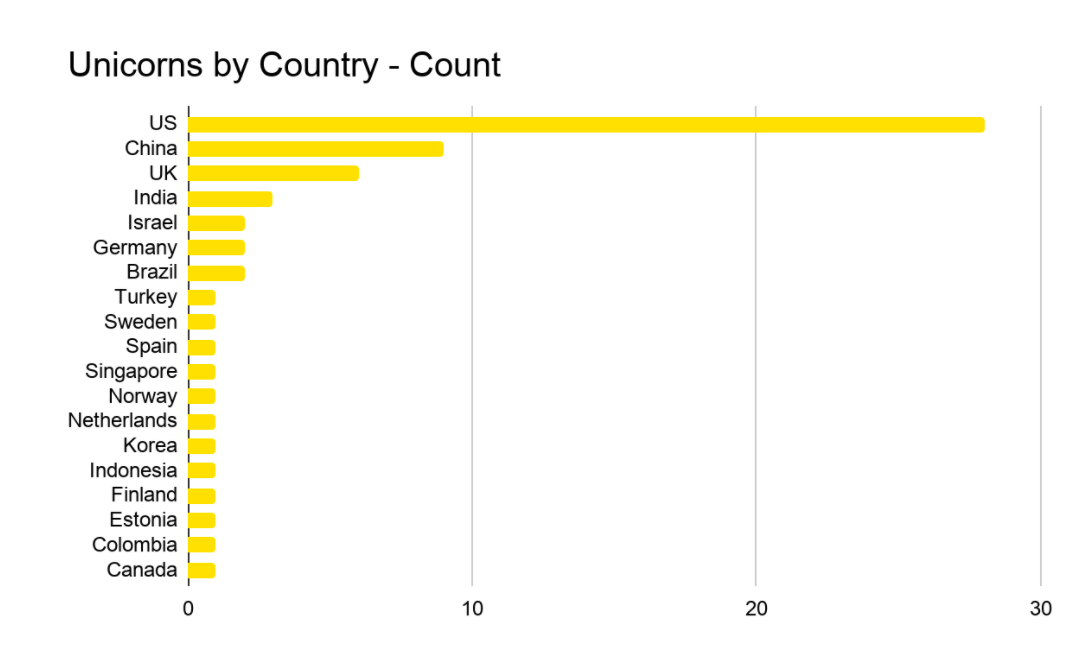

Out of the top 64 unicorns in the industry, 28 are based in North America (with Canada only accounting for 1 unicorn), 17 in Europe (incl. Israel and Turkey), 16 in Asia and 3 in South & Central America.

As the FoodTech sector in the US is by far the most mature one, North America is quite logically leading the ‘unicorn pack’ with almost 44% of the total number of unicorns which have jointly received 39.6% of the total funding of all unicorns. A logic explanation of this phenomenon can be found in the US market providing several advantages to startups aiming to scale up: more capital available, a strong startup ecosystem and entrepreneurial culture, and obviously the access to a very large domestic market, a huge advantage compared to Europe, and can partly explain also why China is the second most represented country with 9 unicorns as its ecosystem presents similar characteristics to the US one.

Yet, when digging deeper in the APAC FoodTech ecosystem, the most funded company in Asia is Jakarta-based Gojek, a multi-platform service and a payment system provider with operations in ride-hailing and food delivery among other services, counting 170M+ users in Southeast Asia. The company is currently valued at €9.5B according to Dealroom, and recently announced their joint venture with the e-commerce platform Tokopedia’

When analysing Europe we count 10 countries with food tech unicorns, UK being the most represented with 6 companies. However, the German delivery startup DeliveryHero is the most funded company on the list, with €4.3B funding raised over time.

The 3 unicorns in South America are Colombian multi-delivery platform Rappi, restaurant delivery app iFood, and shipping logistics firm Loggi, both of the latter were founded in São Paulo, Brazil.

What do they do?

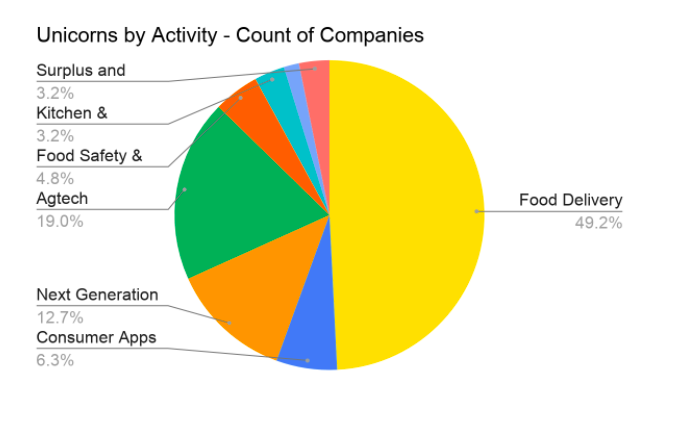

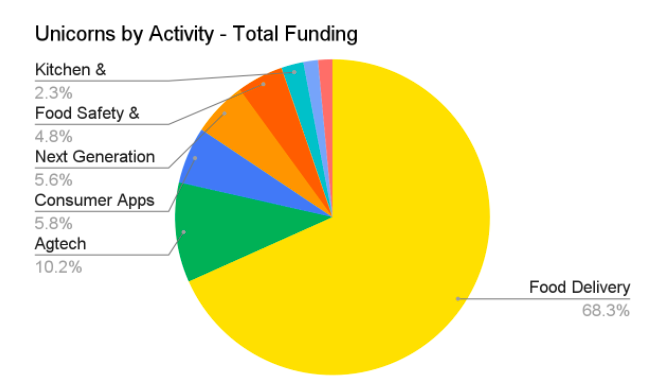

The first wave of Food Tech unicorns are undoubtedly within the Food Delivery sector, gathering 48% of companies and 68% of total funding. These include made-to-order food delivery startups such as Deliveroo and iFood, meal kit subscription companies such as HelloFresh and eGrocers like Instacart and Ocado or dark kitchens like Cloud Kitchen. Worth mentioning that we have excluded from calculations Blue Apron whose valuation crashed dramatically after their 2017 IPO.

Agtech comes next as the second most represented segment, with about 19% of companies and 10% of total unicorn funding, from Agbiotech companies such as Indigo or Benson Hill (who just went public in a $1.35B SPAC merger), vertical & indoor farming companies like Plenty, Aerofarms or App Harvest (the latter 2 also recently went through a SPAC merger). Also excluded from calculations as it has just been announced, U.S. vertical farming company and FoodTech 500 finalist Bowery closed a huge $300M Series C round, becoming the largest-ever private fundraise for an indoor farming company. They claim a valuation of $2.3B, making them enter the unicorn club as well.

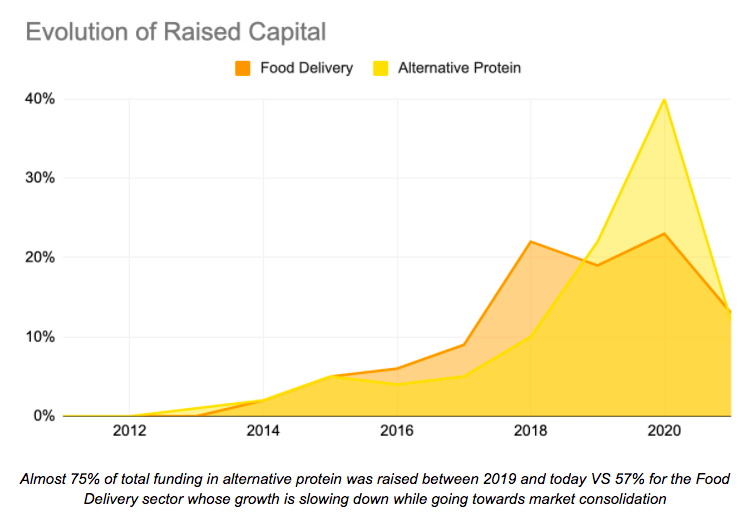

But if you follow the Food Tech space closely, you know that in the past couple of years, alternative protein companies have enjoyed hypergrowth, counting now for 13% of unicorns and yet ‘only’ 6% of unicorn funding so far. However, whether we are talking about plant-based meat and dairy alternatives, cellular agriculture or protein fermentation, more than 40% of total funding for this sector was raised in 2020, and startups have gained more traction than ever despite the pandemic.

Considering the growth path of the curve above, we expect a lot more alternative companies becoming unicorns in the next couple of years. Impossible Foods, Beyond Meat, Perfect Day, Oatly (whose recent IPO resulted in an even higher valuation than expected at US$ 13.1 billion) or Just Inc. are already part of the ‘unicorn family’, and were recently joined by LiveKindly. What is interesting is to also see a company like MeaTech, Israel based cultured meat tech developer who just filed for IPO on NASDAQ earlier this year at a $1.1B valuation, becoming the first ever lab-grown meat company listed on Wall Street (but their valuation went down since the IPO). They also acquired recently Belgium company Peace of Meat (supplier of cultured fat as texturing ingredient for plant-based meat). As investors are pouring always more money into the space to accelerate the development of these companies and get closer to price parity with animal-based protein, we should see more unicorn rising soon, such as Memphis Meat (now rebranded Upside Foods), or Chilean company NotCo who is eying the unicorn status for their next funding round. Last but not least, if not part of the club already, it is worth mentioning alternative protein pioneer Quorn, owned by Monde Nissin Corp who just went through the biggest IPO of the history in the Philippines, and planning an agressive US market expansion for the alternative protein brand.

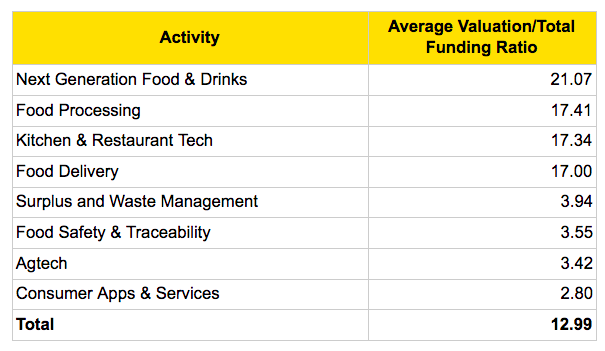

While to be taken with a pinch of salt, it is worth mentioning that the Next-gen Food & Drinks (namely Alternative protein) is the sector with the highest ratio Estimated valuation/Total funding, which quite reflects the hype and very high valuation the sector is currently going through.

The Unicorns of Tomorrow: The FoodTech 500, the Fortune 500 of FoodTech

Are you curious who the next unicorn in the food tech industry might be? Every year at Forward Fooding we craft the list of some of the most innovative and impactful AgriFoodTech startups in our FoodTech 500 list. Check out the finalists of 2020 here and download the White Paper to get a glimpse of the top movers and shakers of 2021, as some of them reach the ‘unicorn status’ in the foreseeable future.

Forward Fooding is the world’s first collaborative platform for FoodTech Data Intelligence and Corporate Startup Collaboration.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]