FORWARD FOODING

THE BLOG

The UK’s AgriFoodTech Industry: A Leading Force in Global Innovation

The AgriFoodTech industry in the UK has experienced significant growth over the past few years, establishing itself as a leader in Europe and a key player on the global stage. London, in particular, stands out as a central hub for this sector, home to over 470 AgriFoodTech companies, which accounts for more than 50% of the UK’s total. This vibrant ecosystem rivals other global hubs like Silicon Valley, Tel Aviv, New York, and Singapore.

Factors Behind the Growth

The UK government is actively fostering a thriving AgriFoodTech industry through strategic investments. This includes significant funding for research institutions like Imperial College London’s impressive £12 million allocation for fermentation research in 2024. Additionally, organizations like Innovate UK and the UK Agri-Tech Centre play a critical role in driving innovation by providing grants, fostering collaboration, and supporting businesses.

Brexit, while presenting some challenges, has also opened doors. The UK now has the flexibility to tailor regulations to promote innovation. The Food Standards Agency (FSA) recently updated regulations for precision fermentation and cell-based meat, demonstrating a commitment to supporting this growing sector. This regulatory agility is vital for staying competitive and attracting investment.

London’s position as a global financial hub offers AgriFoodTech startups a distinct advantage. Easy access to a diverse range of investors, from specialized venture capitalists to established private equity firms, fuels the sector’s growth at every stage, from pre-seed funding to mergers and acquisitions. This robust financial ecosystem ensures startups have the resources they need to scale and innovate.

FInally, the UK boasts a wealth of prestigious research institutions, attracting top international tech talent. This fosters a diverse and highly skilled workforce, a cornerstone for driving AgriFoodTech advancements. The combination of cutting-edge research and a talented pool of innovators positions the UK as a global leader in food technology.

Comparing the UK with Other Markets

The UK is home to over 760 AgriFoodTech companies, making it the most mature ecosystem in Europe and the second-highest globally after the US. Since 2014, UK companies have raised over $17.86 billion, a significant figure but still lower than the $106.8 billion raised in the US. This disparity can be attributed to the larger scale of venture capital activity and a more integrated market in the US.

In Europe, the UK leads in investments, with $12.65 billion since 2014, followed by Germany ($17.1 billion) and the Netherlands ($5.9 billion). Despite challenges like Brexit, the UK’s AgriFoodTech sector has shown resilience, with significant investment growth even in recent years (Source: FoodTech Data Navigator).

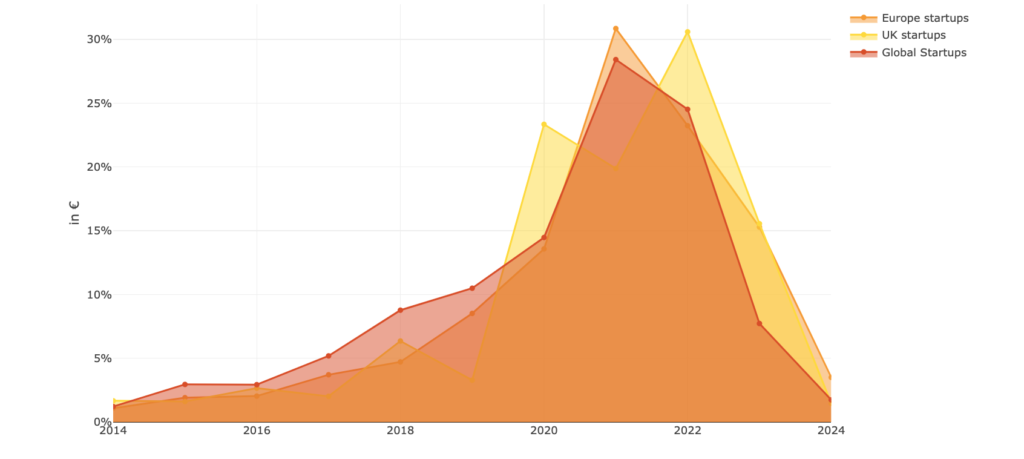

Investments growth trajectory 2014-2024 – UK vs Europe vs Global – % of total funding per year

Source: Forward Fooding FoodTech Data Navigator

Key Strengths in FoodTech

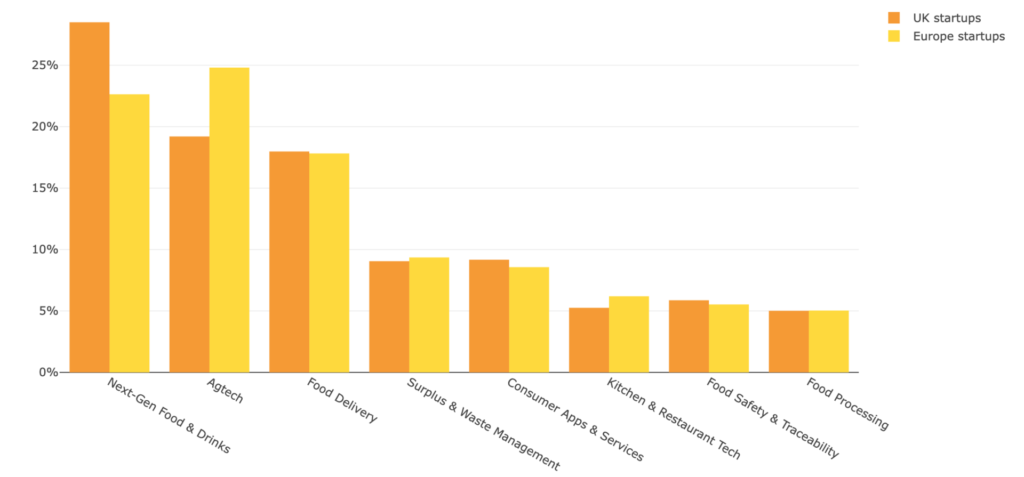

The UK stands out in Europe’s AgriFoodTech landscape. While Agtech dominates across the continent, the UK boasts a thriving Next-Gen Food & Drinks sector, encompassing alternative proteins and functional foods and drinks.This segment makes up a whopping 29% (232 companies) of the UK’s AgriFoodTech ecosystem, significantly higher than the rest of Europe.

Zooming on alternative proteins, despite the challenges the sector is currently facing, the UK counts almost twice as many startups operating in the Plant-based protein space (98) than the Netherlands (57), coming second in Europe, and led by players such as THIS, VFC, or Better Nature. We believe this is a sign that UK consumers are more ready than their European counterparts when it comes to adopting plant-based alternatives. The UK market is on the other hand very competitive and difficult for new plant-based companies to enter.

On the cellular agriculture and fermentation front, companies like Ivy Farms and ENOUGH have been recently in the spotlight with new record-setting production facilities opening last year and total funding reaching $60.9M and $121.1M respectively.

Other players have started to gain significant traction too such as Better Dairy with $26.95M in funding to perfect precision fermentation applied for animal-free dairy, Eden Bio, specialising in strain engineering and closing $1.2M seed in 2022, or Hoxton Farms, focusing on cell-based fat, having raised a $22M Series A round in 2022 and built an impressive pilot plant right in the heart of Shoreditch in London.

Overall, we believe the UK is very well positioned when it comes to ‘enabling technologies’ and alternative ingredients that will contribute to making better alternative protein products in terms of taste, texture, nutrition value, and scalability (e.g. growth medium alternatives, cell-based fat, mycelium). The country has all the ingredients and the potential to become a true powerhouse for alternative protein R&D, in the same fashion as Singapore or Israel.

Split across Activities – UK vs Europe

Source: Forward Fooding FoodTech Data Navigator

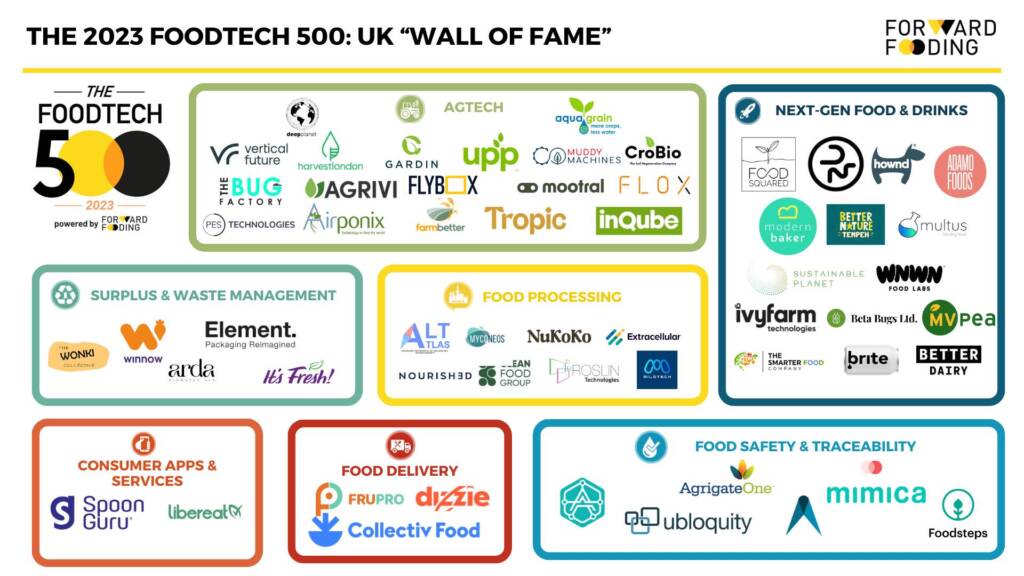

As for the latest edition of the FoodTech 500, the UK is also the most represented country in Europe with 57 finalist companies in the 2023 edition.

Check out the white-paper here and the full ranking here.

Potential Obstacles to Growth

Despite its strengths, the UK’s AgriFoodTech sector faces several challenges:

- Regulatory Hurdles: Navigating the regulatory landscape can be complex, particularly with the ongoing amendments to laws governing novel foods.

- Brexit Aftermath: Brexit has limited access to talent and impacted trade, posing challenges for knowledge transfer and commercial opportunities.

- Industry Pushback: Innovations like cultivated meat and precision fermentation face resistance from traditional meat industry stakeholders, complicating commercialization efforts.

- Red Tape: The regulatory framework, while flexible post-Brexit, still poses challenges for innovative food companies. The FSA is working to amend regulations, but this process can be slow and cumbersome.

Outlook

The UK’s AgriFoodTech ecosystem is a dynamic and rapidly evolving landscape. With strong government support, a robust financial ecosystem, and a thriving innovation hub in London, the sector is well-positioned for continued growth and global leadership. Despite challenges, the UK’s focus on alternative proteins and enabling technologies sets it apart as a key player in the future of FoodTech. By addressing regulatory hurdles and leveraging its strengths, the UK can further cement its position as a leader in the AgriFoodTech industry.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]