FORWARD FOODING

THE BLOG

Understanding the FoodTech Transition: A New Report Series

Our data reveals a key shift: historically slow to adopt new tech, the Food Industry now faces an even steeper climb due to drying up funding and changing patterns. Global venture capital funding is facing turbulent times, with AgriFoodTech being no exception.

Since its peak in 2021, investments in the sector have dropped by 74% in 2023. Regional dynamics are also changing, with Europe emerging as a hotbed for AgriFoodTech innovation, capturing 36% of investments in 2023 (up from 23% in 2021). Alternatively, funding is diversifying, moving away from just Food Delivery and Alternative Proteins. Investors are now looking at a broader range of solutions across the supply chain. This new landscape presents exciting opportunities for investors, with attractive valuations and a more cohesive ecosystem. Nevertheless, it’s evident that the FoodTech sector is undergoing significant changes.

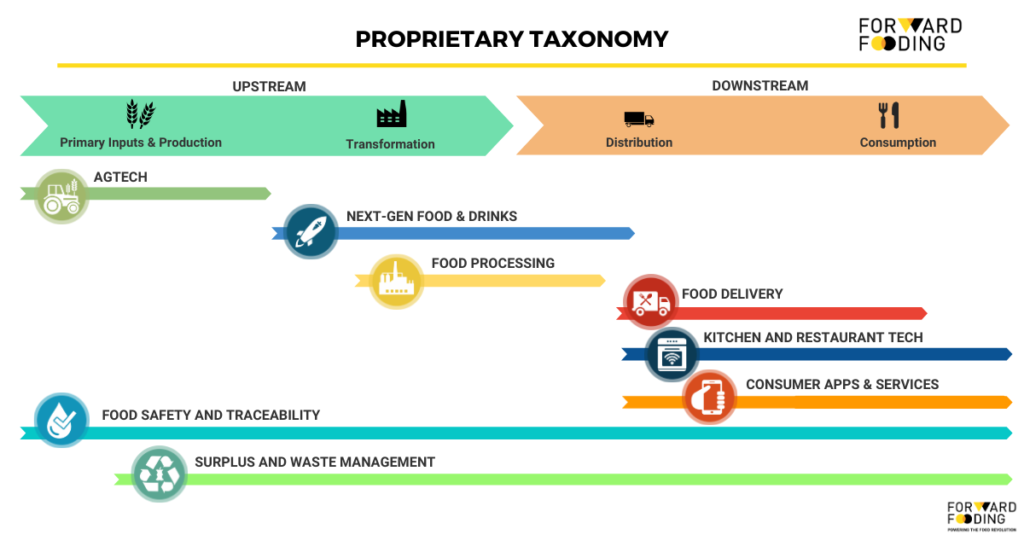

To help you navigate the key trends and market dynamics of the AgriFoodTech actor, and navigate these ‘waves of change’ smoothly, we are creating a new reports series: “Decoding the FoodTech Transition”. By leveraging our FoodTech Data Navigator database, sector knowledge, and network of industry experts, we offer comprehensive and data-driven analysis for each Activity and Domain of our proprietary taxonomy, providing actionable insights and strategic guidance to help you understand this transition period and better prepare for new realities while staying ahead of the curve.

What to expect from ‘Decoding the FoodTech Transition’ reports

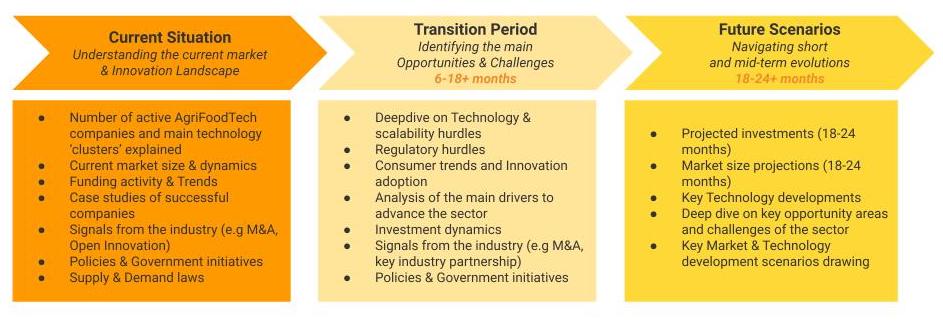

In “Decoding the FoodTech transition’ we embark on a comprehensive, data-driven bottom-up analysis of over 9,600 international FoodTech companies and $190B+ transactions over the last ten years, and cover the following:

- Startup Ecosystem Overview: Gain a comprehensive picture of the Global AgriFoodtech landscape of key technologies, applications, and market dynamics (e.g., active startups, funding levels, and evolution) through a detailed analysis of 9,600+ companies. The aim is to identify the most mature ’emerging technology clusters,’ key investment trends, and fastest-growing sectors.

- Industry Pulse: Stay updated by tracking the innovation activities of key players, such as recent M&A activity, joint ventures, and partnerships.

- Market Analysis: Understand the current market landscape and its projected growth using backcasting market sizing. Identify key drivers & barriers for each technology cluster identified

- Future Projections: Explore potential market scenarios and identify promising areas for investment and growth.

For each vertical (‘Activity’) and sub-vertical (‘Domain’) of our taxonomy, we will aim to provide a 360 realistic view of the sector, structured as follows:

Customized and Modular Reports

Our analysis is designed to provide you with insights that are directly relevant to your business/market. Our reports series will deep-dive on each of the Domains of our proprietary taxonomy:

Interested in deep-diving into the ins and outs of the AgriFoodTech sector?

Download now a free sample of the Plant-based proteins report HERE

OR

Register your interest in exploring additional AgriFoodTech topics HERE.

For more information, please contact info@forwardfooding.com.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]