FORWARD FOODING

THE BLOG

Vertical farming consolidation: the advantages and challenges

Following our previous blogpost regarding the consolidation of the Food Delivery space, we now look at the Vertical/indoor farming space. More specifically, we see what indicators lead us to believe that the two segments will share the same fate, and discover why this consolidation trend could give rise to the next bubble in Agri-Food Tech.

Climate change is already putting a major strain on our global food system. As its processes continue to intensify, it will become increasingly harder to feed the planet. With the global population expected to reach 9.8 billion by 2050 and 12 million hectares of land lost to desertification, land degradation and drought every year, the need to transform our practices has become all the more vital.

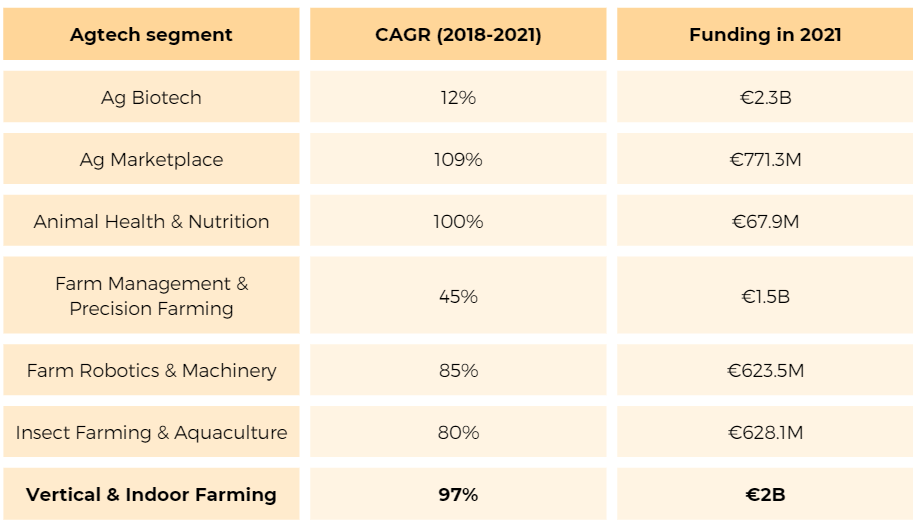

Recognizing this, some companies have started looking at alternative means of food production. One such way is indeed Vertical/indoor farming, which promises to enable the cultivation of a variety of crops with a fraction of the resources required by traditional farming methods. Over the past few years, investments in the segment have seen dramatic growth. Companies raised 2B in 2021, marking a 97% CAGR between 2018 and 2021, according to the FoodTech Data Navigator.

To provide some context, here is a breakdown of the growth rate and funding raised by various areas of Agtech, including Vertical and Indoor farming.

Source: FoodTech Data Navigator

This wave of interest in Vertical/Indoor farming solutions could be attributed, albeit partially, to rising concern about climate change’s impacts on food production. Vertical farming is seen by many as a compelling alternative to traditional resource-intensive agriculture. Its sustainability promises, paired with the growing demand for shorter, more reliable supply chains, have contributed to the sector gaining traction over the years.

The journey of industry pioneer AeroFarms, launched in 2004, reflects this overarching trend. Since its founding, the company has achieved a number of impressive milestones, and is still going strong:

“As a company recognized as the #1 FoodTech company on the FoodTech500 list, we are very excited about the larger value proposition around AeroFarms and vertical farming given the increasing macro challenges of growing outdoors and our fragile global food system,” said Marc Oshima, AeroFarms Co-Founder and Chief Marketing Officer. “Commercially, we are expanding to meet increasing consumer demand both internationally as well as in the United States where we recently launched nationally with Whole Foods Market, an industry first for leafy greens for the indoor growing space, and on the R&D side, we have partnered with the largest food and ag companies in the world like AB InBev and Cargill to drive long-term impact on addressing their agricultural supply chain needs and increasing their resiliency to climate change.“

Despite this success, the expansion of the Vertical Farming segment is associated with the major hurdle of reaching scalability while keeping costs at bay. To overcome this problem, companies are following two alternative routes: internal IP development and acquisition of external IP. Below, we look at how different vertical farming companies are approaching the issue.

Internal IP development

As shown above, one way companies can obtain a competitive advantage is by working on internal IP development. This kind of IP usually takes the form of robotic solutions used to automate farming operations, cut labor costs and ramp up production. Companies are racing to develop these solutions while simultaneously raising massive funding rounds and building new facilities. Some of these players include Plenty, 80 Acres Farms, Oishii and IGS.

US-based Plenty has developed an automated farm setting whereby vertical cultures are harvested at 350X the yield per field acre when compared to conventional farms. The company produces leafy greens which it sells online via a D2C model and through physical and online retailers such as Whole Foods and Instacart. Plenty has raised over €860M in funding over the years. The latest Series E set the world record at a whopping €354M ($400M) and saw leading retailer Walmart as one of the investors. In September, the company announced it will invest $300 million to build a 120-acre facility in Richmond, Virginia.

Example of robotics developed by Plenty

80 Acres Farms pursues a strategy similar to Plenty’s. The Vertical/indoor farming operator’s farms are powered by an automation technology platform called Infinite Acres (a wholly-owned subsidiary of 80 Acres Farms). The subsidiary collaborates with third parties such as Siemens and Dutch consultancy firm Delphy on the development of new technologies and applications for the vertical farming industry. In June, 80 Acres Farms announced its latest expansion efforts – the construction of two new facilities that will allow the company to increase production by more than 700%. This growth is fuelled by the over €200M the company has raised to date.

80 Acres Farms’ market strategy focuses on a strong presence in the physical retail space. In March 2021, the company extended its partnership with Kroger, in a deal that brought fresh produce from the indoor farm operator to 316 Kroger stores.

80 Acres Farm facility in Ohio

Oishii is another example of a company leveraging robotics in the vertical farming setting. Dubbed the Tesla of strawberries, the US-based company recently opened a new 74,000 sq. ft. facility in Jersey City which uses tailored-made lighting systems, robotics and automation to grow a particular variety of Japanese strawberries. The new facility is considered the largest of its kind. It will allow Oishii to cut the price of its products in half and get ahead of competitors such as Bowery Farming (also a strawberry producer). To do this, Oishii will tap into the over €41M ($50M) it raised in a Series A round back in March 2021.

Oishii’s proprietary robotics technology

Another company following the route of internal IP development is Scottish agricultural infrastructure supplier Intelligent Growth Solutions. Unlike other companies listed here, IGS builds vertical farms for third parties. Its LED system allows companies to cut energy usage by up to 40%, contributing to making vertical farming more profitable. The company has raised over €60M so far, €49M ($58M) in the latest Series B round. It now serves clients in four continents and saw its sales quadruple in 2021.

IGS’s patented three-phase LED system

IP acquisition

Internal IP development isn’t the only choice available for vertical farming companies looking to gain a competitive edge. Some players may choose to outsource innovation instead. Benefits include saving money and reducing time to market.

The recent acquisition of indoor farming operator Pete’s by fellow CEA company Local Bounti is a prime example of this approach. With this deal, Local Bounti seeked to gain access to Pete’s large retail customers, including Walmart, Kroger and Albertsons, while simultaneously de-risking its operational execution and adding scale to its operations. The acquisition offered Local Bounti some needed financial stability and laid the foundation for the company’s future expansion plans.

Another notable deal was completed earlier this year when Bowery Farming acquired ag robotics startup Traptic. Traptic robots use a clever combination of AI, computer vision, and robotics technologies to harvest delicate crops, including strawberries and tomatoes. Although the robots were originally built for use in open-field settings, Bowery chose to work on isolating elements of the technology and integrating them into its indoor operations.

One final example of this approach is offered by AppHarvest and its acquisition of Root AI. Root AI claims Virgo is the first universal harvester capable of harvesting crops of different sizes, including delicate crops. Virgo provides support in harvesting operations and collects valuable data while doing it. This data can be used to evaluate crop health, formulate yield predictions and optimise facility operations.

All in all, the existence of companies like Organifarms and MetoMotion, which market robotic and automation solutions specifically to third-party CEA operators, testifies to the feasibility of this route. Beyond that, for some companies this might end up being the only option moving forward.

Sepehr Achard, Chief Executive Officer of iGrow News, explains why:

“Unfortunately, many indoor vertical farms focused on ‘creating’ IPs that already existed in other sectors which is unnecessary and a waste of time/money. Very few actually outsource to third parties to leverage their experience in the industry and knowledge to accelerate their growth and focus on core aspects of their business but I believe that the current capital drought will force them to do so.“

But why the focus on creating technology from scratch? Henry Gordon-Smith, Founder & CEO of Agritecture, helps shed light on this phenomenon:

“I think this is mostly due to the attractiveness of the novel IP story to investors which makes farms appear like technology companies (and get higher valuations when fundraising). In reality, as most of these farms evolve, they become integrators of technology from established equipment suppliers or parallel industries. As the sector goes through a stage of correction in the face of rising energy prices and other obstacles, you will see less emphasis on IP and more on the bottom line.”

Therefore, as things progress, we can expect some companies to adjust their strategies. It is also worth noting that these two approaches – internal IP development and IP acquisition – can coexist. For instance, in September Plenty and berry giant Driscoll’s announced plans to build a new vertical farm. Here, strawberries will be grown using Driscoll’s proprietary genetics and berry expertise and Plenty’s advanced indoor growing technology.

The tendency to raise big is spreading everywhere

Companies mentioned in this list aren’t alone in raising big funds. Many vertical and indoor farming players aiming to fuel their expansion plans and achieve profitability have secured massive funding rounds over the past two years. Here are some of the latest ‘mega-rounds’ raised by Vertical/indoor farms, to further prove how this trend is creating an early-stage bubble:

- In September 2022 Gotham Greens raised €309.3M ($310M) in Series E funding to expand its greenhouses across the US. The company expects to operate 13 farms by next year;

- In June 2022 UAE-based Pure Harvest secured €168.4M ($180.5M) to invest in R&D and expand into the Gulf Cooperation Council and Asia markets;

- In February 2022 UK-based GrowUp Farms raised €120.5M (£100M) to scale its vertical farms in south-east England;

- In December 2021 German Vertical/indoor farming startup Infarm raised €176.7M ($200M) Series D to fuel its international expansion;

- In May 2021 US-based Bowery Farming secured €249.7M ($300M) in Series C funding – the largest private fundraise for an indoor farming company to date – to accelerate its growth. It then raised an additional €132.7M ($150M) in January 2022.

Conclusions

The evidence presented above lets us draw some comparisons between the Vertical/indoor farming sector and the Food Delivery sector. The latter is a mature segment and is currently undergoing a wave of consolidation: some companies are shutting down while others are working to secure large funding rounds just to keep afloat (see Gorilla’s latest valuation).

Vertical/indoor farming is following a similar trend. Challenging unit economics are fuelling a wave of IP reinforcement and strategic acquisitions aimed at generating profitability. Companies are also simultaneously investing in new facilities to achieve economies of scale. Some players will inevitably fall behind. Examples include Fifth Season, Glowfarms and Iron Ox. These occurrences will be more and more common in the years to come. Only the best-equipped players will survive the burst and upcoming wave of capital drought. Still, it remains to be seen whether vertical farming will be able to back its sustainability claims and overcome the rising skepticism.

Do you want to learn more about the food waste space, its challenges, and opportunities you can harness? Keep following our page to keep up to date with our latest posts, access our Food Data Navigator HERE to discover more about the companies analysed in this blog post, or get in touch HERE for a tailored consultancy.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]