FORWARD FOODING

THE BLOG

FoodTech 500 Spotlight: Africa and MENA’s AgriFoodTech Innovators Redefining Global Food Systems

Image: Tomas Hudolin

The Africa and Middle East & North Africa (MENA) regions are emerging as formidable forces in the global AgriFoodTech landscape, with a combined 61 companies earning their place among Forward Fooding’s 2024 FoodTech 500 finalists. Representing 12.2% of all finalists, these innovators are addressing some of the world’s most pressing challenges, including water scarcity, climate resilience, food security, and smallholder farmer empowerment.

Investment Momentum Defies Global Trends

Despite a global funding slowdown, AgriFoodTech investment in Africa and MENA has shown remarkable resilience, underscoring growing investor confidence in regional innovation ecosystems.

According to Forward Fooding’s FoodTech Data Navigator, the two regions together attracted over $420 million in 2024, driven by a surge in agritech, food security, and climate-resilient innovations. It’s worth noting that several countries — including Morocco, Egypt, Tunisia, and Algeria — span both regions, contributing a combined $33 million across 68 companies, which partially overlaps in the regional totals.

- Africa saw $97 million raised across 349 companies in 2024, led by Kenya, Nigeria, and South Africa. This marks a steady rebound in funding after two slower years, highlighting investor appetite for scalable AgriFoodTech solutions that address productivity and market access.

- MENA, by contrast, recorded a stronger $323 million in 2024 and an additional $357 million already raised by mid-2025, defying global venture trends, which are expected to decline during the same period.

- Israel remains the powerhouse within the region, with 473 active AgriFoodTech companies that collectively secured $209 million in 2024 and $80 million so far in 2025, continuing to dominate the Middle East’s innovation and investment landscape.

This sustained funding momentum reflects the strategic alignment between public policy and private investment. Governments across both regions are embedding food innovation within broader economic diversification agendas—whether through national food security strategies in the Gulf or digital agriculture programs in Sub-Saharan Africa—creating fertile ground for AgriFoodTech entrepreneurs and investors alike.

Innovation Hubs Leading Regional Growth

Kenya has re-emerged as the top African hub of AgriFoodTech investment in 2024, attracting $83M across 19 deals, accounting for nearly 53% of the continent’s total. Egypt was second with 15% of total investment, and Nigeria came in at third with 10%. Kenya’s mobile-first culture and strong agricultural sector provide fertile ground for Agtech solutions, while Nigeria’s large population and growing middle class make it a natural hub for marketplace innovations.

Israel stands as the undisputed innovation hub of the MENA region, with its AgriFoodTech ecosystem featuring over 750 companies. The country’s robust venture capital ecosystem, world-class research institutions, and government support create a breeding ground for breakthrough technologies in precision agriculture, biotechnology, and alternative proteins.

The United Arab Emirates is slowly emerging as a strategic center for food innovation, driven by its National Food Security Strategy 2051, which aims to make the UAE the world’s best in the Global Food Security Index by 2051 and among the top 10 by 2021. The plan outlines 38 key initiatives focused on developing sustainable food production systems, diversifying import sources, and fostering international partnerships to ensure long-term food security and resilience.

Aligned with these national priorities, the UAE continues to set ambitious sustainability goals, such as halving food loss and waste by 2030. This target is supported by Ne’ma’s National Baseline Study, which involves 3,000 participants and tracks waste across all seven emirates. According to Ne’ma, around Dh6 billion (US$1.63 billion) worth of food is wasted in the Emirates annually, with each resident discarding an average of 224 kg of food per year, nearly double the levels seen in Europe and North America.

Meanwhile, the UAE’s investments in alternative proteins and supply chain technologies further reflect its drive to reduce import dependency while nurturing a knowledge-based economy. Building on this, Ne’ma recently signed multiple Memoranda of Understanding (MoUs) with Nestlé and House of Pops to strengthen private sector engagement in building a more efficient and circular food system.

- Under the agreement, Nestlé UAE will contribute relevant operational data and insights to the country’s Food Loss and Waste Baseline Study, as well as support the national Zero Food Waste Framework. The company’s broader activities in the UAE already support over 7,200 jobs and contribute AED 4.8 billion in gross value to the economy annually.

- House of Pops will spearhead youth-focused awareness campaigns through school roadshows, workshops, and community activations to instill more mindful attitudes toward food, as well as mobilize the hospitality sector and ecosystem stakeholders to contribute to innovation and data-sharing efforts towards national impact.

These partnerships illustrate how the UAE’s sustainability goals are not only government-led but also deeply intertwined with private-sector innovation, ensuring that collective action drives lasting change across the entire food value chain.

Another prime example is the AGWA Cluster, launched in June 2024, which aims to serve as a global hub for novel food production and water-abundance solutions. The initiative is expected to attract AED 128 billion (≈ USD 34.8 billion) in investments, generate AED 90 billion (≈ USD 24.5 billion) in additional GDP, and create over 60,000 new jobs by 2045. Meanwhile, AGWA’s PALT initiative is designed to bring together global leaders in alternative proteins, regulators, and investors, reinforcing the UAE’s pivot from traditional food systems toward innovative production models.

Addressing Critical Challenges

Image: Clark Wilson

Image: Clark Wilson

Both regions face mounting climate pressures. MENA’s precision agriculture tools help farmers adapt to increasing water scarcity and temperature extremes. Meanwhile, African companies build supply chains that can withstand climate volatility while reducing post-harvest losses that disproportionately affect tropical climates.

With rapidly growing populations and increasing urbanization, both regions prioritize food security. In the MENA region, local leaders used the recently concluded Global Food Week 2025 in Abu Dhabi to unveil a series of initiatives that underscore the region’s commitment to innovation, trade, and sustainability in food systems – to name a few:

- A multilateral MoU signed by the Abu Dhabi Agriculture and Food Safety Authority (ADAFSA), Abu Dhabi Investment Office (ADIO), Abu Dhabi Airports Company, and Abu Dhabi Customs, alongside leading agribusiness firms, to streamline logistics, strengthen cold-chain infrastructure, and enhance the export of perishable goods.

- A strategic partnership between ADIO, Pure Harvest Smart Farms, Silal Food and Technology, and other private-sector partners aimed at scaling the global export capacity for high-quality perishables while improving supply-chain integration across the Gulf region.

- Abu Dhabi launched a pioneering regulatory framework for novel foods, developed jointly by the Abu Dhabi Agriculture and Food Safety Authority, the Abu Dhabi Quality and Conformity Council, and the Abu Dhabi Investment Office. The framework aims to cut registration time for novel foods by 6–9 months, unify halal and import certification under a single system, and establish a national database of approved food products, reinforcing the emirate’s ambition to become a global hub for food innovation and sustainable production.

Africa, on the other hand, focuses on strengthening existing agricultural systems through better market access, financing, and technology adoption that respects traditional farming knowledge while introducing efficiency gains.

The need for sustainable food production drives innovation in both regions. MENA companies lead in technologies that maximize output from limited water and arable land. African innovators work to increase productivity among smallholder farmers who cultivate much of the continent’s food, recognizing that small-scale farming remains central to African food security.

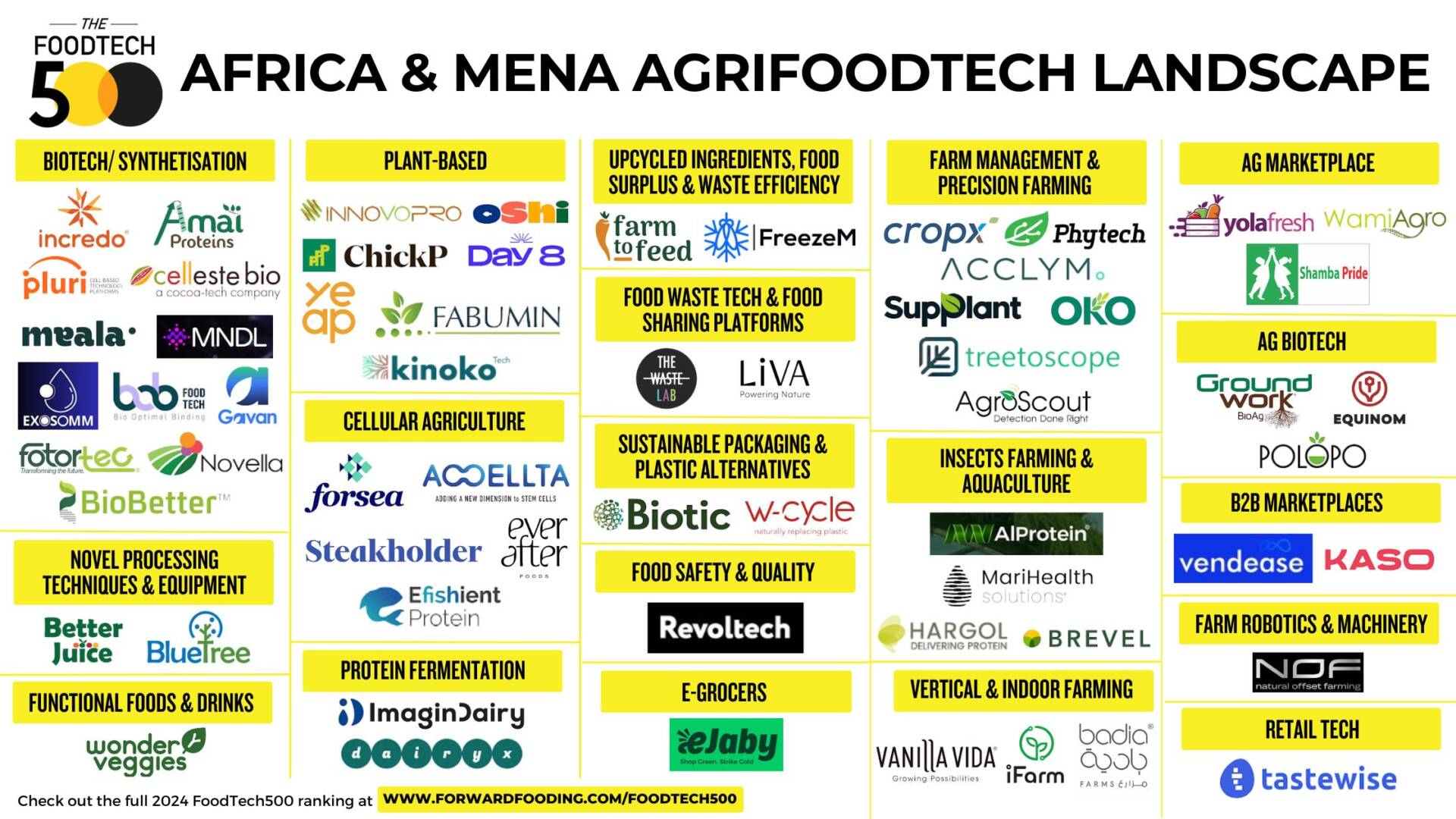

Meet the FoodTech 500 Finalists from Africa and MENA

These innovators from Africa and MENA have claimed their place in the 2024 FoodTech 500, demonstrating remarkable progress, creativity, and influence in shaping the AgriFoodTech landscape:

AFRICA

Vendease (#27 in the 2024 FoodTech 500) | B2B Marketplaces | Streamlines supply chain operations and end-to-end restaurant management through its marketplace and tech solutions

YoLa Fresh (#52 in the 2024 FoodTech 500) | Ag Marketplace | Builds an efficient distribution, sourcing network, and technology for smallholder farmers and traditional retailers

Shamba Pride (#90 in the 2024 FoodTech 500) | Ag Marketplace | Offers a range of services, including agro dealer upscaling, financial management, soil testing, and logistics management

WamiAgro Limited (#122 in the 2024 FoodTech 500) | Ag Marketplace | Offers Ag Marketplace solutions to bridge the gap between smallholder farmers and agribusiness financing

Farm to Feed (#257 in the 2024 FoodTech 500) | Upcycled Ingredients, Food Surplus & Waste Efficiency | Offers a tech-enabled solution to food loss and waste

AlProtein (#395 in the 2024 FoodTech 500) | Insects Farming & Aquaculture | Offers eco-friendly, vegan, and gluten-free protein powders using plant-based and algae-based sources

MariHealth Solutions (#439 in the 2024 FoodTech 500) | Insects Farming & Aquaculture | Leverages biotechnology to promote sustainable aquaculture practices and optimized fish feed production

MENA

CropX (#9 in the 2024 FoodTech 500) | Farm Management & Precision Farming | Offers advanced soil and crop intelligence and a suite of digital agronomic decision and planning tools

Groundwork BioAg (#12 in the 2024 FoodTech 500) | Ag Biotech | Produces highly concentrated mycorrhizal inoculants that restore soil fertility, sequester carbon, and unlock mycorrhizal carbon credit revenue for farmers

Phytech (#36 in the 2024 FoodTech 500) | Farm Management & Precision Farming | Offers an innovative plant sensor system that monitors plant growth in real-time and sends critical alerts to growers through web and mobile applications

Equinom (#49 in the 2024 FoodTech 500) | Ag Biotech | Develops sustainable, non-GMO plant-based ingredients

Tastewise (#59 in the 2024 FoodTech 500) | Retail Tech | Offers a generative AI solution that can predict consumer trends and provide data-driven insights tailored to the needs of food and beverage brands

Incredo (#68 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Offers a sugar reduction technology that can deliver up to 70% reduction in sugar

Amai Proteins (#69 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Paunching sweelin®, a sweet protein that reduces 40-70% of sugar without compromising taste, health, cost, and sustainability

Acclym (formerly Agritask) (#84 in the 2024 FoodTech 500) | Farm Management & Precision Farming | Provides visibility into predictability and sustainability of crop supply for food & beverage enterprises

SupPlant (#91 in the 2024 FoodTech 500) | Farm Management & Precision Farming | Provides high-resolution, real-time, and forecasted insights and irrigation commands for an accurate irrigation regime and practices

Innovopro (#98 in the 2024 FoodTech 500) | Plant-based | Develops and produces unique plant-based protein ingredients, with a focus on chickpea proteins and other chickpea ingredients

Apply now for the 2025 edition of the FoodTech 500

Pluri (#103 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Develops sustainable, cell-based solutions in regenerative medicine and FoodTech

Hargol FoodTech (#107 in the 2024 FoodTech 500) | Insects Farming & Aquaculture | Provides healthier, more sustainable, and affordable protein alternative made from grasshoppers

Celleste Bio (#108 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Combines BioTech, AgTech, and AI to produce 100% natural cocoa ingredients at scale

Forsea Foods (#150 in the 2024 FoodTech 500) | Cellular Agriculture | Develops cell-cultured seafood using patented organoid technology

Oshi (#152 in the 2024 FoodTech 500) | Plant-based | Produces plant-based fish fillets

Meala Foodtech (#153 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Offers functional proteins designed as binding and gelling agents

AgroScout (#159 in the 2024 FoodTech 500) | Farm Management & Precision Farming | Leverages cutting-edge AI to optimize crop yields, reduce waste, and improve farm efficiency

FreezeM (#166 in the 2024 FoodTech 500) | Upcycled Ingredients, Food Surplus & Waste Efficiency | Boosts insect protein production by supplying high-performing, life-cycle Black Soldier Fly neonates at scale

Gavan Technologies (#168 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Develops innovative technology to extract high-purity proteins from plants while maintaining their physical structure and functionality

Treetoscope (#181 in the 2024 FoodTech 500) | Farm Management & Precision Farming | Develops the first and only commercial device that senses the internal water flow of a plant and directly measures its water consumption and real-time irrigation needs

Imagindairy (#191 in the 2024 FoodTech 500) | Protein Fermentation | Uses fermentation to produce milk proteins that are animal-, lactose-, growth hormone-, and cholesterol-free

Vanilla Vida (#192 in the 2024 FoodTech 500) | Vertical & Indoor Farming | Delivers the world’s highest quality vanilla beans through controlled and patented growing and curing methods

Better Juice (#208 in the 2024 FoodTech 500) | Novel Processing Techniques & Equipment | Develops innovative technology that can reduce sugars in orange juice by up to 80%

iFarm (#223 in the 2024 FoodTech 500) | Vertical & Indoor Farming | Offers an indoor farm management software that maximizes technological efficiency, optimizes yields, and increases farm productivity

PoLoPo (#224 in the 2024 FoodTech 500) | Ag Biotech | Leverages molecular farming to produce animal-based proteins in potatoes, starting with egg protein

Brevel (#299 in the 2024 FoodTech 500) | Insects Farming & Aquaculture | Offers a highly functional and affordable microalgae-based protein with a full amino-acid profile

Steakholder Foods (#248 in the 2024 FoodTech 500) | Cellular Agriculture | Develops and manufactures cutting-edge, 3D-printing technology and plant-based premixes to produce high-quality alternatives to meat and fish products

Badia Farms Agricultural (#266 in the 2024 FoodTech 500) | Vertical & Indoor Farming | Produces fruits and vegetables year–round using hydroponic growing techniques

MNDL Bio (#275 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Uses AI-powered gene optimization to reduce costs and accelerate food & biotech production

Ever After Foods (#277 in the 2024 FoodTech 500) | Cellular Agriculture | Uses advanced manufacturing technology to generate cultivated meat on a mass scale for commercialization cost-effectively

BioBetter (#280 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Utilizes plant-based platforms to produce cost-effective, high-quality growth factors essential for the cultured meat industry

ChickP Protein (#291 in the 2024 FoodTech 500) | Plant-based | Innovates chickpea protein isolate, with a 90% protein content

OKO (#309 in the 2024 FoodTech 500) | Farm Management & Precision Farming | Offers automated crop insurance for smallholder farmers in Africa

The Waste Lab (#322 in the 2024 FoodTech 500) | Food Waste Tech & Food Sharing Platforms | Offers a comprehensive & sustainable food waste management solution for businesses and communities, focused on nature-based principles and data-driven operations

Biotic (#323 in the 2024 FoodTech 500) | Sustainable Packaging & Plastic Alternatives | Manufactures fully bio-based, fully biodegradable PHA polymers to replace fossil-based plastics

Kinoko-Tech (#354 in the 2024 FoodTech 500) | Plant-based | Develops sustainable, minimally processed plant-based protein alternatives using proprietary solid-state fermentation technology

eJaby (#358 in the 2024 FoodTech 500) | eGrocers | Delivers high-quality overstock products from supplier warehouses directly to consumers at discounted prices

DairyX (#366 in the 2024 FoodTech 500) | Protein Fermentation | Produces animal-free dairy using precision fermentation

BOB FoodTech (#378 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Provides scalable and targeted toxin removal solutions for the food and beverage sector using patented RNA technology

KASO (#401 in the 2024 FoodTech 500) | B2B Marketplaces | Connects restaurants and suppliers to simplify the food procurement process

Revoltech (#403 in the 2024 FoodTech 500) | Food Safety & Quality | Uses a proprietary freezing technology to ensure that food retains its cellular structure, resulting in higher quality and longer shelf life

Fotortec (#409 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Upcycles vegetable side streams into mushroom-based protein ingredients

Day 8 (#425 in the 2024 FoodTech 500) | Plant-based | Upcycles discarded agricultural biomass to create sustainable, high-quality Rubisco protein

Accellta (#429 in the 2024 FoodTech 500) | Cellular Agriculture | Offers a proprietary 3D suspension platform to address the critical scalability bottleneck in the FoodTech industry

BlueTree Technologies (#432 in the 2024 FoodTech 500) | Novel Processing Techniques & Equipment | Develops a platform to selectively reduce sugar content in natural beverages without affecting taste or nutritional value

EXOSOMM (#438 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Develops a variety of nutritional solutions based on natural milk-derived exosomes

Novella (#448 in the 2024 FoodTech 500) | Biotech/ Synthetisation | Leverage cellular agriculture to offer consistent, high-value bioactives for nutraceuticals and functional foods

Yeap (#459 in the 2024 FoodTech 500) | Plant-based | Produces sustainable, nutritious, easy-to-scale, and inexpensive protein made out of spent yeast.

NOF – Natural Offset Farming (#472 in the 2024 FoodTech 500) | Farm Robotics & Machinery | Develops advanced cooling technology, and focuses on the field of CO2 utilization and decarbonization

FABUMIN (#476 in the 2024 FoodTech 500) | Plant-based | Transforms legume wastewater into plant-based egg

E-FISHient Preotein (#479 in the 2024 FoodTech 500) | Cellular Agriculture | Uses advanced cellular agriculture technology and fish science to create a scalable and cost-effective process for producing high-quality cultivated fish meat

LiVA (#485 in the 2024 FoodTech 500) | Food Waste Tech & Food Sharing Platforms | Develops smart bio-preservation and bio-control solutions for food shelf-life extension and crop protection

Wonder Veggies (#490 in the 2024 FoodTech 500) | Functional Foods & Drinks | Develops technology to grow produce rich in healthy probiotics

W-Cycle (#497 in the 2024 FoodTech 500) | Sustainable Packaging & Plastic Alternatives | Offers innovative PFAS-free and laminate-free food-contact approved compostable packaging

Download the full 2024 FoodTech 500 list here.

Looking Forward

The 61 companies from Africa and MENA in the 2024 FoodTech 500 represent more than technological innovation—they embody a fundamental reimagining of food systems suited to unique regional challenges. As climate change intensifies and resources become scarcer, solutions developed in these regions will become increasingly relevant globally.

MENA’s expertise in water-efficient agriculture, sugar reduction, and alternative proteins positions the region as a critical solution provider for global challenges. Africa’s marketplace innovations and farmer-centric approaches offer blueprints for agricultural transformation in other developing regions. The convergence of MENA’s technological sophistication and Africa’s grassroots innovation creates a powerful force for food system transformation extending far beyond their borders.

Building on this trajectory, findings from our AgriFoodTech in the Middle East & Wider Region Ecosystem Report 2022 in collaboration with NEOM show that the region’s AgriFoodTech ecosystem has experienced steady, government-backed growth over the past decade, marked by increasing investments, startup formation, and strategic public–private partnerships.

A few key insights from the 2022 report include:

- The Middle East continues to grapple with local agricultural production challenges, overreliance on food imports, and rapid population growth, all of which are fueling the adoption of AgriFoodTech as vital solutions.

- The UAE’s National Food Security Strategy 2051 and initiatives such as FoodTech Valley underscore the region’s commitment to sustainable food innovation and ecosystem development.

- The most active sectors in the Middle East’s AgriFoodTech scene include Food Delivery (35.6%), AgTech (28.9%), and Next-Gen Food & Drinks (15.2%), reflecting an ecosystem initially focused on immediate consumer and production needs, but poised to diversify further.

- The strong presence of AgTech startups highlights how local innovators are addressing pressing agricultural needs while gradually expanding into more advanced areas such as AgriFinance, personalized nutrition, and food waste management.

These insights reinforce that the Middle East’s AgriFoodTech evolution is no longer in its infancy but entering a maturity phase defined by ecosystem diversification, regulatory reform, and cross-sector collaboration. Together with Africa’s rising innovation ecosystems, these regions are shaping the next frontier of global food system resilience.

Ready to make your mark on the future of food? The Forward Fooding FoodTech 500 2025 is calling for applications from groundbreaking companies. Don’t miss your chance to be recognized. APPLY NOW!

Forward Fooding is the world’s first collaborative platform for the Food & Beverage industry via FoodTech Data Intelligence and Corporate-Startup Collaboration – Learn more about our Consultancy and Scouting Services and our Startup Network.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]