Kitchen and Restaurant Tech

The restaurant industry has seen big technological changes. It’s gone from streamlining operations to adopting new generative AI and robotics. Adapting to emerging kitchen and restaurant tech is unavoidable. Technology wasn’t the sole driver. During the pandemic, the whole industry faced massive challenges. Restaurant operators tried many solutions. These aimed to fill vacant positions and increase efficiencies. Big chains are exploring broader applications of automation and AI. But the recent macro tech layoffs have also altered the landscape. This shift necessitates a reevaluation of the kitchen and restaurant tech ecosystem.

What is Kitchen and Restaurant Tech?

Kitchen and restaurant tech include smart kitchen appliances for consumers. They also include smart equipment or technologies that help restaurants manage their business better. This category includes hardware and software. They make professional kitchens smarter with IoT (internet-of-things) tech. It includes POS systems and supply chain tools. Also, ordering platforms, kitchen robotics, and other smart food appliances.

The Role of Kitchen and Restaurant Tech in Shaping the Agrifood System

Restaurant technology remains relevant in the food system due to the rapid digital and technological transformation the industry is experiencing. The integration of various technologies such as online ordering, automation, robots, QR codes, and advanced data analytics has revolutionised restaurant operations, making them more efficient and enhancing the overall dining or customer experience.

In 2021, the global TAM of restaurant tech was estimated at around $3 trillion. The Global Restaurant Digitalization Market is projected to reach USD 29.6 Billion by 2032, up from USD 7.9 Billion in 2023, with a robust CAGR of 16.3% from 2023 to 2032.

Restaurant tech is important not only for operational efficiency but also for adapting to the evolving demands of the market and providing an enhanced experience for both customers and restaurant owners. Kitchen and restaurant tech benefits the food industry in several ways:

- Efficiency and productivity in tasks such as order processing, inventory management, and kitchen operations by automating processes to reduce manual efforts and minimise errors

- Enhanced customer experience with technologies like digital menus, online ordering systems, and personalised recommendations contribute to a more seamless and enjoyable customer experience.

- Cost optimization through data-driven insights, efficient inventory management, labour scheduling, and resource utilisation

- Informed decision-making with data analytics of customer preferences, operational performance, and market trends. This data-driven decision-making improves strategies for marketing, menu planning, and overall business growth.

- Streamlining operations to ensure a smoother workflow in restaurant operations

- Labour optimization by automating repetitive tasks, optimising staff schedules, and addressing labour shortages.

- Sustainability and waste reduction by optimising inventory to reduce waste, implementing resource-efficient kitchen appliances, and adopting eco-friendly practices.

Trends in Kitchen and Restaurant Tech

Consumer demands and behaviour and the impact of automation on jobs are pivotal in shaping the restaurant and kitchen tech industry.

- Diners now crave dining experiences that are not only delicious but also come with a side of convenience, personalization, and speed. Think smooth online orders, contactless payments, and menu suggestions tailor-made just for you.

- The rise of food delivery apps, social media’s influence on dining choices, and the demand for sustainable and ethically sourced ingredients are shaping consumer behaviour in the industry.

- Rapid advancements in technology such as AI, robotics, data analytics, and IoT are transforming kitchen and restaurant operations. Self-checkout screens and the use of robots can potentially reduce labour costs and minimise human error.

- Integration of tech solutions like POS systems, online ordering platforms, and automation tools is becoming essential for efficiency and competitiveness.

- Growing awareness of environmental sustainability is driving the adoption of eco-friendly practices in the industry. Restaurants are implementing resource-efficient equipment, cutting down on food waste, and sourcing locally to minimise their environmental impact.

- In 2024, with economic uncertainty, the struggling restaurant industry faces additional budget cuts as consumers tighten spending. Technology offers solutions to cut costs, emphasising quality and customer experience as crucial, given customers’ reduced tolerance for any negative experiences.

- Policies related to data privacy, health regulations, and sustainability initiatives shape how restaurants adopt technology.

- Digital collaboration tools and Industry 4.0 technologies like AI and IoT are being integrated into the food supply chain, raising significant ethical considerations.

- The integration of technology in kitchens and restaurants raises concerns about job displacement due to automation. According to a survey by Oxford Economics, around 45% of people in the restaurant industry may lose their jobs due to automation by 2030.

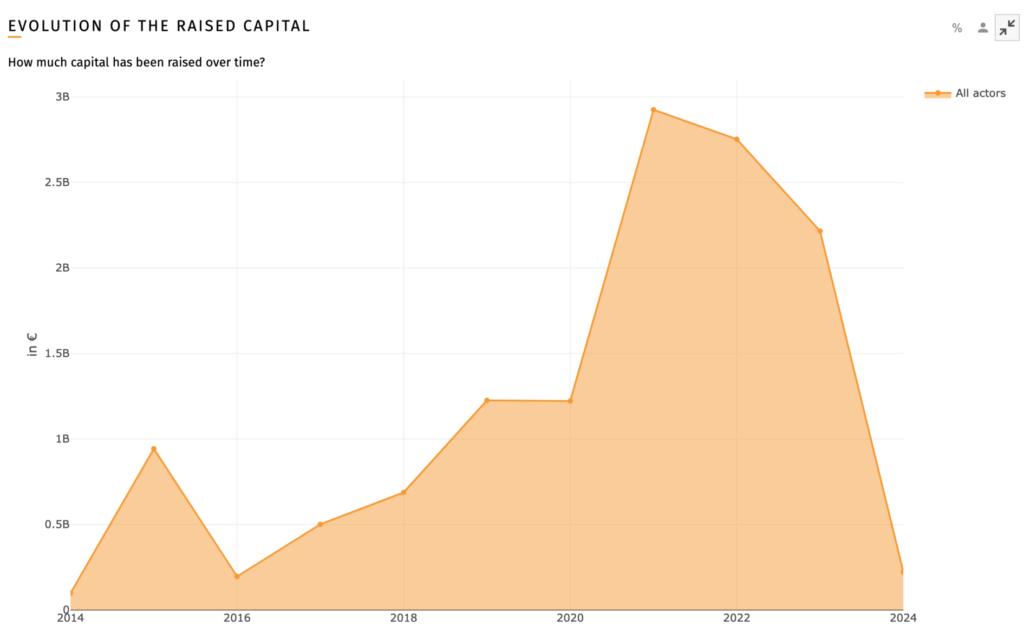

Capital raised from 2014 – February 2024: €12.66 Billion (Source: FoodTech Data Navigator)

Kitchen and Restaurant Tech Domains

Kitchen and Restaurant Tech encompasses various domains, each contributing to the transformation of the agrifood system. Here are some key domains within our proprietary taxonomy:

- Appliances – Refers to kitchen equipment and devices that are integrated with advanced technology to enhance efficiency, precision, safety, and overall performance in commercial kitchens

- Commercial Robotics & Hardware – Encompass advanced technological solutions, including robots and hardware devices, designed to revolutionize operations in the food service industry.

- Restaurant Operations Management & POS Systems – Involve the use of advanced technology to streamline and optimize various aspects of running a restaurant including managing sales transactions, order processing, inventory tracking and customer interactions.

Companies Shaping the Industry

The Food Tech Data Navigator shows 665 actors in the Kitchen and Restaurant Tech (Source: FoodTech Data Navigator)

Appliances:

- Click & Grow (Estonia) #21 in the 2023 Foodtech 500 | Creating simple, sustainable indoor gardens that allow anyone to grow fresh food at home, in restaurants, schools or wherever indoors.

- Natural Machines (Spain) #146 in the 2023 Foodtech 500 | Provides customized 3D-printing solutions at or closer to the point of consumption

- Nymble (USA) #286 in the 2023 Foodtech 500 | Building an autonomous cooking future through home robots

- Ovie (USA) | Provides Smarterware products designed to make any fridge a smarter fridge.

- Kara Water (USA) | The world’s first air-to-water dispenser of mineral-rich alkaline water.

- MealTec (Canada) | Offers a fully automated home-cooking solution.

- Milky Plant (UK) | Developed a revolutionary plant milk maker, allowing users to easily make their own plant and nut milk at home in just minutes.

Restaurant operations management & POS systems:

- Klimato (Sweden) #73 in the 2023 Foodtech 500 | Calculating carbon emissions for food businesses.

- OlaClick (Brazil) #101 in the 2023 Foodtech 500 | Connects SMB restaurants in LATAM to sell food directly to their customers and organize their business

- ClearCOGS (USA) #362 in the 2023 Foodtech 500 | Predictive Restaurant Forecasting using machine-learning and AI to make proactive decisions to reduce management stress, labor inefficiencies, and food waste.

- First Bite (USA) | A go-to-market software platform for food manufacturers.

- Foodics (Saudi Arabia) | Cloud-based all-in-one restaurant management system.

- Olo (fka Omnivore; USA) | Offers a point-of-sale integration API allowing uniform access to the POS systems.

- Owner (USA) | All-in-one platform for managing a restaurant’s digital presence

- Piecemeal (Canada) | Online platform tailored for hotels, restaurants, and food service operators that uses AI to automate various tasks

- Malou (France) | Food marketing and digital marketing solutions for restaurants.

- Last.app (Spain) | Provides comprehensive restaurant software solution that aims to simplify and optimize the tasks of restaurant teams

- Bite (USA) | Develops digital ordering technology that elevates hospitality by personalizing each guest interaction.

- Orda (Nigeria) | A cloud-based restaurant operating system specifically designed for African chefs and food business owners.

Commercial Robotics & Hardware:

- Pubinno (USA) #77 in the 2023 Foodtech 500 | Connects the world through the Internet of Beer with its patented AI and robotics technologies

- Rozum Robotics (Republic of Belarus) #86 in the 2023 Foodtech 500 | Making automation affordable for all SMEs with the help of a collaborative robot

- Keenon Robotics (China) | Indoor service robot developer and manufacturer for various industries such as restaurants, hotels, hospitals, airports, and shopping centers.

- Chef Robotics (USA) | Focused on serving the food industry by utilizing flexible robotics and machine learning to increase production volume.

- Aniai (South Korea) | Resolve labor shortages in Quick Service Restaurants (QSR) through Robotic Kitchens

- Miso Robotics (USA) | Develops and manufactures artificial intelligence-driven robots for the commercial foodservice industry.

- auum (France) | A glass cleaning machine that optimizes the cleaning process and reduces its water consumption.

- Goodbytz (Germany) | Specializes in building robotic kitchens that serve as assistants to professional chefs.

- Sidework (USA) | Provider of universal, commercial-grade, automated beverage dispensers that are designed to enable precision and versatility.

- Cook Ease (France) | Professional kitchen equipment company that specializes in robotic and IoT solutions for restaurants.

- Brightloom (USA) | Offers a comprehensive cloud-based software platform for enhancing the guest experience.

Our Blogs on Kitchen and Restaurant Tech

- Sustainable Kitchen: The Transformation Every Restaurant Needs

- Meet Emilio and Lynette from Natural Machines, one of the FoodTech 500 winners

- Kitchen design post COVID-19: 5 key trends for 2020

Interested in deep-diving into the ins and outs of the AgriFoodTech sector? Explore our New Report Series, ‘Decoding the FoodTech Transition,’ providing in-depth analysis and strategic insights into the evolving AgriFoodTech sector. Download a free sample now of the Plant-based Proteins Report HERE.

Explore Our Proprietary Taxonomy

Navigate the market dynamics of the AgriFoodTech sector with our proprietary taxonomy that covers the entire food supply chain, categorized into verticals (‘Activities’) and further divided into subcategories (‘Domains’). Click below the activity you want to explore.