Surplus and Waste Management

The Surplus and Waste Management sector focuses on reducing waste generation, maximising resource utilisation, and promoting sustainability. Companies in the space make use of biomaterials, biochemicals, and advanced technologies to achieve this goal. Despite the promising contributions of recent innovations in waste management, the sector still faces several hurdles: inadequate infrastructure, limited access to technology, and regulatory barriers.

What is Surplus and Waste Management?

Surplus and Waste Management includes products and solutions that help reduce food waste. For instance, consumer-facing apps that redistribute food surplus from restaurants & supermarkets, products or byproducts made of food waste, and optimisation of sidestreams. This category also includes sustainable packaging solutions such as plastic alternatives made of biopolymers, or biocoating solutions to extend products shelf life.

The Role of Surplus and Waste Management in Shaping the Agrifood System

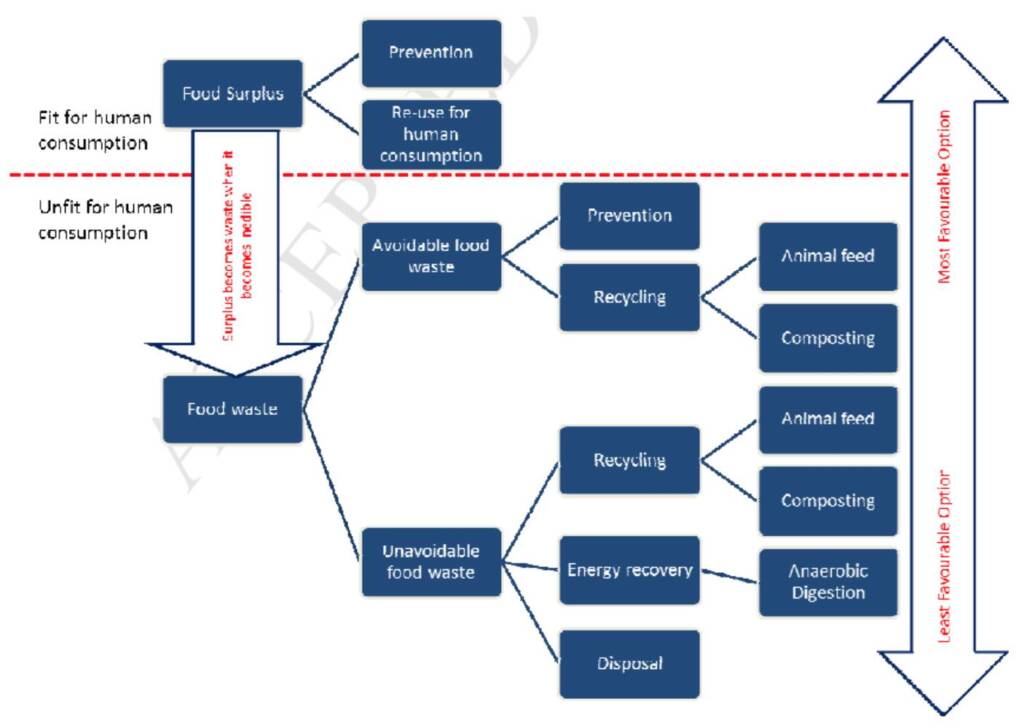

Companies in the Surplus and Waste Management space are utilizing various methods and technologies to achieve the common goal of managing food waste. Some of these include reusing, recycling, and recovery strategies, replacing non-biodegradable materials, and promoting circular economic models.

The food waste hierarchy as a framework for managing food surpluses and waste.

According to a recent report by Market Research Future, the global food waste management market is expected to reach US$63.45B by 2032 from last year’s US$40.41B, with and CAGR of 5.8%.

The agrifood sector generates substantial quantities of surplus, waste, and loss throughout the supply chain, contributing to environmental concerns, economic burdens, and social inequities. Here are some key aspects of the Surplus and Waste Management sector’s impact on the agrifood system:

- Resource conservation: Repurposing surplus food reduces the need for raw material extraction and minimises the environmental footprint of the food system.

- Reduced greenhouse gas emissions: Decreasing food waste lowers methane emissions from decomposition in landfills and decreases the carbon intensity of the food system.

- Improved food security: Redistributing surplus food helps alleviate food poverty and supports vulnerable populations while reducing food waste.

- Circular economy principles: Valorising surplus food aligns with the circular economy paradigm, extending the lifecycle of resources and creating new economic opportunities.

- Technological advancements: Developments in food preservation, sorting, and tracking technologies enable more efficient food waste management and support the transition toward a zero-waste food system.

Trends in Surplus and Waste Management

One of the primary facets driving the growth and innovation of the Surplus and Waste Management sector is food waste’s environmental impacts.

Food surplus and waste framework

- Public awareness regarding waste management and environmental consciousness drive behavioral shifts, fostering a more sustainable future.

- Educational campaigns and partnerships with schools and universities help spread knowledge about waste reduction techniques and encourage responsible behaviors

- Advanced waste disposal technologies, such as landfill gas-to-energy (LFGTE) and waste-to-energy conversions, enhance operational efficiencies and reduce environmental impacts.

- Continuous research and development in waste treatment methods contribute to the evolution of the waste management industry.

- Climate change, natural disasters, and global warming pose threats to the waste management industry, requiring adaptation and resiliency measures.

- Strict environmental regulations and the shift towards a circular economy model further challenge traditional waste management practices.

- Economic downturns might result in budget cuts for waste management agencies, potentially hindering their capacity to address waste problems effectively.

- Anti-trust laws, pricing mechanisms, and waste disposal regulations vary among nations, necessitating careful navigation of the political landscape.

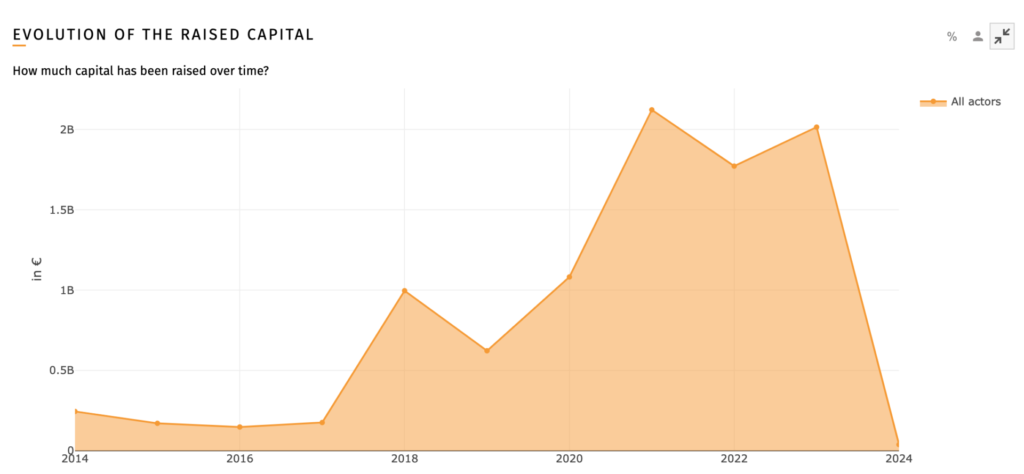

Capital raised from 2014 – February 2024: €9.3 Billion (Source: FoodTech Data Navigator)

Surplus and Waste Management Domains

Surplus and Waste Management encompasses various domains, each contributing to the transformation of the agrifood system. Here are some key domains within our proprietary taxonomy:

- Food Waste Tech & Food Sharing Platforms – Involves the use of technology to address food waste issues by monitoring freshness, extending shelf-life, and facilitating the sharing of surplus food.

- Sustainable Packaging & Plastic Alternatives – Focuses on developing environmentally friendly packaging solutions that reduce the reliance on single-use plastics and minimize waste generation.

- Upcycled Ingredients, Food Surplus & Waste Efficiency – Refers to strategies that utilize upcycled ingredients, repurpose food surplus, and enhance efficiency in managing food waste.

Companies Shaping the Industry

The Food Tech Data Navigator shows 720 actors in the Surplus and Waste Management sector (Source: FoodTech Data Navigator)

Food waste tech & Food sharing platforms:

- Winnow (United Kingdom) #11 in the 2023 Foodtech500 | Offers digital tools that accurately measure and manage waste, cut costs, and save time.

- Spoiler Alert (United States) #14 in the 2023 Foodtech500 | helps CPG manufacturers and distributors to manage excess and slow-moving inventory by digitizing the liquidation process.

- Fazla (Turkey) #22 in the 2023 Foodtech500 | Develop technology-based, holistic solutions to reduce waste generation at its source and ensure the recycling of waste is converted into a circular economy.

- Mori (United States) #36 in the 2023 Foodtech500 | Creates a protective layer that slows down three key mechanisms that cause food spoilage.

- Nilus (Argentina) #44 in the 2023 Foodtech500 | A digital retailer for the bottom of the pyramid, leveraging the power of disintermediation, food rescue and community group buying.

- Hazel Technologies (United States) #71 in the 2023 Foodtech500 | Offers products stabilize the health of your fruits and vegetables, allowing them to stay fresher through storage, transit, and on the shelf.

- Goodr (United States) #83 in the 2023 Foodtech500 | Leverages intuitive technology and nationwide logistics to divert waste and get food to those who need it most.

- Chinova Bioworks (Canada) #89 in the 2023 Foodtech500 | Turns natural mushroom fiber extracts into a shelf-life extending ingredient for food and beverages.

- Foodsi (Poland) #102 in the 2023 Foodtech500 | Provides a platform for producers to sell their unsold goods at a discounted price, reducing food waste.

- Food To Save (Brazil) #110 in the 2023 Foodtech500 | Connects “foodsavers” dedicated to combating food waste with establishments, savings thousands of tons of food that would have otherwise been discarded.

- B4waste (Brazil) #128 in the 2023 Foodtech500 | Connects consumers with products that are close to their expiration date, which can be bought at a reduced price.

- Wasteless (Israel) #131 in the 2023 Foodtech500 | Provides machine learning and realtime tracking solution for grocery stores to offer customers dynamic pricing based on product expiration date.

- It’s Fresh! (United Kingdom) #136 in the 2023 Foodtech500 | Helps the entire food supply chain to extend the shelf-life of fresh fruit and vegetables to reduce waste and optimise produce quality.

Sustainable packaging & Plastic alternatives:

- Element Packaging (United Kingdom) #229 in the 2023 Foodtech500 | Offers affordable eco-friendly alternatives to disposable tableware.

- Biotic (Israel) #359 in the 2023 Foodtech500 | Reinvents plastics with a scalable, circular, fully bio-based & fully biodegradable alternative material (PHA).

- Pack2Earth (Spain) #470 in the 2023 Foodtech500 | Offers packaging alternatives made from bio-based materials, which compost at ambient temperature and do not harm human health.

Upcycled Ingredients, Food Surplus and Waste Efficiency:

- PeelPioneers (The Netherlands) #30 in the 2023 Foodtech500 | Transforms orange peels into orangeade, essential oil, and fiber that meets international standards.

- Kaffe Bueno (Denmark) #122 in the 2023 Foodtech500 | Upcycles coffee by-products into high-performance, and all-natural ingredients.

- Agrain (Denmark) #163 in the 2023 Foodtech500 | Turns spent grains into nutritious and aromatic flours.

- Crush Dynamics (Canada) #195 in the 2023 Foodtech500 | Transforms agricultural residuals into high-performance bioactive food ingredients that address key challenges faced by food manufacturers, including flavor, nutrition, and shelf life.

- Green Spot Technologies (France) #217 in the 2023 Foodtech500 | Leverages upcycling and fermentation at industrial scale to produce natural ingredients with functional and nutritional advantages and the lowest environmental footprint.

- FreezeM (Israel) #236 in the 2023 Foodtech500 | Enables waste management companies to convert their bio-waste into protein incorporated into aquafeeds, pet food, agricultural fertilisers, and oleochemicals.

- Volare (Finland) #260 in the 2023 Foodtech500 | Helps food manufacturers and processors upcycle their side streams back into the food chain as high-quality protein and lipid ingredients.

- Agrosingularity (Spain) #277 in the 2023 Foodtech500 | Produces ingredients from non-valued plant products and by-products, fruits, and vegetables.

- Malty Foods (Turkey) #302 in the 2023 Foodtech500 | Produces nutritious foods with innovative and upcycled ingredients.

- Ingredalia (Spain) #313 in the 2023 Foodtech500 | Develops and produces natural functional ingredients from plant by-products from agri-food companies.

- RE:harvest (South Korea) #319 in the 2023 Foodtech500 | Reharvests by-products such as barley, ginger, and soybean curd to transform them into highly nutritious resources.

- Rebread (Poland) #321 in the 2023 Foodtech500 | Provides know-how and technology to create value-added sustainable products from leftover bread.

- Arda Bio (United Kingdom) #327 in the 2023 Foodtech500 | Transforms waste feedstocks into smarter, circular biomaterials for fashion, home goods, automotive, and more.

- Moa FoodTech (Spain) #328 in the 2023 Foodtech500 | Combines biotechnology and artificial intelligence to transform agri-food by-products into a next-generation protein.

Our Blogs on Surplus and Waste Management

- Food Upcycling: AgriFoodTech’s New Treasure

- Designing Tomorrow’s Packaging Today: Exploring F&B Trends and Optimizing the Consumer Experience

- Food Waste: Understanding the issue before taking action

Interested in deep-diving into the ins and outs of the AgriFoodTech sector? Explore our New Report Series, ‘Decoding the FoodTech Transition,’ providing in-depth analysis and strategic insights into the evolving AgriFoodTech sector. Download a free sample now of the Plant-based Proteins Report HERE.

Explore Our Proprietary Taxonomy

Navigate the market dynamics of the AgriFoodTech sector with our proprietary taxonomy that covers the entire food supply chain, categorized into verticals (‘Activities’) and further divided into subcategories (‘Domains’). Click below the activity you want to explore.