FORWARD FOODING

THE BLOG

FoodTech in 2025: The Great Recalibration

Disclaimer: This analysis is based exclusively on FoodTech Data Navigator‘s proprietary dataset of 1,474 funding rounds from January 2024 through August 2025, with filters applied to exclude outlier companies with funding exceeding $300M and post-IPO activities.

The first half of 2025 tells two very different stories about the future of AgriFoodTech and food innovation more broadly. While DailyPay, a restaurant payroll platform, secured a massive $200 million in debt financing and precision farming company Chestnut Carbon Solutions raised $160 million, hundreds of other FoodTech startup companies struggled to find investors willing to write checks. The era of ‘easy money’ in FoodTech has definitely ended, but what’s emerging isn’t collapse—it’s evolution.

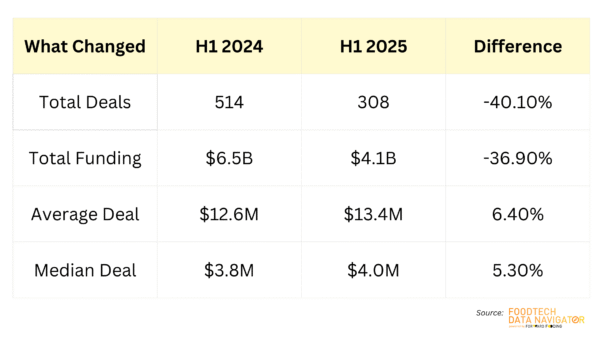

After reaching a staggering $71 billion globally in 2021, AgriFoodTech investment has been on a steep decline. The numbers from H1 2025 follow a similar trend: funding dropped from $6.5 billion across 514 deals in H1 2024 to $4.1 billion across 308 deals—a 37% funding decline and 40% fewer deals. But here’s what makes this different from a typical ‘market crash’: the quality of the deals is actually getting better and has shifted towards new areas and a broader set of solutions.

The GLOBAL FOODTECH SECTOR Has ‘Grown Up’

While fewer companies are getting funded, those that do are receiving slightly larger checks. Average deal sizes jumped from $12.6 million to $13.4 million, and even median deals grew from $3.8 million to $4 million.

Where the Money Went (And Where It Didn’t)

Where the Money Went (And Where It Didn’t)

The most telling part of 2025’s story isn’t just the overall decline—it’s how dramatically money shifted between different types of FoodTech companies. Some sectors saw their funding drop drastically, while others actually grew their share of investment even as the overall pie shrank.

SOME OF The Winners – Traceability & Circularity

Restaurant and Kitchen Technology became the surprise winner, doubling its share from 10% to 18% of all funding. But this growth came from just a few massive deals rather than widespread investor enthusiasm. DailyPay’s $200 million round, Owner’s $120 million Series C, and India’s Jumbotail securing another $120 million drove most of this growth. These companies are solving immediate problems like payroll management and inventory tracking that restaurant owners desperately need.

Food Waste and Surplus Management (including packaging) companies more than doubled their funding share from 4% to 10% of Global AgriFoodTech funding. Instead of 41 smaller deals worth $246 million like in 2024, investors wrote fewer but larger checks — 27 deals worth $406 million to be precise. This reflects growing recognition that waste-to-value circular food systems represent genuine business opportunities rather than just feel-good sustainability projects. Notable deals include Tidal Vision ($140M) and Pulpex ($78M) among others.

Food Safety and Traceability tripled its funding share from 3% to 7%, driven largely by upcoming FDA regulations requiring comprehensive food traceability by January 2026. When regulatory compliance becomes mandatory, it creates a predictable demand that investors love.The looming deadline for the U.S. Food and Drug Administration’s (FDA) Final Rule on Food Traceability, which becomes fully effective in January 2026, is compelling companies to invest in robust digital systems. This has created a significant and predictable market opportunity, with companies such as Clear Labs or Treefera having raised significant rounds ($30M each) among others.

Precision Farming stood out as perhaps the most resilient category, growing from 7.3% to 10.9% of funding. Chestnut Carbon Solutions’ $160 million Series B and Netherlands-based Xocean’s $118.7 million round show that agricultural technology focused on measurable outcomes—carbon sequestration, crop monitoring, resource optimisation—continues attracting serious investment.

SOME OF The Losers – Capex-Heavy and Consumer-Facing Models

Cellular Agriculture essentially disappeared as an investment category, falling from 2.2% to nearly 0% of funding—a 99% decline in absolute dollars. That being said; there are signs of “cautious optimism” for 2025, and progress is being made in terms of scalability and regulation. However, the industry remains plagued by fundamental challenges: capital requirement to scale production and a deeply uncertain regulatory landscape, with slow approvals in the EU and a growing patchwork of state-level bans in the U.S.

The Food Delivery sector (excluding outlier deals) saw its funding share cut from 17% to 8%. The pandemic boom is definitely over, and investors have finally confronted the challenging economics of last-mile delivery that many companies never figured out how to make profitable.

Vertical Farming, despite 80 Acres Farms securing a notable $115 million round, belongs in the correction category. The sector’s capital requirements and energy costs have made it increasingly difficult to justify the massive upfront investments these operations require. In a recent article, though, we are deep-diving into the solutions that will contribute to increasing efficiency and scalability in vertical farming.

Farm Robotics and Machinery funding share dropped from 3.4% to 0.7% of the market. The long development timelines, high customer acquisition costs, and complex field testing requirements have made these ventures less attractive to investors seeking more predictable returns. Yet, given the need to automate farming operations, some recent Q3 deals from 4Ag Robotics ($28M) or Saga Robotics ($11M), among others, leave room for optimism.

The Funding Evolution: Beyond Venture Capital

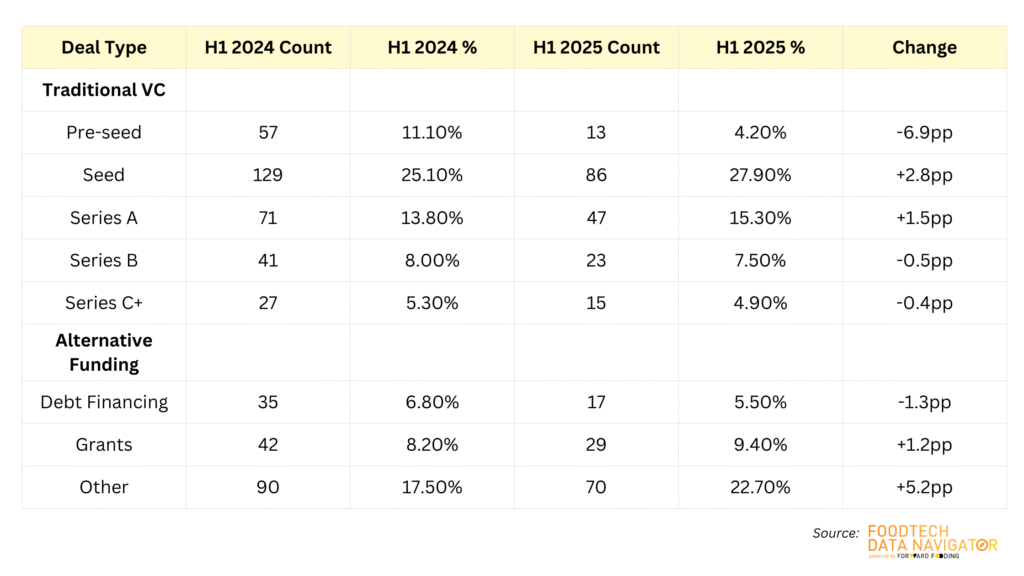

One of the most significant changes in 2025 has been how companies are getting funded. The traditional venture capital model—where startups raise Series A, B, and C rounds in a predictable sequence—is giving way to more diverse funding approaches.

The data shows grants maintaining their importance (actually growing as a percentage), while “other” funding types—including corporate partnerships, revenue-based financing, and strategic investments—have become much more common. This reflects a maturing industry where companies are matching their funding sources to their business models rather than defaulting to traditional venture capital.

The proportional drop in Pre-seed funding is nonetheless a worrying factor for early-stage companies, which need more than ever to rely on alternative source of funding.

The Rise of FoodTech Wave 3.0

What’s emerging from this market recalibration aligns with what industry observers call FoodTech Wave 3.0—a fundamental shift from consumer-facing novelty toward infrastructure and systems thinking.

Wave 1.0 (2010s) brought us food delivery apps and restaurant discovery platforms. Wave 2.0 (2019-2022) promised revolutionary new foods—plant-based meats, lab-grown proteins, and vertical farms that would transform how we eat.

Wave 3.0 (2023+) is more pragmatic, focusing on solutions that integrate into existing food systems while delivering measurable improvements.

The funding patterns clearly show this transition. Companies working on AgBiotech innovations like Inari’s $144 million Series G for predictive breeding, or those developing biotech-enabled food manufacturing approaches, continue attracting significant investment. Meanwhile, companies pursuing food as medicine approaches—like Nourish’s $70 million Series B for personalised nutrition—represent the practical application of health-focused innovation.

Looking Ahead: Reasons for Optimism

While the funding environment remains challenging, several factors suggest the food tech industry is building stronger foundations for sustainable growth:

Investors Are Still Investing: The improvement in deal quality metrics shows that capital remains available for companies solving genuine problems. Investors haven’t abandoned the sector—they’ve just become much more selective.

Corporate and Government Support: The growth in grants and alternative funding sources indicates that corporations and governments are stepping in where venture capital has pulled back. This provides more stable, long-term support for infrastructure development.

Regulatory Tailwinds: Requirements like FDA traceability mandates create predictable markets for technology solutions, reducing the market risk that has made investors cautious.

Infrastructure Focus: The shift toward Wave 3.0 approaches means companies are building solutions that integrate with existing food systems rather than trying to replace them entirely, making adoption more likely and business models more sustainable.

The monthly progression through 2025 shows both the challenges and opportunities ahead. After strong starts in January (69 deals, $866M) and February (55 deals, $982M), activity gradually declined through the year, reaching a low of just 16 deals worth $224 million in August. This suggests the market correction is continuing to deepen, but it also means that companies capable of raising money in this environment are likely building something genuinely valuable.

The great recalibration of 2025 isn’t marking the end of FoodTech innovation—it’s simply forcing the industry to ‘grow up’. The companies that emerge from this period will focus on solving real problems with sustainable business models, thereby building the infrastructure for a more resilient and efficient food system. For entrepreneurs willing to focus on practical solutions and investors ready to support long-term value creation, the opportunities have never been more clearly defined.

In our opinion, there has never been a better time to invest (smartly) in ‘modernizing’ the world’s largest industry, however, we see that governments, industry incumbents and institutional investors will need to step up even further to take a slice of the FoodTech pie.

Forward Fooding is the world’s first collaborative platform for the Food & Beverage industry via FoodTech Data Intelligence and Corporate-Startup Collaboration – Learn more about our Consultancy and Scouting Services and our Startup Network.

Follow us

Sponsored Articles

9 July 2025

Forward Fooding celebrates the selection of 12 pioneering startups for the inaugural pladis Accelerator Programme. From water lily popcorn to sugar-converting enzymes, these innovations represent the future of snacking, addressing obesity, sustainability, and personalized nutrition through cutting-edge food technology.

21 March 2025

Tim Ingmire, VP of Global Innovation & Technology at pladis, discusses how the snacking giant is supporting early-stage startups in foodtech, health, and sustainability through their accelerator program. Learn about their focus on personalized nutrition, functional foods, and future ingredients to bring innovative, delicious products to consumers worldwide.

8 February 2024

Future Food-Tech returns to San Francisco on March 21-22 Over 1,700 food-tech leaders, from CPG brands, retailers, ingredient providers, [...]

1 February 2023

The 4th edition of FoodTech 500 is taking off and we are excited to partner with NEOM for the third consecutive year to support the best international AgriFoodTech entrepreneurs.

10 February 2022

One of the elements we enjoy the most here at Forward Fooding about working with AgriFoodTech startups is being [...]